- The government stuck to the fiscal consolidation path, pegging the FY20 deficit at -3.3% of GDP, improving on Interim Budget’s and FY19’s -3.4%

- Primary deficit (excluding one-off revenues) points to a modest slippage

- The burden of revenue generation shifts to tax and non-tax proceeds, accompanied by a firmer nominal GDP growth

- Expenditure outlays are up sharply vs. actual FY19 math

- Measures to boost the rural sector and broader social welfare construct will continue, even if expectations of an explicit boost to short-term consumption was unmet

- Shades of change were present in multiple aspects, including a shift to raise part of the borrowings to offshore markets, a blueprint for national grids in key utilities and bigger free float for equity markets

- Bond yields declined sharply on Friday, meeting our targets

- With the government exercising fiscal restraint, this reinforces our view that another 50bp of rate cuts are likely in rest of FY20

India’s full-year Budget for FY20 not only stuck to the fiscal consolidation path, but also lowered the deficit target vs the Interim Budget and FY19. This improvement is backed by higher indirect tax and non-tax revenue assumptions along with firmer nominal GDP growth, while expenditure was held largely unchanged.

Before we delve into the specifics, the FY20 Budget marked a sense of continuity but also carried the winds of change. The broader fiscal consolidation path was adhered to along with a continuation of the emphasis on the welfare construct and push to improve infrastructure. While expectations of an explicit tax relief or cash transfers did not pan out (already laid out in February and widened the net last month), the Finance Minister signaled that plans to boost consumption would remain a priority. Meanwhile, the government took stock of progress on social sector plans, including rural road development, housing, electricity, gas connections, sanitation etc. and assured that these supply-side measures will continue. Moves were also made to attract more investments (details are in the latter part of the note). Addressing the near-term need for financial stability, INR700bn will be infused into domestic banks. Non-bank sectors also received a hand with key changes including banks incentivized to buy highly rated NBFC assets to provide liquidity, amongst others.

In the meantime, there were shades of change, marked by plans to raise part of the fiscal borrowings in offshore markets, merging of NRIs and FPIs investor categories, the blueprint for national grids in key utilities and bigger free float for equity markets. Bond markets reacted positively to the announcement of a move to the offshore markets, with 10y yields slumping by more than 10bp.

There were also other ambitious plans, while details are awaited, including a blueprint for a national gas grid, water grid and airports, improve accessibility to clean water, proposal for INR100trn investments into infrastructure over the next five years, amongst others.

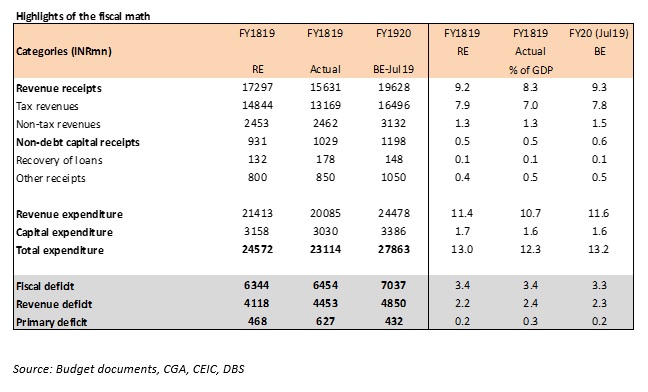

The underlying fiscal math

The government stuck to the fiscal consolidation path, pegging the FY20 deficit at -3.3% of GDP improving on Interim Budget’s and FY19’s -3.4%. While the revised FY19 numbers were available in the Budget documents, we prefer to compare with the FY19 actual numbers, which had seen revenues undershoot revised estimates and led to a scaling back in the expenditure as well. Compared to a fall to 8.3% of GDP in FY19 (actual), FY20 revenue receipts are pegged to rise to 9.3%, underpinned by better tax and non-tax contribution. Amongst the measures on Friday were that the cut in the corporate tax rate to 25% will now be applicable to all firms with a turnover of over INR4bn (~covers 99% of the firms according to the FM).

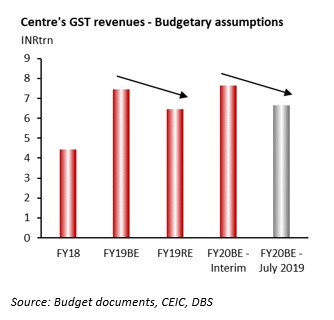

Under indirect taxes, encouragingly, center’s GST revenues were revised down by INR1trn from an inflated assumption in February. To make up for this shortfall import duties on gold (10% to 12.5%) and precious metals have been raised as well as cess on petroleum and diesel sales. The most notable rise was in divestment proceeds – from INR800bn in FY19 to INR1.05trn (0.5% of GDP). Pending the decision on the economic capital framework, RBI (and other PSU) dividends are estimated at an optimistic INR900bn (0.4% of GDP).

Under expenditure, FY20 total outlays have raised due to higher revenue expenditure while capital expenditure continues to be scaled back. Amongst the sectors, disbursements towards agri-allied activities is expected to rise a sharp 75% YoY vs a 65% rise in FY19 RE, accompanied by higher allocation towards IT and telecom, rural development, education, development of the North East region and a 74% rise in the centre’s transfer to the GST compensation fund.

While the headline deficit points to a moderation in the fiscal deficit, our preferred gauge i.e. primary deficit (fiscal deficit excluding one-off revenues) points to a slippage suggesting an underlying shift towards an expansionary budget.

Highlights of measures

(the complete list can be found here)

Taxation: The lower corporate tax rate of 25% was extended to companies with a turnover of INR4bn. Relief in levy of Securities Transaction Tax (STT) provided by restricting it only to the difference between settlement and strike price in case of exercise of options. Increase in the surcharge for individuals with taxable incomes above INR50mn to 42% and 38% for incomes above INR20mn to INR50mn. Select import duties and cess have been raised.

Social welfare construct: For affordable housing, permit an additional deduction of up to INR150k on interest paid on loans borrowed up to 31st March, 2020. Ensure watre security and supply by integrating demand and supply side management of water at the local level, including the creation of local infrastructure for source sustainability like rainwater harvesting, groundwater recharge and management of household wastewater for reuse in agriculture. Plans to invest widely in agriculture infrastructure.

Scheme of Fund for Upgradation and Regeneration of Traditional Industries’ (SFURTI) aims to set up more Common Facility Centres (CFCs) to facilitate cluster based development to make the traditional industries more productive and generate employment.

Financial sector: Public Sector Banks will to be provided with INR700bn capital to boost credit and banks have been asked to leverage technology and unify systems by enabling customers of one Public Sector Bank to access services across all Public Sector Banks.

Banks have been incentivised to purchase high-rated pooled assets of financially sound NBFCs amounting to INR1trn during FY20, backed by a one-time six-month partial credit guarantee by the government. Regulation of the Housing Finance companies will now come under the central bank from the National Housing Board. Regulatory changes including the housing finance companies brought under the preview of the RBI from National Housing Board earlier. NBFCs which do public placement of debt have to maintain a Debenture Redemption Reserve (DRR) and in addition, a special reserve as required by RBI, has also to be maintained.

These measures to revive credit flow from NBFCs are timely, which should ideally be followed by the regulators conducting a thorough asset quality review and take resolution steps thereafter. Credit flow is likely to return to the NBFCs once the asset-liability mismatch has been tended to, with banks meanwhile likely to come back to the fore.

Real and portfolio investments: A Credit Guarantee Enhancement Corporation for which the RBI has notified regulations, will be set up in 2019-20. An action plan to deepen the market for long term bonds. It is proposed to permit investments made by FIIs/FPIs in debt securities issued by Infrastructure Debt Fund – Non-Bank Finance Companies (IDF-NBFCs) to be transferred/sold to any domestic investor within the specified lock-in period.

Further opening of the FDI in aviation, media (animation, AVGC) and insurance sectors is under study. 100% FDI will be permitted for insurance intermediaries. Local sourcing norms will be eased for FDI in Single Brand Retail sector.

For portfolio investors, rationalize and streamline the existing Know Your Customer (KYC) norms for FPIs. merge the NRI-Portfolio Investment Scheme Route with the Foreign Portfolio Investment Route.

For start-ups, to resolve the so-called ‘angel tax’ issue, the start-ups and their investors who file requisite declarations and provide information in their returns will not be subjected to any kind of scrutiny in respect of valuations of share premiums. The issue of establishing identity of the investor and source of his funds will be resolved by putting in place a mechanism of e-verification.

Incentives have also been outlined for start-ups and electric vehicle segments, in addition to other green initiatives.

Policy implications

Domestic bond markets were watching the borrowing program with trepidation after a sharp increase in the Interim’s Budget gross borrowing program had seen long-term yields jump earlier in the year. Of interest, the government announced plans to raise part of its gross borrowings via foreign currency borrowings (size still to be announced). On the positive side, this will allow more room for private sector borrowers to tap the domestic markets, whilst also setting a benchmark for external investors, yielding to better pricing for other Indian credits. A con is, however, that this break from tradition could also be seen as an indication that domestic household savings were probably insufficient to meet the government’s funding needs and a new investor base could be tapped in midst of low/negative yielding papers globally. While this is a positive as a move to involve another investor class, this will also be approached with caution to ensure that any interest in these papers does not cannibalize demand for FPI purchases of domestic bonds. Any volatility in global markets could also meanwhile ripple into the domestic markets.

Gross borrowings for FY20 was meanwhile retained at INR7.1trn, with net at INR4.7trn. Markets reacted favourably to the government’s plans to raise part funds in the offshore markets, which led the 10Y yields to slip more than 10bps to mid-6.6% on Friday. This closes in with our target for the 10Y as we had laid out here.

For monetary policy, as the government maintains fiscal restraint, this reinforces our view that another 50bp cuts are likely in rest of FY20. Monetary policy is likely to do the heavy-lifting to boost growth this year (see here).

Radhika Rao, Economist

DBS Group Research

Disclaimers and Important Notices

The information herein is published by DBS Bank Ltd and PT Bank DBS Indonesia (collectively, the “DBS Group”). It is based on information obtained from sources believed to be reliable, but the Group does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation & the particular needs of any specific addressee. The information herein is published for the information of addressees only & is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Group, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Group or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Group & its associates, their directors, officers and/or employees may have positions or other interests in, & may effect transactions in securities mentioned herein & may also perform or seek to perform broking, investment banking & other banking or finan¬cial services for these companies. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. Sources for all charts & tables are CEIC & Bloomberg unless otherwise specified.

DBS Bank Ltd., 12 Marina Blvd, Marina Bay Financial Center Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

PT Bank DBS Indonesia, DBS Bank Tower, 33rd floor, Ciputra World 1, Jalan Prof. Dr. Satrio Kav 3-5, Jakarta, 12940, Indonesia. Tel: 62-21-2988-4000. Company Registration No. 09.03.1.64.96422.