- Save

- Invest

- Borrow

- Pay

- More

- Customer Services

How the power of compounding in mutual funds makes you rich

Whenever we hear of any scheme that promises to double or triple our money, most of us become wary. After all, there is no dearth of con artists who have duped thousands of their hard-earned savings. Despite this, we do wish that our money would double or triple in some way. It’s one of the reasons people invest in equity and equity mutual funds.

The two pillars of growth

There are two things that are required for our investments to grow - time and returns. The more of either of these two things an investment gets, the more it grows. Many investors don’t see their wealth grow because they fail to give either sufficient time for the growth or they invest in something that doesn’t give sufficient returns, given their goals.

In school, most of us learned about compound interest. Unlike simple interest, the principal on which you earn interest gets augmented by adding the previously accumulated interest. The new principal thus is greater, and as a result grows more.

The point to note here is that as your principal grows, so does the amount of the interest on it even if the rate of interest hasn’t changed. This rule is the reason why veteran investors strongly suggest staying invested for long. In the case of mutual funds, things like interest and dividend also get added to the initial principal invested thus increasing the amount on which returns are generated.

What’s the power of compounding?

Compounding in the case of mutual funds

In the case of mutual funds, you don’t earn an interest. What you do have is a growth in the value of the units you buy. Let’s say you invest Rs. 10,000. In exchange for this amount, you receive 100 units of the mutual fund, each of which is worth Rs. 100. The price of each unit is called Net Asset Value or NAV of the mutual fund.

Let’s say, after a year each unit is worth Rs. 110. This growth of Rs. 10 is called capital gain. Your investment is now worth Rs. 110 X 100 or Rs. 11,000 & your investment has grown by (11,000 – 10,000) = 1,000. This is how growth in mutual fund investment happens. Now imagine, if you kept investing the same amount each year.

With each passing year, the value of your earliest investments will grow the most. The older an investment, the greater its value. This is because that investment has had that much longer to grow.

This is where the effect of compounding is seen, as it is similar to the concept of compound interest where the principal grows with each year.

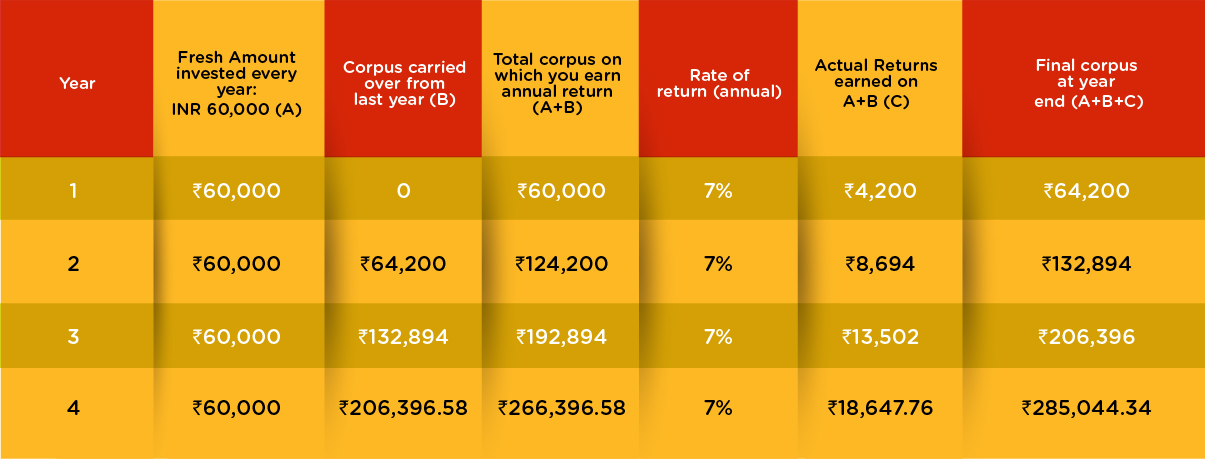

For example, if you invest Rs. 10,000 each year for ten years, the 10,000 you invested in the first year would have grown the most as it has had ten years to grow. Compare this to the investment you make in the 10th year which has just one year to grow. This is compounding in action. Check the table below to see how compounding can work when you invest Rs. 5,000 each month in a debt mutual fund. As you can see, each year the interest is on not just that year’s investment but that year’s investment and the previous years as well. With each year, the principal goes up and so does the amount earned.

*The figures mentioned above are for illustrative purposes only. Final corpus will depend on the market performance of the invested funds during the investment period. Final corpus shown here is calculated assuming an annual SIP return of 7% over the investment period.

What you should take away from all this

Now that you know what everybody is talking about when they talk about compounding in mutual funds, the lesson is pretty simple. The longer an investment stays invested, the more it grows with time. This means the earlier you start investing, the more growth your investments will see. So why wait? Start now!

DBS Bank offers Mutual Funds that are instant, paperless, signatureless – even transaction fee-less! What’s more? You get to choose from 250+ Mutual Funds across 15 top-performing asset management companies. So why wait? Login to DBS Bank (app or internet banking) and start investing in a flash with instant Mutual Funds on DBS Bank.

Read up more on Mutual Funds here

Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.