- Save

- Invest

- Borrow

- Pay

- More

- Customer Services

De-Mystifying Total Expense Ratio

What is Total Expense Ratio?

As a potential investor in mutual funds, the total expense ratio is a term you will come across frequently. To be an aware mutual fund investor, you should know what total expense ratio is and how it affects you.

A mutual fund is a professionally managed avenue for you to proceed with investments. It helps you grow your wealth by investing your money in equities, debt or other assets. A mutual fund is managed by qualified fund managers, who have the technical know-how and researched data to take a well-informed call on these investments.

The mutual fund house charges you for this expertise, administration, risk management, and for trying to maximise your returns. This cost, charged by the mutual fund house on the investor, is referred to as the total expense ratio (TER).

Types of expenses incurred by a mutual fund

There are two types of expenses that a mutual fund incurs. One is the non-recurring type, that is, the cost incurred in launching a fund, fund promotions, marketing costs, and so on. Generally, the non-recurring cost is not passed on to the investor. The recurring cost, (which includes the fund management fee, commission for distribution, registrar’s fee, administrative expenses, etc.,) is charged in the form of Total Expense Ratio. In short, it is a percentage of assets managed by the fund.

What are the Total Expense Ratio Limits?

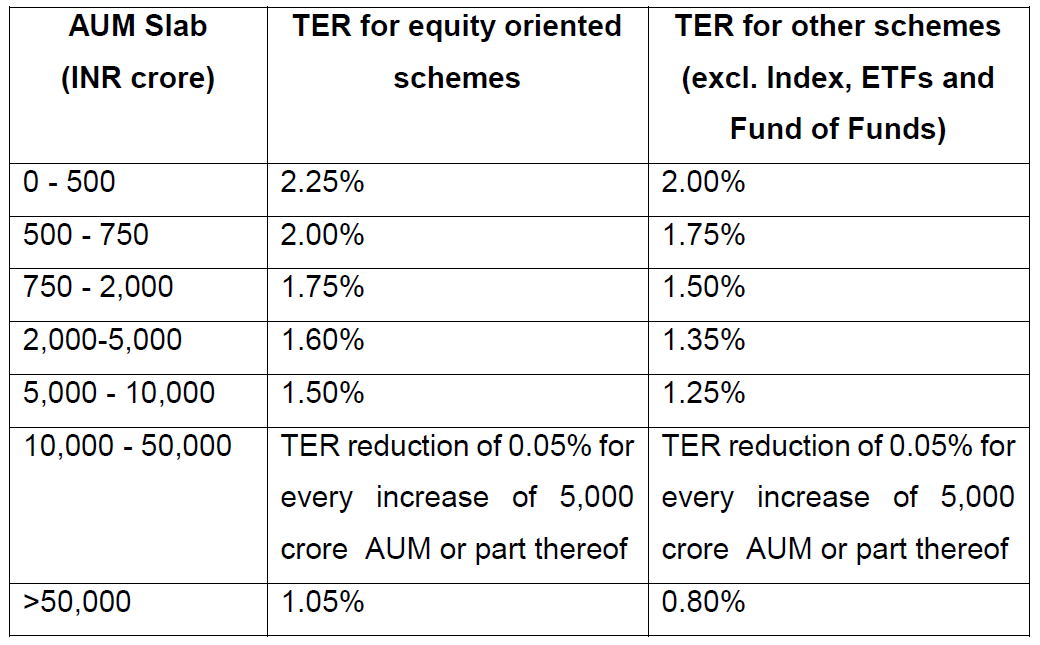

To make sure mutual funds do not charge an unreasonably high total expense ratio, market regulator SEBI regulates it from time to time.

- The TER for equity-oriented funds, which are mostly actively managed, is capped at 2.25% of the total assets under management

- The cap is lower at 2.25% for other schemes (excluding Index, ETF and FOFs) and

- 1.00% for index funds

- The TER of FoF scheme (including underlying plans), shall be a maximum of twice the TER of the underlying funds subject to a capping of 1.00% for FOFs investing in Liquid, Index & ETFs; 2.25% for Equity and 2.00% for other schemes

- Also, for equity and other schemes, the TER is capped incrementally lower based on the size of the assets under management

- SEBI provides an additional incentive of 30 basis points on the daily net assets from the inflows from retail investors from B30 cities. These B30 cities are those other than the 30 top cities in terms of MF mobilisation.

- SEBI allows mutual funds to charge additional expenses, not exceeding 0.05 percent of daily net assets, due to credit of any exit load to the scheme

Components of TER

TER is essential because it includes different types of costs charged to the investor, apart from the exit load. The investor is informed about the TER once every six months, although it’s accounted for daily. TER mainly includes three crucial components.

- Management Fees

Fund management is a highly skilled job, and a management fee is a price you pay for this skill and execution. Managing a fund requires devising investment strategies which align financial goals with an expectation of returns. A fund manager is responsible for maximising profits for the investor. He or she needs to possess relevant experience in managing investors’ money along with excellent performance records. Generally, the management fee is in the range of 0.05% (mainly for Liquid schemes) and 1 % (primarily for equity schemes) of the assets being managed. - Administrative Costs

These include costs of running the fund like IT services, customer support, data records, and infrastructural costs, among other things. These differ from one fund to another. - Distribution commission

You, as an investor, do not pay the distributor of the fund. It is the fund house which pays. But, the fund charges you for it as part of TER. A distribution commission entails distributorship, promotions, and marketing costs.

Why should you care about the TER?

There are a couple of reasons why TER should matter to mutual fund investors.

- TER has an impact on your returns: For example, you add Rs. 10,000 to a fund, and the expense ratio is 2.5%. Then, you pay Rs. 250 toward this percentage. If the mutual fund you have invested in gives a return of 12%, then, after netting the TER of 2.5%, you will effectively earn 9.5%. The NAV (net asset value) of your fund is gross asset value minus the expense ratio.

Therefore, a lower TER will ensure higher returns for you. The TER becomes a vital factor when investors are trying to pick between similar schemes with comparative yields.

You may feel half a percentage here and there in TER may not make much difference. But, when you make lump sum investments in mutual funds over time and earn big returns, TER can cause a significant difference in what you ultimately get.

Example

To understand better, let us take an example of two index funds. Their performance is indexed to BSE Sensex. One has a TER of 1%, and the other has a TER of 0.5%, only half a percent apart. If you invest Rs. 1 lakh in both the schemes for 15 years, you will see the first one would fetch you Rs. 8.9 lakh and the second one Rs. 10 lakh. - An important component in actively traded funds: In case of actively managed funds, the role and skills of a fund manager become crucial for the performance of the fund. In an actively managed portfolio, the fund manager is responsible for everything. It starts with security selection to allocation, performance tracking, risk-return analysis, and continues with monitoring portfolio returns. He or she constructs a portfolio based on the investment and targeted growth objectives of the fund. Here, if there is a considerable gap between the performances of your fund versus index funds, then you may have to review your choice.

DBS Bank offers Mutual Funds that are instant, paperless, signatureless – even transaction fee-less! What’s more? You get to choose from 250+ Mutual Funds across 15 top-performing asset management companies. So why wait? Login to digibank (app or internet banking) and start investing in a flash with instant Mutual Funds on DBS Bank.

Read up more on Mutual Funds here

Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.