- Save

- Invest

- Borrow

- Pay

- More

- Customer Services

- Enjoy an Edge Over Ordinary with DBS Elevate Salary Account

- Features of DBS Bank Corporate Salary Account

- Benefits of DBS Bank Corporate Salary Account

- Meet the bank that sets you ahead of the curve.

- Banking Made Smarter with the DBS digibank app

- Insurance benefits

- Edge above the ordinary connection

- Your Life? A Mile Ahead of the Curve!

- A Debit Card That’s One Step Ahead Of You

- We’re Your 24x7 Banking Buddy!

- Want to Stay a Cut Above the Rest?

- Think That's All? There's more where that came from!

- Frequently Asked Questions- Corporate Salary Account

Designed for businesses and their employees, the DBS Bank Elevate Corporate Salary Account offers a smarter way to bank. Earn high-interest returns, enjoy zero-fee transactions, and manage your money easily through the DBS digibank app. Open your corporate salary account online in just a few clicks and experience hassle-free banking from day one.

Features of DBS Bank Corporate Salary Account

Here are the key features of savings account banking designed for professionals who prioritise efficiency, flexibility and better value.

![]()

Up to 5.5%* interest rates

![]()

Unlimited free domestic ATM transactions

![]()

Free IMPS transfers

Benefits of DBS Bank Corporate Salary Account

The DBS Bank Corporate Salary Account brings added value to your everyday banking. From complimentary travel to lifestyle vouchers and curated holiday stays, enjoy meaningful benefits of savings account designed for working professionals:

![]()

*Fly for free – Your flights ticket is on us

- All Eligible customers shall be entitled to an offer which consists of a one-way flight ticket to domestic destination (Base Fare Only) within India.

- It is valid for all sectors subject to a flight time not more than 1.55 hours.

![]()

*Avail Lifestyle offers worth Rs. 5,000

- Eligible customers will receive Welcome E-Voucher from DBS Bank, within 60 days of the first salary credit into the salary account and the Monthly E-Voucher within 60 days of eligible Debit Card spends on their registered mobile number or primary email address shared with DBS Bank.

![]()

*Holiday package- Enjoy a 2N/3D stay

- Rs.899 for Domestic Destinations, the confirmation is subject to payment of the prescribed charges (utility)

- The packages are not valid for certain peak periods like Diwali ,Christmas Holidays, and New Year, (i.e. from 18th December to 4th January) International trade fairs in respective countries.

Meet the bank that sets you ahead of the curve.

Enjoy the warmest welcome with:

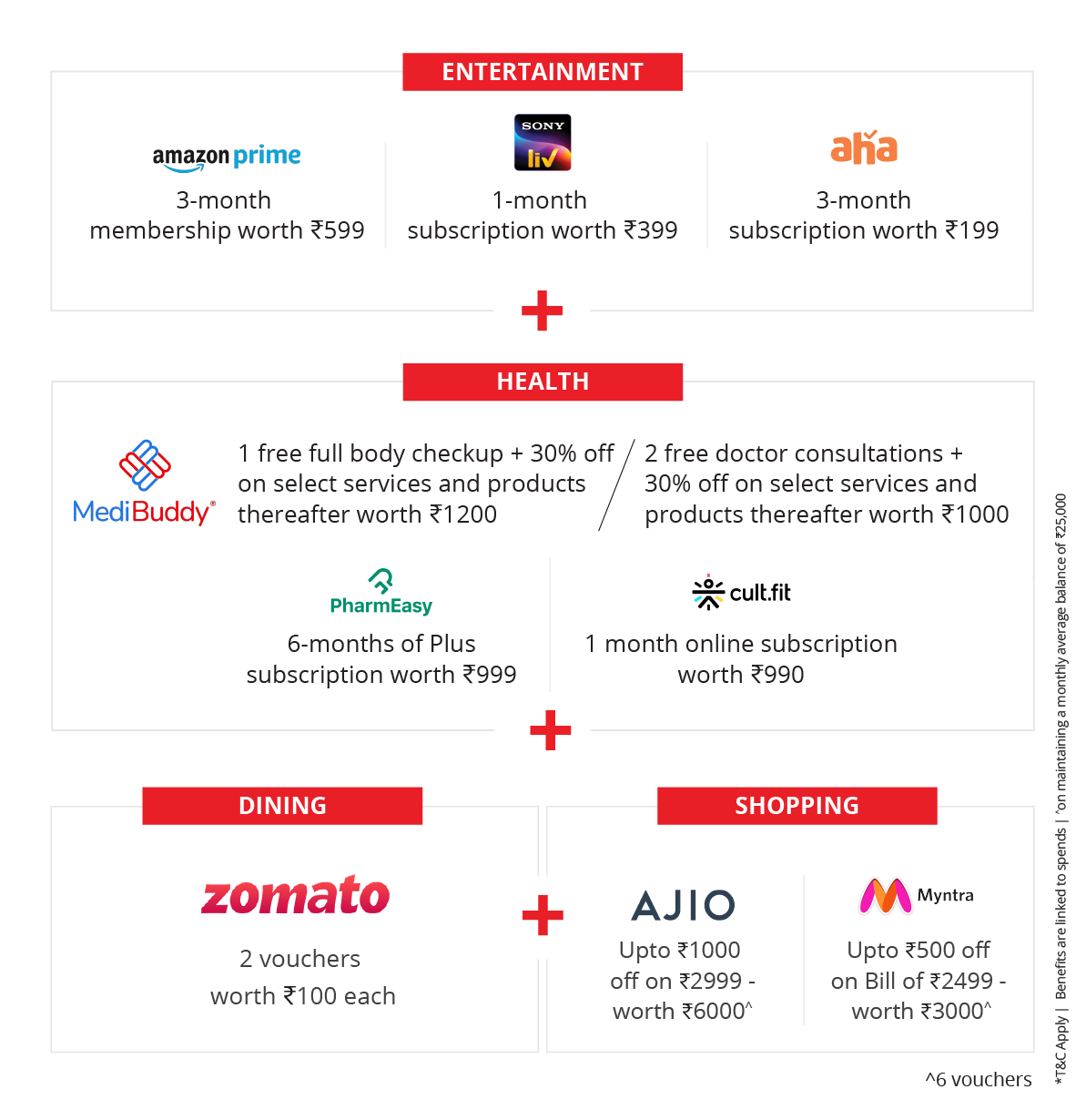

- Exclusive DBS Offers worth up to INR 50,000/- across 50+ brands

- Also, earn an extra bonus with our refer and earn programme!

Eligibility Criteria for DBS Bank Corporate Salary Account -

You are eligible to open a DBS Bank Corporate Salary Account if you meet the following conditions:

- Resident Indian aged 18 years or above

- You are employed and salaried individual.

- You have a valid Aadhaar and PAN linked to your mobile number.

Documents Required for DBS Bank Corporate Salary Account

DBS Bank follows a fully digital, paperless onboarding process. To open your Corporate Salary Account, keep the following ready:

- PAN and Aadhaar, linked to your mobile number for e-KYC

- Employment proof, such as an offer letter or recent salary slip (may be requested)

- A valid email ID and mobile number for verification and communication

All documents can be submitted securely online via the digibank app or online application form.

How to Open a DBS Bank Corporate Salary Account

Opening your DBS Bank Corporate Salary Account is quick and paperless. Just follow these steps:

Step 1: Visit the DBS Bank website or download the digibank app to start the process.

Step 2: Keep your Aadhaar and PAN ready for instant e-KYC.

Step 3: Complete a secure video KYC using your smartphone or laptop.

Step 4: Once verified, your account will be activated digitally—no paperwork required.

Banking Made Smarter with the DBS digibank app

The DBS digibank app is a secure, mobile-first platform that brings all your banking needs together. From opening your corporate salary account to managing money, tracking spends, and paying bills, everything happens in one intuitive app built for convenience.

![]()

Open Account Instantly

![]()

Link and manage all your bank accounts from just one app

![]()

Bill payments of 200+ Vendors

^Insurance benefits

- Personal Accident Cover up to ₹ 30 lacs

- Lost Card Liability and Purchase Protection up to ₹1 lac

- Loss of Checked Baggage up to ₹ 75000

- ATM Assault Protection up to ₹ 50000

^Insurance benefits Terms and Conditions

Mutual Funds Edge above the ordinary connection

Give Your Money an Edge Above the Ordinary

Get more out of your salary with special benefits on your salary account. Fastrack your dreams with instant and paperless personal loans. Stay ahead of the game with curated mutual funds. Live your dream with better interest rates* on home loans. Send love undelayed with instant international fund transfers!

Instant & Paperless Personal Loans

Morningstar-rated Mutual Funds

Better Interest Rates* on Home Loans

Same Day, Zero-Fee Remittance

Your Life? A Mile Ahead of the Curve!

Get more in less time with your salary account! Welcome to a world where managing your salary is instant, intelligent and intuitive. Open your salary account in a matter of few minutes, link and operate multiple bank accounts, pay over 200+ bills from just one app!

![]()

Open Account Instantly

![]()

Link and manage all your bank accounts from just one app

![]()

Bill payments of 200+ Vendors

A Debit Card That’s One Step Ahead Of You.

Live more, with greater control with a free debit card that’s Visa payWave-enabled. You can generate/change your PIN, temporarily block and unblock your card and switch to international mode with just a tap. There’s more. Lost your card? You get a lost card liability coverage for FREE!

Exclusive Offers

Exclusive Offers Visa payWave enabled

Visa payWave enabled Temporary Block/Unblock

Temporary Block/Unblock Switch to International Mode

Switch to International Mode Free Lost Card Liability Coverage

Free Lost Card Liability Coverage

We’re Your 24x7 Banking Buddy!

Get an edge over the ordinary all day, with our AI-based 24x7 virtual assistance, live chat and dedicated Relationship Manager.

24x7 Virtual Assistance

Live Chat

Dedicated Relationship Manager

Want to Stay a Cut Above the Rest?

We’ve got you covered

|

Sr No |

Offer Details |

Qualifying Month |

How to avail the offers |

|

1 |

Welcome Voucher |

M2 |

Rs 250 voucher on minimum Net Salary Credit |

|

2 |

5K Bundle Voucher |

M2 |

Spend cumulative Rs. 10,000 using Debit Card (excluding ATM withdrawals, Wallet transactions), P2M UPI by M2 |

|

3 |

Holiday offers 2N & 3D |

M4 |

Spend every month a cumulative amount Rs.5,000 using Debit Card (excluding ATM withdrawals, Wallet transactions), P2M UPI, every month till M4 & lumpsum of more than Rs. 20,000 OR one active SIP of min Rs. 5,000 in digibank app by M4 |

|

4 |

One way Flight Ticket |

M5 |

Spend every month a cumulative amount Rs.5,000 via Debit Card ((excluding ATM withdrawals and Wallet transactions) or P2M UPI, every month till M5 & once active Fixed Deposit of more than Rs. 20,000 OR one active Recurring Deposit of Rs. 5000 of 12 months or more by M5 |

M0 is the month of account opening

Monthly voucher has been discontinued from 31st Aug’25.

E-NACH Payment service, you can now easily pay your loan EMI s from your bank account, without the need for paper based mandates. E-NACH Stands for Electronic National Automated Clearing House.

Terms & Conditions for CEP Offers& Benefits

*Rates & offers are subjected to change at the sole discretion of the Bank without prior notice.

Think, Thats All? There's more where that came from!

Whether it’s smarter savings, better investments, easy personal loans, international fund transfers - your DBS Bank is designed to help you live better. It’s so easy, it feels like magic!

Personal Loan

Fast-track your life with instant paperless DBS Bank personal loans of up to ₹15 Lakh.

Recurring Deposit

Make goal-oriented savings effortlessly at a higher interest rate!

Remittance

Keep love and life undelayed with instant international transfers at no extra cost.

Insurance

Through thick and thin, we’ve got you covered with health insurance plans for the family, automobile insurance and travel insurance.

A salary account is a type of savings account used by employers to credit monthly salaries. It typically comes with added benefits such as zero minimum balance, exclusive offers, and faster banking services.

Yes, the DBS Bank Corporate Salary Account offers a competitive savings account interest rates of up to 5.5% p.a., helping you grow your idle balance while you spend and save.

No, DBS Bank Corporate Salary Accounts are zero balance accounts, so you don’t need to maintain a monthly average balance to keep your account active.

If salary credits are not received for a continuous period (typically 3 months), the salary account may be converted to a regular savings account, and standard charges may apply thereafter.

If your salary is deposited in your DBS Bank savings account regularly and your company has tie up with DBS Bank, the bank will automatically recognize it as a salary account.

There is only one variant of DBS Bank Salary account. However, if you monthly salary is over INR 2 lakh, you might be upgraded to premium DBS Treasures account which comes with additional benefits.

Yes, but only if your new employer is also registered with DSB Bank and you keep receiving salary into the same account.

Most essential banking services like ATM withdrawals, IMPS transfers, and debit card issuance are free. However, charges may apply for non-standard services. It's advisable to review the detailed fees and charges mentioned by the DBS Bank.

Our Products

- Savings Account

- Personal Loan

- Fixed Deposit

- Recurring Deposit

- Remittance

- Mutual Fund

- SIP

- Debit Card

- Bill Payment

- Internet Banking

- Travel Now

- PRIME Savings Account

- Safe Deposit Locker

Need Help?

- Calling from India:

1860 210 3456 / 1860 267 4567 - Calling from Overseas:

+91 44 6685 4555 - Help & Support

- Grievance Redressal

- Get in Touch with Us

Interest Rates & Calculators

- FD Interest Rates

- RD Interest Rates

- Personal Loan Interest Rates

- Savings Account Interest Rates

- Savings Account Interest Calculator

- FD Calculator

- RD Calculator

- Mutual Fund Calculator

- EMI Calculator

- SIP Calculator

- Lumpsum Calculator

- Financial Goal Calculator

- Monthly Investment Calculator

- ELSS Calculator

- Personal Loan EMI Calculator

Open Instant DBS Bank Savings Account

Useful Links

- About DBS

- Rates & Fees

- In the News

- Forms & Legal

- Grievance Redressal

- Anti-Malware Security Features

- Cyber Security

- Savings Schedule of Benefits

- Schedule of Charges

- KYC FAQs

- DBS Mobile Checksum

- Sitemap

- List of Recovery Agency

- List of Repossessed Properties

- Financial Inclusion

- Digital Lending Partnership CRED

- Co-lending partnership HCIN