- Save

- Invest

- Borrow

- Pay

- More

- NRI Banking

- Customer Services

Growth vs value investing. Which is the right way

The two common strategies for picking stocks.

Growth and value investing may be related, but have very different ways of analysing stocks. Here’s how the two methods work.

Growth Investing

Growth investing focuses on identifying companies that could see a rapid increase in their share prices.

This is the kind of stock growth investors look for. They’re the talent scouts of the stock market, seeking companies that could become “the next Google” and these are some of their key considerations:

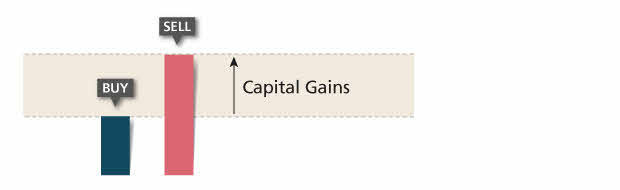

Capital gains over dividends

Growth investors are not interested in a stock’s dividends. They are more interested in selling the stock at a profit. Many growth stocks seek to maximise capital gains. Dividend pay-out are usually not considered.

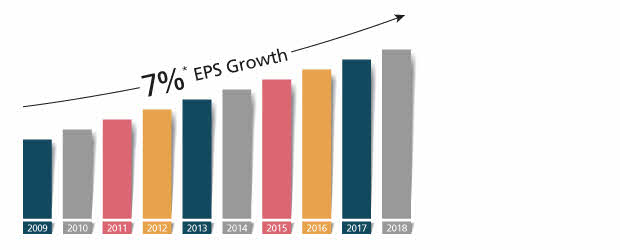

Strong Earnings Per Share (EPS) growth

Growth investors want to see EPS constantly growing. An acceptable example for a growth stock would be EPS growth of seven per cent over a 10-year period (this may vary from investor to investor). Steady EPS growth suggests a company is growing, and will be worth more in future.

Value Investing

Value investors look for stocks that are undervalued. That means the price of the stock is lower than it should be, given the current price of what the stock is fetching (value of the company).

These are just some of the qualities that value investors look for:

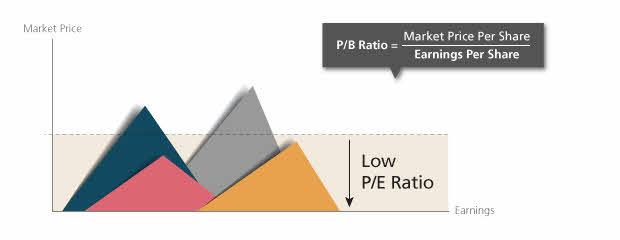

Low Price-to-Earnings (P/E) ratio

The P/E ratio is the ratio of the stock’s price, relative to its Earnings Per Share (EPS). A P/E ratio of 15 would mean that a stock price is 15 times its current earnings. Most value investors will avoid stocks with a P/E ratio higher than 15*.

*This is loose rule. Whether a P/E ratio is low or high depends on the industry in question. Among retail companies, a P/E ratio of 20 might be considered high; but among medical research companies, a P/E ratio of 100 might be considered low.

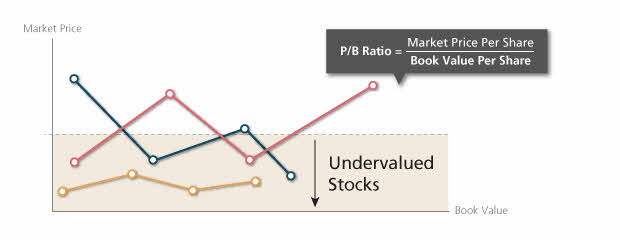

Low Price-to-Book (P/B) ratio

The P/B ratio is a company’s current stock price, compared to its estimated total value. If the P/B ratio is less than 1, a company’s stock could be undervalued.

Which is Right for Me

Neither method can be proven to be better. It comes down to which style best suits your personal approach.

- You have a higher risk appetite, or want to invest in a way that impacts the world

Growth stocks offer the potential, but not the guarantee of higher returns. If you want a more aggressive portfolio to meet your aspirations, consider growth investing. - You’re risk averse and prefer to analyse data.

If you feel safer investing in companies with good fundamentals (e.g. low debt, an established business model), then you’ll be more comfortable with value investing.

In general, it’s riskier to speculate on business growth. Business growth can be impacted by many unforeseen factors, such as government intervention or failed research.

But both methods sound complicated

Picking your own stocks requires a lot of time and research. As such, Do-It-Yourself stock picks are best left to passionate investors who have the time and drive to follow the market.

For more passive investors, you can opt to invest in a Mutual fund that specialises in growth or value stocks. This will leave the work in the hands of a qualified fund manager.

DBS Bank offers Mutual Funds that are instant, paperless, signatureless – even transaction fee-less! What’s more? You get to choose from 250+ Mutual Funds across 13 top-performing asset management companies. So why wait? Login to digibank (app or internet banking) and start investing in a flash with instant Mutual Funds on DBS Bank.

Read up more on Mutual Funds here

Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.