India currently enjoys an ideal mix of political stability, a credible central bank, and a reform-centric focus. Time is ‘RIPE’ for growth to climb out of the current slowdown.

- With the general elections over, another term of political and policy continuity lies ahead

- Expectations are running high on what the next five years will hold

- We reckon time is ‘RIPE’ for the economy is climb out of the current slowdown and

- … head back towards its potential growth rate

- From a negative output gap, we expect the economy to accelerate past potential

A decisive win for the incumbent ruling party in last month’s elections was a strong vote for political and policy continuity. Expectations are running high on what the next five years will hold for the economy. India currently enjoys an ideal mix of political stability, a credible central bank, reform-centric focus and catalysts for growth to recover. We reckon time is ‘RIPE’ for growth to climb out of the current slowdown and return towards its potential rate over the next two-three years.

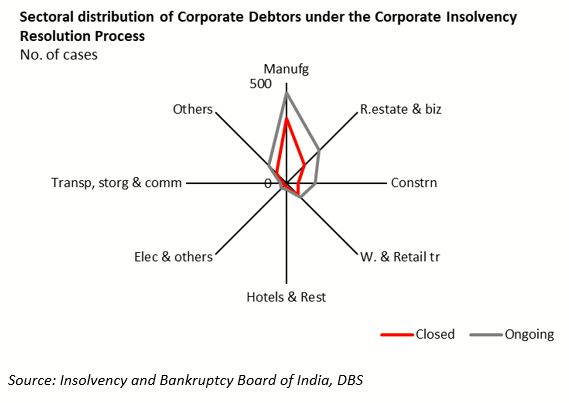

‘R’eforms will be crucial, with the ball already set rolling in the government’s first term. Rather that rollout of another bunch of fresh reforms, there is value in ensuring efficient and effective implementation of the already announced measures. This will not only narrow income inequality but also grow the pie to supportive more redistributive policies and raise productivity.

Reviving the ‘I’nvestment climate is of paramount importance, which has been moderating for the past five-six years. Encouragingly, fixed capital formation as % of GDP bottomed out in FY17 and crept higher to 29.3% of GDP in FY19. The breakdown reveals that the government’s infrastructure spending has led much of the recovery. Capacity utilization rates have improved in the past four quarters but has been insufficient to draw in private sector capex.

Besides the domestic agenda, authorities will require ‘P’roactive efforts to guard against rising external risks. Multiple headwinds have emerged over the course of first half of 2019, led by a rising protectionist tide across economies as US-China trade dispute escalates, moderating in in G7 growth, sluggish global trade, Brexit-led uncertainty, volatile oil prices and slower China. G3 policymakers have signaled a softening in the policy bias to proactively arrest evolving risks to growth. On trade, Washington wants to maintain existing tariffs to ensure China’s compliance to address America’s concerns on its trade deficit, intellectual property and other issues. Developments on the US-China trade dispute and other protectionist policies, present both a challenge and opportunity for India.

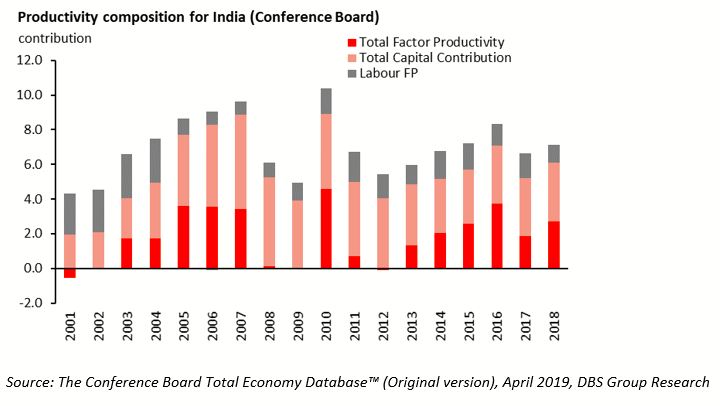

Return to faster ‘E’xpansion mode on the cards. Apart from the cyclical swings, there is a clear need for potential growth to improve. Various studies, RBI [3] and World Bank [4], estimate potential growth in the range of 7-7.2%. Annual GDP in the past decade has been oscillating around this level, peaking above 8% in FY16-FY17 vs a trough around 5.5% five years prior. The structural need to raise potential growth to provide for the economy’s rising employment needs, higher savings rate and in turn, boost investment capacity through domestic resources, should remain a priority. Hence as highlighted in this report, the combination of effective reforms and improved productivity, are crucial ingredients for the economy to return to potential growth and accelerate further.

To read the full report, click here to Download the PDF.

Radhika Rao, Economist

DBS Group Research

Disclaimers and Important Notices

The information herein is published by DBS Bank Ltd and PT Bank DBS Indonesia (collectively, the “DBS Group”). It is based on information obtained from sources believed to be reliable, but the Group does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation & the particular needs of any specific addressee. The information herein is published for the information of addressees only & is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Group, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Group or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Group & its associates, their directors, officers and/or employees may have positions or other interests in, & may effect transactions in securities mentioned herein & may also perform or seek to perform broking, investment banking & other banking or finan¬cial services for these companies. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. Sources for all charts & tables are CEIC & Bloomberg unless otherwise specified.

DBS Bank Ltd., 12 Marina Blvd, Marina Bay Financial Center Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

PT Bank DBS Indonesia, DBS Bank Tower, 33rd floor, Ciputra World 1, Jalan Prof. Dr. Satrio Kav 3-5, Jakarta, 12940, Indonesia. Tel: 62-21-2988-4000. Company Registration No. 09.03.1.64.96422.