Types of Bonds

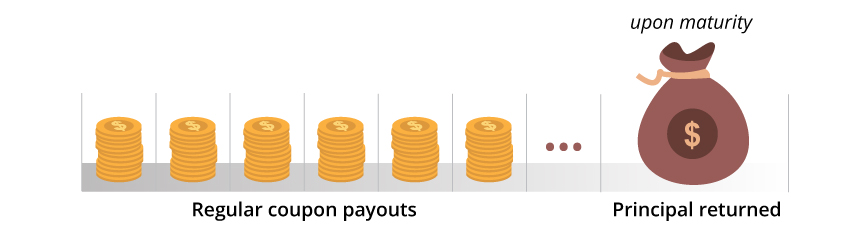

Traditional bonds

These have fixed coupon payments and maturities. They can be issued by companies or governments. Bonds issued by companies are commonly known as Corporate Bonds or Credits. Government bonds are bonds issued by the central government and supervised by the the Central Banks like Reserve Bank of India (RBI).

Within these two broad classes of traditional bonds, there are different sub-categories classified by their credit quality and geography. These include investment grade bonds, speculative grade bonds, and emerging market bonds.

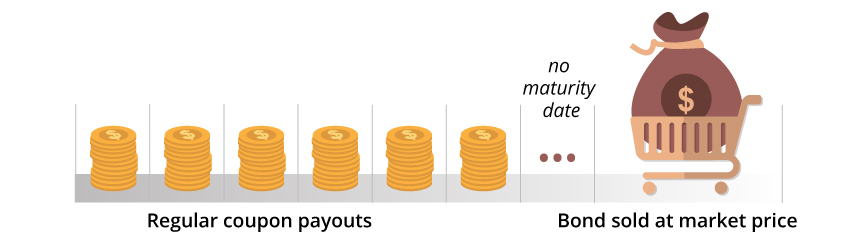

Perpetuals

A hybrid between a bond and a stock, also known as a ‘perp’. It offers fixed income but has no maturity date. That means the issuer has no obligation to pay the investor the principal at a specific date. So, investors usually can only get their funds back by selling the bond on the market at the prevailing price at the time.

Some perpetuals may be called back (redeemed) but this is at the discretion of the issuer.

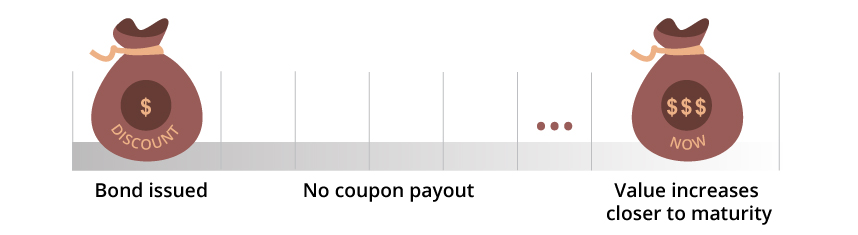

Zero coupon bonds

No fixed coupon component but issued at a discount to the par value, or amount repayable by the issuer on maturity. These bonds appreciate in value as they approach maturity.

How to Assess Credit Risks?

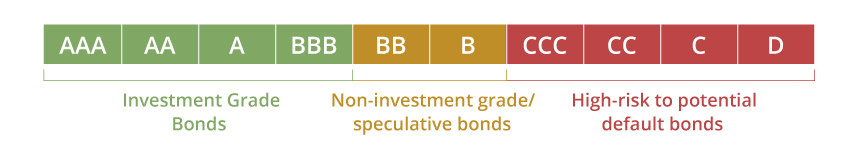

Where available, credit ratings are guides to credit quality. The higher the credit rating, the stronger the financial standing of the bond issuer in the eyes of the ratings agency. Different credit ratings agencies use different ratings system.

A widely followed agency Standard & Poor uses the following system:

However, an unrated bond does not mean that the issuer is of poor financial standing. In some cases, the issuing company is so confident that its bonds will sell on the company’s brand name or reputation and does not want to put resources towards getting a credit rating.

In such an instance, unless you are able to assess the non-rated issuer’s balance sheet, earnings, cash flow situation and outlook yourself, you are taking on the risk of lending only on the basis of reputation, which may or may not be indicative of actual credit quality.

DBS Bank offers Mutual Funds that are instant, paperless, signatureless – even transaction fee-less! What’s more? You get to choose from 250+ Mutual Funds across 13 top-performing asset management companies. So why wait? Login to digibank (app or internet banking) and start investing in a flash with instant Mutual Funds on DBS Bank.

Read up more on Mutual Funds here

Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.