- Save

- Invest

- Borrow

- Pay

- More

- Customer Services

Anti-Malware Security Features

- DBS Anti-Malware Security Features

- Important information

- The rise of malware threats

- What we are doing to protect you

- Seeing a message that your digibank access is restricted?

- Apps From Unverified App Stores

- Known Malware Application

- Screen-Sharing

- Is your device jailbroken or rooted?

- Frequently Asked Questions

- Knowledge and Tips

- Understanding Malware and Malware Scams

- Tips to protect yourself from malware attacks

- Make use of your security features today!

DBS Anti-Malware Security Features

What we’re doing to better protect you from malware threats and scams.

Important information

- Had your digibank access restricted? Please follow our detailed guide below to restore your digibank access.

- If you suspect that you are a victim of scam, call our 24-hour fraud hotline at 1860 210 3456/ 1860 267 1234 or our overseas customer service number 91-44-66854555 from overseas.

- Disclaimer: While our anti-malware tool is provided on a best effort basis, users are encouraged to use their own trusted anti-malware solutions for protection.

The rise of malware threats

Malware threats are on the rise, with scammers using carefully planned and sophisticated methods to trick customers into downloading malware through malicious apps. Once your phone is infected by malware, scammers can steal sensitive information like your banking login credentials and SMS OTPs. They can remotely control your mobile device to perform fraudulent monetary transactions without your knowledge or consent.

What we are doing to protect you

We have recently enhanced our anti-malware capabilities to prevent scammers from logging into customers’ digibank accounts.

Our enhanced anti-malware tool restricts digibank access when it detects log-in attempts from mobile devices that are likely infected with malware or have settings that make it prone to security vulnerabilities. This includes:

- Known malware applications and jailbroken or rooted mobile devices

- Mobile devices with risky apps or permission settings

- Mobile devices with potentially unauthorised ongoing screen-sharing

To safeguard your banking accounts and money, you will need to remove malicious or risky apps, turn off accessibility permission settings, or stop screen-sharing before you can access digibank again.

As with all our security features, customers can be assured that the use of the anti-malware tool is limited to the detection of malware activity and security threats. No additional personal data from their device is collected.

Seeing a message that your digibank access is restricted?

This is our precautionary measure to safeguard you against potential malware threats. If you see this, it means that your mobile device is likely exposed to malware-related threats.

Select the message you see on your mobile device, and we’ll guide you on how to restore your digibank access.

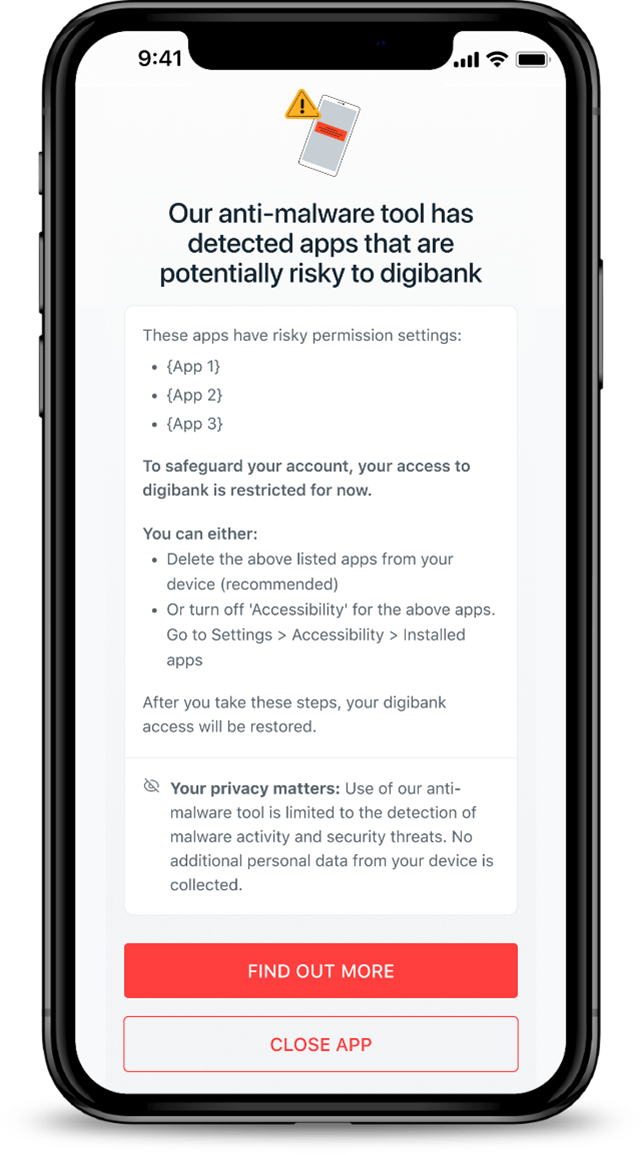

Apps From Unverified App Stores

Why are you seeing this?

If you see this message, it means that your mobile device contains apps that are not downloaded from official app stores and has accessibility settings switched on. This may give scammers control of your device.

To safeguard your banking account, access to digibank has been restricted.

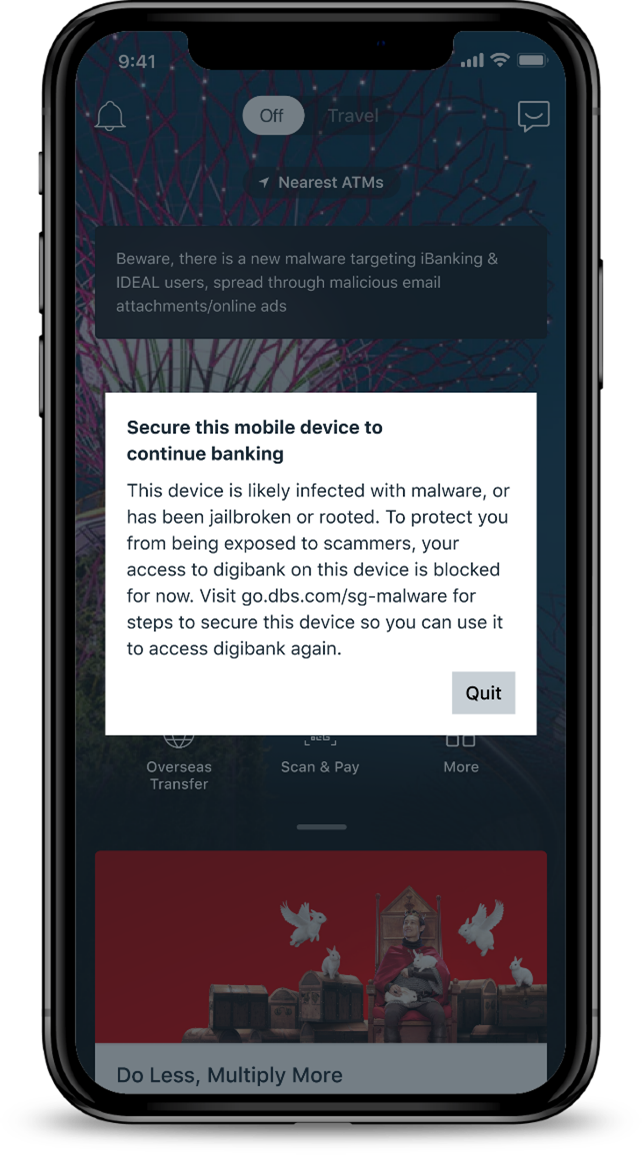

Known Malware Application

Why are you seeing this?

If you see this message, it means that your device is likely infected with known malware applications or is jailbroken or rooted. You may have downloaded malicious apps via links in text messages, social media, or third-party websites instead of official sources like the Google Play or Apple App Store.

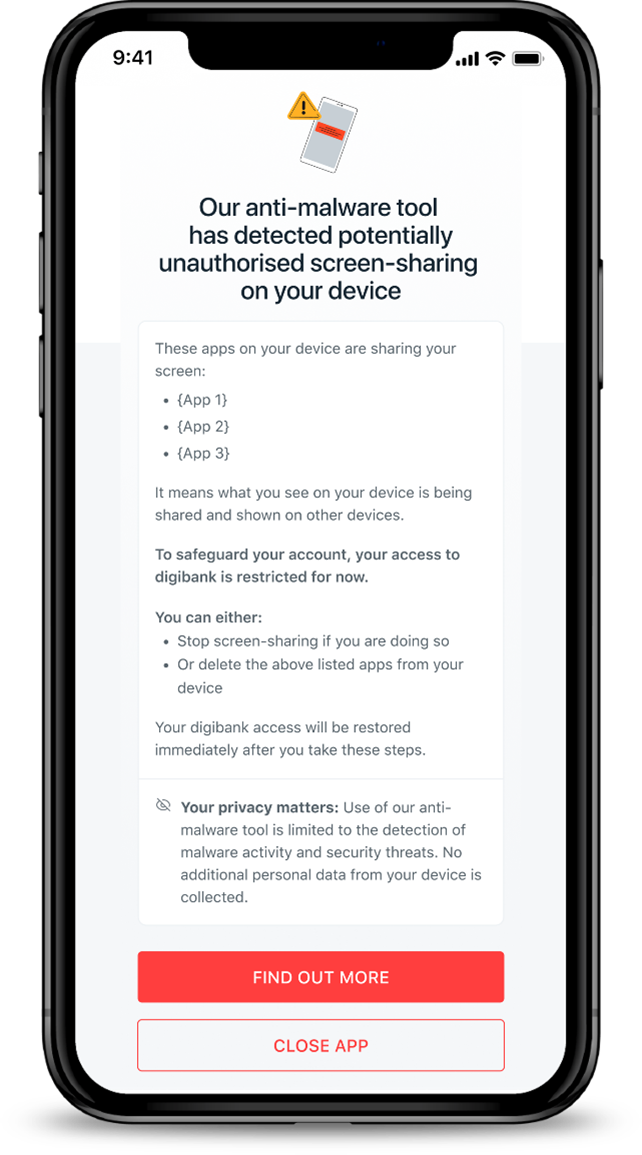

Screen-Sharing

Why are you seeing this?

If you see this message, it means that screen-sharing or mirroring is taking place on your device. This may be a sign of a malware attack. To safeguard your banking account, access to digibank will be restricted while screen-sharing or mirroring is going on.

For Customers Encountering Screen Share Issues:

We recommend, installing any diagnostic tool which can assist in easily identifying the package ID of the screen-sharing application. Once the diagnostic tool is installed, you can obtain the relevant application details / package ID and provide it to RM/branches for further support and solutions.

Is your device jailbroken or rooted?

Jailbreaking (for Apple devices) or rooting (for Android devices) means removing the software restrictions put in place by device manufacturers. Some users do this so they can install third-party software from unofficial sources.

Your device’s manufacturer sets limitations so you can only use software that is verified, safe and legal. By jailbreaking or rooting and downloading unofficial apps, it:

- gives malicious apps and their creators, possibly scammers, a back door into your phone and private data

- voids the warranty of your device

- can damage your device and make it faulty or unstable

- weakens your device security

- may be illegal if you download software that infringes on copyright laws

You may wish to perform a factory reset on your device. If this does not work, you may need to setup your digibank mobile app on another device which has not been jailbroken or rooted.

Frequently Asked Questions

If you need to make an urgent banking transaction, you may visit any of our DBS ATMs or branches where our staff can help you with your requests. Find the nearest branch and their opening hours using our ATM & Branch Locator.

You may also use digibank online on your laptop or desktop. However, only limited services will be available as you will not be able to perform some actions that require additional authentication. For instance, adding new recipients or increasing your transaction limits.

You are strongly encouraged to secure your mobile device before you continue to perform any banking activity.

Your privacy matters. Use of the anti-malware tool is limited to the detection of malware activity and security threats. No additional personal data from your device is collected.

No. With the rise in malware-related scams and attacks, this is a mandatory security feature that has been put in place to safeguard your banking accounts and money.

While this security feature can detect malware activity with a high degree of accuracy, no security feature is foolproof. As scammers become more sophisticated in their operations, we encourage customers to play their part to form a strong multi-layered defence.

To remain vigilant, be careful of the types of apps you install and the permissions you enable on your phone. Check out our Security Alerts webpage to be aware of the latest security threats.

Knowledge and Tips

Malware and Malware Scams

Malware or “malicious software” is any software that is used to disrupt operations, gather sensitive information, or gain access to a device, including a smartphone.

Once a malicious application is installed, scammers can remotely access the victim's device and steal sensitive information, including personal data and banking credentials to perform fraudulent monetary transactions.

Scammers employ social engineering tactics and fake advertisements on social media platforms and e-commerce websites. They often offer enticing deals for products and services, such as popular foods like durian and seafood, or services like food catering, pet grooming, home cleaning and aircon maintenance.

Victims are then tricked into clicking on a web link to download an app that is not from the official Google Play or Apple App Store.

When the malware app is installed, scammers will have access to control your device remotely and may use this ability to steal your personal and banking credentials. They can even log in to your digibank and perform fund transfers without your knowledge.

- Device is operating slower than usual

- Apps are taking longer to load

- Battery drains faster than expected

- Seeing a lot of pop-up ads

- Device has unfamiliar apps that you do not recognise

- Unexplained increase in data usage

- Higher than expected phone bills

Tips to protect yourself from malware attacks

- Because it probably is! Scammers have been offering fake, attractive deals like extremely cheap iPhones or durians, and very low prices for services like cleaning or pet grooming. Such scams are often found in website ads, emails, text messages, or on WhatsApp.

- Once you click on the ad or contact the seller, you may be asked to download unfamiliar, harmful apps to make payment. That’s how your device gets infected with malware.

- When downloading mobile apps, only use trusted sources like the Google Play Store or Apple App Store. These app stores have measures in place to reduce your risk of installing harmful apps.

- Even on official stores, always check descriptions, reviews, and ratings of apps to make sure they're trustworthy. Avoid downloading apps from third-party websites, emails, text messages, or social media.

- Whenever an app you install asks for permissions, take a moment. If it asks for accessibility permissions, full control over your device, or access to sensitive information like your text messages and emails that it does not need, it could be a warning sign of a malicious threat.

- For example, a shopping app should not be asking for access to your contact list, camera, or photos. Such permissions can allow a scammer to get full control of your device.

- Consider using reputable mobile security software to protect your device. Such software can help detect and block any harmful apps and alert you to potential risks.

Make use of your security features today!

To strengthen your digibank security, knowing what tools you have to protect yourself is crucial.

- Personal Particulars Update: Keep your contact details updated to get timely alerts and detect fraudulent transactions early.

- Transaction Alerts: Set alerts on your bank accounts and debit or credit cards to be notified of transactions.

- Transfer Limits: Set lower daily transfer limits in digibank to limit your exposure to fraudulent transactions.

- Payment Controls(for your card): Review your card transactions regularly. If you notice anything unauthorised, use Payment Controls to block your debit or credit card immediately and call us.

- Safety Switch(for your account): Suspect a scam attack on your account? Activate our Safety Switch to suspend access to your funds and self-service banking facilities quickly.

- Call our 24-hour fraud hotline at 1860 210 3456/ 1860 267 1234 or our overseas customer service number 91-44-66854555 from overseas.

Our Products

- Savings Account

- Personal Loan

- Fixed Deposit

- Recurring Deposit

- Remittance

- Mutual Fund

- SIP

- Debit Card

- Bill Payment

- Internet Banking

- Travel Now

- PRIME Savings Account

- Safe Deposit Locker

Need Help?

- Calling from India:

1860 210 3456 / 1860 267 4567 - Calling from Overseas:

+91 44 6685 4555 - Help & Support

- Grievance Redressal

- Get in Touch with Us

Interest Rates & Calculators

- FD Interest Rates

- RD Interest Rates

- Personal Loan Interest Rates

- Savings Account Interest Rates

- Savings Account Interest Calculator

- FD Calculator

- RD Calculator

- Mutual Fund Calculator

- EMI Calculator

- SIP Calculator

- Lumpsum Calculator

- Financial Goal Calculator

- Monthly Investment Calculator

- ELSS Calculator

- Personal Loan EMI Calculator

Open Instant DBS Bank Savings Account

Useful Links

- About DBS

- Rates & Fees

- In the News

- Forms & Legal

- Grievance Redressal

- Anti-Malware Security Features

- Cyber Security

- Savings Schedule of Benefits

- Schedule of Charges

- KYC FAQs

- Sitemap

- List of Recovery Agency

- List of Repossessed Properties

- Financial Inclusion

- Digital Lending Partnership CRED

- Co-lending partnership HCIN