- Save

- Invest

- Borrow

- Pay

- More

- NRI Banking

- Customer Services

DBS Bank Remittance Services

Frequently Asked Questions

The Swift code for DBS Bank India Limited is DBSSINBBXXX with last 3 digits (XXX) is the branch code where the customer holds the account. Refer the attached list for branch codes.

- Zero fees - We will not charge you any fees. No fees imposed on your recipient either

- Same day delivery - Your money will be delivered same day if your transaction is sent before cut-off time

- Very competitive exchange rate

- Guaranteed delivery of full credit to your payee

- 24x7 confirmed fx rates

Post login to DBS Bank application, you will be required to add new overseas payee before initiating an overseas payment. Please keep required details handy like payee full name, account no., bank details etc. to add overseas payee.

Please ensure that you have downloaded and logged into digibank app at least once before adding a new overseas payee.

Once the payee is set up, your newly added payee will be saved so that you don’t need to enter them all over again in your next transfer.

- Account not having sufficient funds

- Amount of transaction exceeding USD 25000 or equivalent

- In case the annual LRS limit of USD 250,000 has been utilized

- If beneficiary country is not part of “Permitted Country List”

- If the beneficiary is not part of the “Permitted Beneficiary List”

- Remittance being sent to your own account overseas

- If incorrect or partial details of beneficiary / beneficiary’s bank has been provided

- In case of unauthorized / non-permissible transactions not allowed as per RBI Regulations

- Maintenance of Family / Close Relatives Abroad

- Education Abroad

- Medical Treatment Abroad

- Emigration

- Other Travel (Including holiday trips & settlement of international credit card transactions)

- Business Travel

- Travel for Education (including fees, hostel expenses etc.)

- Travel for Medical Treatment

- Travel for Pilgrimage

- Gifts / Donation

The maximum limit of USD 250,000 or equivalent per year for transferring money abroad under Liberalized Remittance Scheme (LRS) is applicable for a customer for all transactions routed through all permissible channels / Authorized Dealers Banks (subject to any purpose specific limit specified by Reserve Bank of India).

|

Amount of Currency Exchanged (ACE) |

GST rates |

Minimum GST |

Maximum GST |

| Upto Rs. 1 lakh | 0.18% of ACE | Rs. 45 | Rs. 180 |

| Between Rs. 1 lakh and up to Rs. 10 lakh | INR 180 + 0.09% of ACE |

Rs. 180 | Rs. 990 |

| Above Rs. 10 lakh | INR 990 + 0.018% of ACE |

Rs. 990 | Rs. 10800 |

Applicable value of service = 1% of INR 50,000 i.e. INR 500 on which GST is applied @18% i.e. 18% of INR 500 = INR 90. Thus, GST payable is INR 90.

Now Let's say you are exchanging currency of INR 150,000:

Applicable value of service = INR 1,000 plus (0.5% of INR (150,000 - 100,000) i.e. INR 1,250 on which GST is applied @18% i.e. 18% of INR 1,250 = INR 225. Thus, GST payable is INR 225.

Let us explain with another example wherein you are exchanging currency of INR 60,000,000:

Applicable value of service = INR 5,500 plus (0.1% of INR (60,000,000 - 1,000,000) i.e. INR 64,500. But maximum value of service is capped at INR 60,000. Hence, the GST is applied @18% on INR 60,000 i.e. INR 10,800. Thus, GST payable is INR 10,800.

Hope that clarifies.

You can share the Nostro / Correspondent Bank details with the remitter as mentioned in the link: https://www.dbs.com/in/iwov-resources/pdf/deposits/correspondent-bank-details.pdf.

Tax Collected at Source (TCS) is an income tax collected in India on some transactions given in the Section 206C of the Income Tax Act 1961.

From 1st October 2020, Banks, being an Authorised Dealer (‘AD’), are required to collect TCS on certain remittances made under the Liberalised Remittance Scheme.

The Union Budget 2020 has mentioned that "As authorized dealers, Banks are required to collect tax at source (TCS) @5% u/s 206C on foreign remittances exceeding ₹10 lakh (from 1st April 2025 as per latest guidelines) under Liberalized Remittance Scheme (LRS) of RBI."

The tax collection at source will be effective Oct 1, 2020 on all LRS transactions including international debit card transactions.

Below transactions are under the purview of TCS applicability -

- LRS outward remittance transactions through DBS branch or digibank app.

- Foreign Currency Demand Draft or Cash issuance from domestic resident account under LRS purpose.

- International transactions, on Debit cards transactions (including transactions done on Foreign Merchants).

- Transfers from domestic resident customers to NRO account under LRS (Loan to NRI or Gift to NRI).

|

Purpose Description |

PAN- Aadhaar linked |

PAN Aadhaar not linked/ ITR not filed |

|

< = INR 10 lac – 0% ; > INR 10 lac – 0% |

< = INR 10 lac – 0% ; > INR 10 lac – 0% |

|

< = INR 10 lac – 0% ; > INR 10 lac – 5% |

< = INR 10 lac – 0% ; > INR 10 lac – 10% |

|

||

|

||

|

||

|

All other travel purposes |

< = INR 10 lac – 0% ; >INR 10 lac – 20% |

< = INR 10 lac – 0% ; >INR 10 lac – 20% |

|

||

|

||

|

If the purpose of transfer is under LRS (Loan to NRI or Gift to NRI), TCS will be applicable on transfers from domestic account to NRO account.

TCS paid can be adjusted against tax payable when individuals who would have paid TCS file income tax returns (ITR) in India. Please consult your tax advisor/consultant for further information.

TCS is applicable on all LRS transactions. LRS permits Rupee loan and gift to a NRI/PIO who is a close relative. In this case, for such rupee transactions, TCS will be applicable.

- Education loan sanction letter with student name and parent who is the co-borrower

- Declaration on the LRS application from client that the source is from loan

- Bank statement showing the source of funds as unutilized disbursed Education loan by a financial institute

TCS is applicable at PAN level. The LRS limit maintenance, TCS charging and TCS reporting is consolidated at customer level i.e. at PAN level.

Please note TCS once deducted cannot be refunded by the bank in case of any return of transaction/remittances. Remitter can approach for refund from tax authority while filing Income Tax Returns or consult with tax advisor for refund/adjustment.

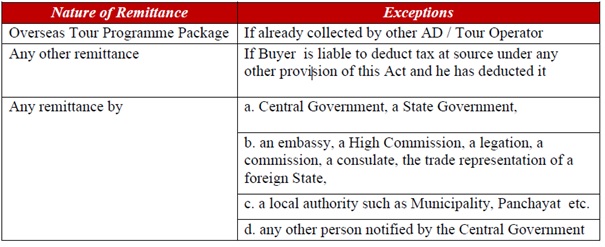

Yes there are following exceptions when TCS need not be collected:

TCS is to be collected at the time of debiting the amount payable by the remitter or at the time of receipt of such amount from the remitter, by any mode, whichever is earlier.

For remittances up to USD 25,000/day, you may explore and avail instant transfers from the comfort of your home by using DBS Bank https://www.dbs.com/digibank/in/banking/remittance/international-money-transfers.

Customers can call their Relationship Managers for Remittances above USD 25,000 upto USD 2,50,000 in a financial Year.

Dynamic currency conversion or cardholder preferred currency is a process whereby the amount of a Visa transaction is converted by a merchant or ATM to the currency of the payment card's country of issue at the point of sale.

- Use ‘Education/Studies Abroad’ if the funds are being sent directly to the educational institute.

- Use ‘Travel for Education’ if funds are for consulting fees, living expenses, or extra-curricular activities.

- Incorrect Purpose Code: Ensure you select the correct code. When unsure, please check with your RM or bank.

- LRS Limit Breach: You may have exceeded the ₹2.5 lakh USD annual limit under the Liberalised Remittance Scheme (LRS). Check your available limit before initiating a transfer.

- Invalid SWIFT Code: If there’s doubt about the SWIFT/BIC code, please contact the beneficiary bank directly.

- Gifting to Self: Remittances cannot be sent as a gift to yourself. Such transactions will be declined as per RBI guidelines.

-

Online outward remittance via Digibank: Zero fees (sending local currency to home country), eOTT charges of 500+GST applies for USD transfers to countries other than the USA

Country/Currency

Bank Fee

1. USD to USA

Rs. 0

2. GBP to United Kingdom

3. AUD to Australia

4. EUR to Eurozone

5. HKD to Hong Kong

6. SGD to Singapore

7. CAD to Canada

USD to other countries (exc. USA)

Rs 500

-

Offline outward/inward remittance (processed through branch): Agent/correspondent bank charges and other third party charges may apply, depending on the remitting currency, country and intermediary banks involved.

Yes, for capital account transactions (like investments, property purchase, etc.), the bank is mandated to collect specific documents. This applies to both online and offline remittances. Please refer to the list of required documents.

|

Sr. No |

Source of Funds |

Eligible Documents |

|

1 |

Salary |

1. Account statement showing salary credit with relevant narration |

|

2 |

Fixed Deposit (FD) / Mutual Fund (MF) Redemption |

1. Account statement showing credit entry with narration mentioning FD/MF redemption |

|

3 |

Rental Income |

1. Account statement showing credit entry with narration mentioning rent |

|

4 |

Interest / Dividend Income |

1. Account statement showing credit entry with narration mentioning interest/dividend |

|

5 |

Other Income / Credits |

1. Account statement showing credit entry |

Our Products

- Savings Account

- Personal Loan

- Fixed Deposit

- Recurring Deposit

- Remittance

- Mutual Fund

- SIP

- Debit Card

- Bill Payment

- Internet Banking

- Travel Now

- PRIME Savings Account

- Safe Deposit Locker

Need Help?

- Calling from India:

1860 210 3456 / 1860 267 4567 - Calling from Overseas:

+91 44 6685 4555 - Help & Support

- Grievance Redressal

- Get in Touch with Us

Interest Rates & Calculators

- FD Interest Rates

- RD Interest Rates

- Personal Loan Interest Rates

- Savings Account Interest Rates

- Savings Account Interest Calculator

- FD Calculator

- RD Calculator

- Mutual Fund Calculator

- EMI Calculator

- SIP Calculator

- Lumpsum Calculator

- Financial Goal Calculator

- Monthly Investment Calculator

- ELSS Calculator

- Personal Loan EMI Calculator