- Save

- Invest

- Borrow

- Pay

- More

- Customer Services

Visit nearest DBS India branch

The DBS Growth Plus Savings Account offers rewards worth up to ₹75,000. Earn vouchers across food, shopping, health, and entertainment when you spend with your debit card. Get helpful money insights, monthly statements, and control over how your card works. You can open a savings account online and start enjoying the benefits today.

Here's why you should choose a DBS Bank Growth Plus Savings Account

worth ₹250*

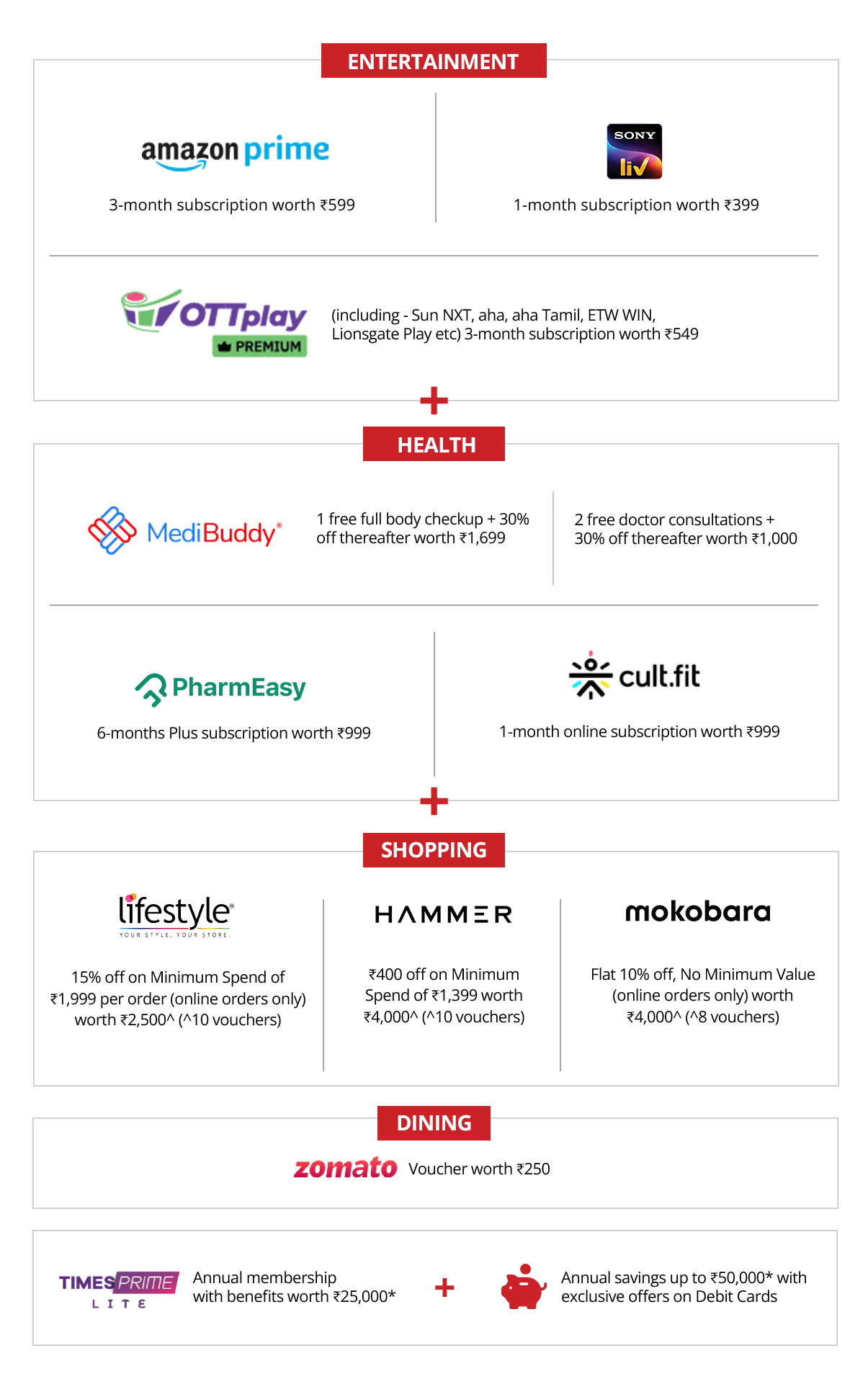

Host of offers across Entertainment, Health, Shopping and Dining = Benefits over ₹5,000*

Membership with benefits worth ₹25,000*

Annual savings up to ₹50,000* with exclusive offers on your Visa Platinum Debit Card

Here's more and more and more!

Free cheque book

Free intelligent banking insights

Free monthly account statements

Seamless buying of Mutual Funds from your account

Free access to DBS Bank’s digital banking services

An elevated lifestyle with Platinum Visa Debit Card

Maintain a Monthly Average Balance (MAB) of ₹INR 25,000 in your DBS Bank Savings Plus Account and enjoy a host of benefits.

Offer details, that's sure to offer you immense delight!

Amazon Pay gift card worth ₹250*

+

Offer bundle with a host of benefits worth over ₹5,000 across Entertainment, Health, Dining, and Shopping. Choose ONE offer from each category, based on your lifestyle.

Features of DBS Bank Growth Plus Savings Account

Get key banking features that are clear, simple, and secure, so you stay in charge of your money:

- Free Platinum Visa Debit Card with full control over usage.

- Monthly account statements and cheque book included.

- Invest in mutual funds directly from your savings account.

- Track spending and get money insights in the DBS digibank app.

DBS Bank Growth Plus Savings Account Interest Rate

With the DBS Bank Growth Plus Savings Account, you can earn up to 5.50% p.a. on your savings.

The savings account interest rates is calculated daily and credited every quarter, helping your balance grow steadily over time. This ensures idle money is growing while keeping it safe and accessible.

Manage Your DBS Bank Growth Plus Savings Account with the DBS digibank App

Experience the benefits of a savings account with full control through the DBS digibank app.

- Check your balance, transfer money, pay bills, and invest from one place

- Set spending limits and manage your debit card easily

- Turn international usage on or off with a simple tap

- View insights to understand and improve your spending habits

- Access your account securely anytime, anywhere from your phone

Eligibility Criteria for DBS Bank Growth Plus Savings Account

You are eligible to open a DBS Bank Growth Plus Savings Account if you meet the following conditions:

- You are a resident Indian aged 18 years or above

- You can apply individually or jointly

- You have a valid Aadhaar and PAN card linked to your mobile number

- You can maintain a Monthly Average Balance (MAB) of ₹25,000

Documents Required for Opening a DBS Bank Growth Plus Savings Account

Keep the following documents ready for a smooth account opening process:

- Proof of Address: Aadhaar, Passport, Voter ID, Utility Bill, Driving Licence, or other government-recognised address proof

- Proof of Identity: PAN, Aadhaar, Passport, Voter ID, Driving Licence, or any photo ID issued by a government body

- Photographs: Two recent passport-sized photos

How to Open a DBS Bank Growth Plus Savings Account

Here’s how you can open a DBS Bank Growth Plus Savings Account in four simple steps:

Step 1: Visit the DBS Bank website or download the DBS digibank app to begin the account opening process.

Step 2: Keep your PAN card and Aadhaar card handy for instant verification.

Step 3: Complete your onboarding through a secure video KYC using a smartphone or computer with camera access.

Step 4: Once your KYC is verified, your Growth Plus Savings Account will be activated with full access to features.

Redeeming offers, easier than ever.

1

To get the Amazon Pay Gift Card worth ₹250, maintain a Monthly Average Balance of ₹25,000 in the month following account opening, regardless of the date of opening the account.

2

Avail offers worth ₹5,000 on brands like Amazon Prime, Cult.Fit, Swiggy, etc. by spending ₹10,000 on your Debit Card by the end of the month, following the account opening month.

3

To get a TimesPrime Lite Annual membership with benefits worth ₹25,000, spend cumulative ₹30,000 on your Debit Card by the end of 3rd month, following account opening.

Think, Thats All? There's more where that came from!

Whether it’s smarter savings, better investments, easy personal loans, international fund transfers - your digibank is designed to help you live better. It’s so easy, it feels like magic!

Personal Loan

Fast-track your life with instant paperless DBS Bank personal loans of up to ₹15 Lakh.

Recurring Deposit

Make goal-oriented savings effortlessly at a higher interest rate!

Remittance

Keep love and life undelayed with instant international transfers at no extra cost.

Insurance

Through thick and thin, we’ve got you covered with health insurance plans for the family, automobile insurance and travel insurance.

Frequently Asked Questions

The DBS Bank Growth Plus Savings Account is a digital savings account that makes everyday banking more convenient with more control to you with helpful banking tools. As an account holder you also enjoy lifestyle rewards and exclusive offers.

You need to maintain a Monthly Average Balance (MAB) of ₹25,000 in your Growth Plus Savings Account.

The savings account interest rate is calculated daily and paid every quarter to your account. You can also use a savings account interest calculator to estimate how much you’ll earn.

You will receive monthly account statements for your Growth Plus Savings Account, either on email or through the DBS digibank app.

Yes. When you open savings account online with DBS Bank, a virtual debit card is issued instantly, and the physical card is sent to your address.

It includes features of savings account such as spending controls, investment access, and money tracking. It offers the benefits of savings account like interest earnings, debit card features, and account insights, along with extra value through vouchers and spend-based rewards.

Our Products

- Savings Account

- Personal Loan

- Fixed Deposit

- Recurring Deposit

- Remittance

- Mutual Fund

- SIP

- Debit Card

- Bill Payment

- Internet Banking

- Travel Now

- PRIME Savings Account

- Safe Deposit Locker

Need Help?

- Calling from India:

1860 210 3456 / 1860 267 4567 - Calling from Overseas:

+91 44 6685 4555 - Help & Support

- Grievance Redressal

- Get in Touch with Us

Interest Rates & Calculators

- FD Interest Rates

- RD Interest Rates

- Personal Loan Interest Rates

- Savings Account Interest Rates

- Savings Account Interest Calculator

- FD Calculator

- RD Calculator

- Mutual Fund Calculator

- EMI Calculator

- SIP Calculator

- Lumpsum Calculator

- Financial Goal Calculator

- Monthly Investment Calculator

- ELSS Calculator

- Personal Loan EMI Calculator

Open Instant DBS Bank Savings Account

Useful Links

- About DBS

- Rates & Fees

- In the News

- Forms & Legal

- Grievance Redressal

- Anti-Malware Security Features

- Cyber Security

- Savings Schedule of Benefits

- Schedule of Charges

- KYC FAQs

- DBS Mobile Checksum

- Sitemap

- List of Recovery Agency

- List of Repossessed Properties

- Financial Inclusion

- Digital Lending Partnership CRED

- Co-lending partnership HCIN