- Save

- Invest

- Borrow

- Pay

- More

- NRI Banking

Signature

Visa Debit Card

Visa Debit Card

with the Upgraded DBS Bank Signature

Visa Debit Card.

Visa Debit Card

An Upgraded Debit Card with Curated Benefits.

The Signature Visa Debit Card is designed to match your style. It elevates your lifestyle via exclusive benefits.

24*7 Signature Visa Concierge Service

Avail premium Signature Visa Concierge services any time, any day.

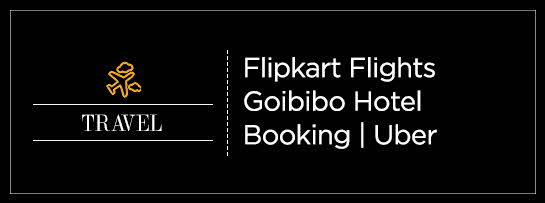

Special Travel Perks

Premium travel with 1 airport lounge access per quarter across India.

Better Rates and Higher Limits on withdrawals & spends

- Competitive Forex mark-up of 2.5% for international purchase and travel.

- Higher daily limit than before on ATM withdrawals & spends.

- Domestic ATM and Purchase Limit – ₹150,000

- Overseas ATM and Purchase Limit – ₹100,000

- 20 free non-DBS ATM transactions

Global Citizenship

Your Signature Visa Debit Card is accepted by 10 million merchants and 1.9 million ATMs globally.

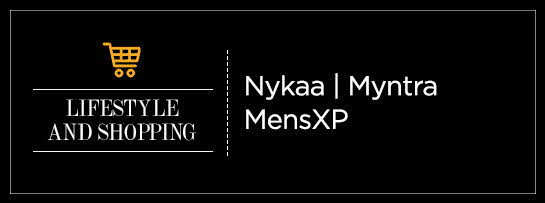

Exclusive Annual Privileges / Benefits Worth ₹60,000*!

Live the life you dream of with exclusive privileges and benefits from

curated just for you.

and much more from partners!

Note: DBS India is not liable for your use of any of the offers or its fulfillment. Your availment of the offers is purely voluntary and DBS India is not responsible or liable for the or provision of any goods or service availed by you from any of the merchant brands listed here and the same is subject to the merchant(s) terms and conditions.

Elevate Your Life Today.

Want to upgrade from the Classic Debit Card to the Signature Debit Card?

DBS Bank customers who maintain a minimum relationship value^ of ₹2 lakhs are eligible for the benefits.

^Total Relationship Value (TRV) is across all accounts and calculated by aggregating average quarterly saving account balances and end of period term deposits and investments.

We’ve Got Your Back, For LIFE!

We take care of your life itself. Get a complimentary Personal Accident & Dismemberment Insurance coverage of up to ₹5 lakhs. Also enjoy Zero Liability Protection, a unique feature that gives your debit card superior protection against unauthorised purchases on loss, theft or misplacement.

Complimentary Personal Accident & Dismemberment Insurance

Zero Liability Protection

How can DBS Customers activate their membership

Customer will receive a congratulations e-mail/SMS within 72 hours on successful activation of DBS Visa Signature debit card, which will contain e-code to obtain Times Prime Membership.

Customer will visit www.timesprime.com or download the Times Prime Mobile Application and sign up with his Email Id or Mobile Number.

Customer enters the e-code in the “Have a Gift/referral code?” option on the sign up page.

Customer completes the registration sign up process and activates his/her annual Times Prime Membership.

Times Prime Membership - Terms and Conditions

- E- code shared with the customer will remain active for 3 months from the date of receipt of e- code.

- The 12-month membership starts from the day the customer activates his/her Times Prime membership.

- The e-code is applicable once per user and is not valid for existing Times Prime members.

- In case of any issues related to the redemption of the e-code, please contact [email protected].

- Times Prime reserves the right to terminate, modify, extend the timelines and features, at any time at its absolute discretion.

- The offers/memberships subscriptions must be unlocked within the Times Prime Membership period.

- All Times Prime terms and conditions (as mentioned in the T&Cs on https://www.timesprime.com/terms-and-conditions) are applicable to the membership availed under this offer.

For Debit Card Terms and Conditions, please click here.

Our Products

- Savings Account

- Personal Loan

- Fixed Deposit

- Recurring Deposit

- Remittance

- Mutual Fund

- SIP

- Debit Card

- Bill Payment

- Internet Banking

- Travel Now

- PRIME Savings Account

- Safe Deposit Locker

Need Help?

- Calling from India:

1860 210 3456 / 1860 267 4567 - Calling from Overseas:

+91 44 6685 4555 - Help & Support

- Grievance Redressal

- Get in Touch with Us

Interest Rates & Calculators

- FD Interest Rates

- RD Interest Rates

- Personal Loan Interest Rates

- Savings Account Interest Rates

- Savings Account Interest Calculator

- FD Calculator

- RD Calculator

- Mutual Fund Calculator

- EMI Calculator

- SIP Calculator

- Lumpsum Calculator

- Financial Goal Calculator

- Monthly Investment Calculator

- ELSS Calculator

- Personal Loan EMI Calculator