World's best digital bank,

now in your neighborhood

![]()

Asia's

Safest Bank

![]()

World's

Best Bank

![]()

Presence across

350+ cities

World’s Best Digital Bank, now in your city. Get ready to enjoy an experience like never before with DBS!

Now enjoy interest rates upto 5.5% p.a.* on your savings account. Open an account

Savings Account interest rates can’t get

BIGGER than this

Now enjoy interest rates upto 5.5% p.a.* on your savings account

![]()

Amazon Pay Gift Card worth up to Rs 250

![]()

Get 5X benefits through exclusive offers, memberships, and vouchers.

![]()

Times Prime Lite Membership with benefits worth Rs 25,000*

Get annual savings up to Rs 25,000 with exclusive offers on debit card.

Priority banking services

designed to make you smile

enjoy handpicked benefits with

![]()

Higher Interest Rates

& Fee Waivers

![]()

Tailor made liquidity & payout options on deposits

![]()

Added Joys with Cyber Insurance Cover & Legacy Planning

![]()

Curated Health &

Wellness Benefits

*T&C Apply

With so many benefits, we call it a benefits account

Enjoy 5X benefits with exclusive offers, memberships, and vouchers:

![]()

Amazon Pay Gift Card valued at up to ₹250*

![]()

Select one offer from each category according to your lifestyle

![]()

Times Prime Lite Membership offering benefits valued at Rs 25,000*

![]()

Save up to Rs 25,000 annually with exclusive debit card offers

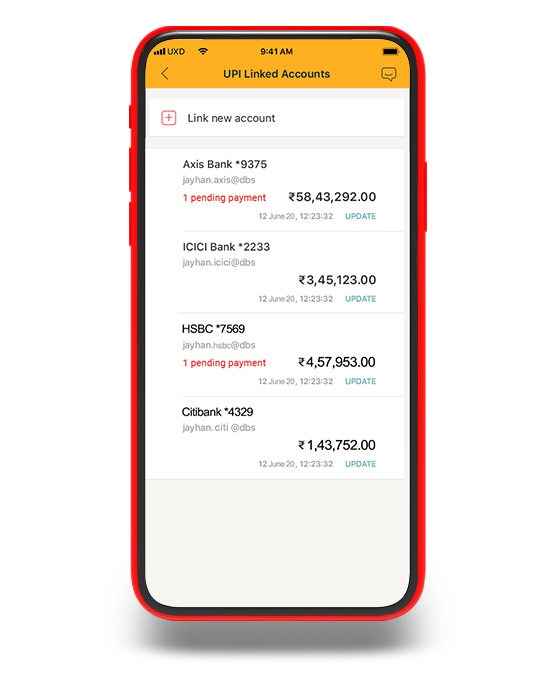

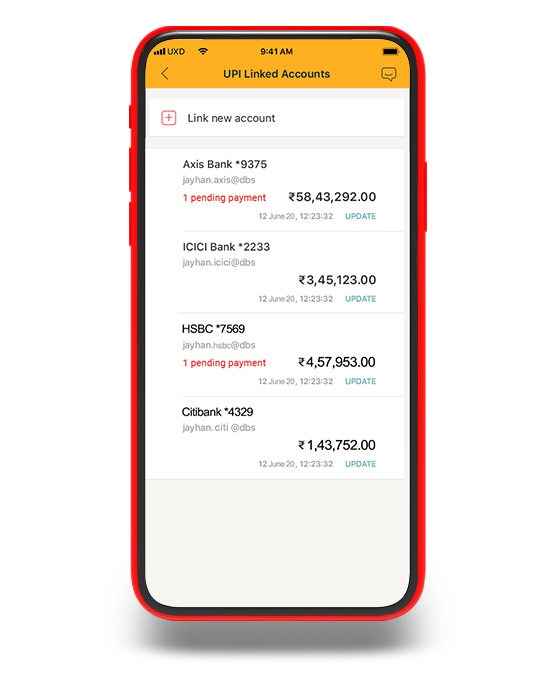

Unclutter with banking's

universal remote

Scrambling to keep track of multiple accounts and their passwords and OTPs is so last year. Bring all your accounts under one secure roof with a unified platform that acts as your own personal universal remote for banking.

Interest rate so good,

it will always be on your mind!

![]()

7.05%* p.a. interest on Fixed Deposits

Why should only the finance nerds have all the fun and high returns? All you have to do is invest your money and go do your thing, while DBS takes care of the rest.

What’s up DBS!

A Debit Card that's always

one step ahead of you

![]()

One Tap International Mode

![]()

Temporary

Card Block

![]()

Smart Spending

Delights

Your present and your future is taken care of with our debit card’s smart features that are just a tap away. Trot the globe like a pro, handle those “Dude, where’s my card?” situations without losing your mind. Spoil yourself silly with carefully curated delights you can actually use.