- Save

- Invest

- Borrow

- Pay

- More

- Customer Services

How to invest when interest rate rises

Interest rates are influenced by your country’s central bank. They may be adjusted to stimulate or curb a country's economic growth.

Understanding how the rise and fall of interest rates affect businesses, individuals (like you and me) and ultimately your investments, will help you ride the wave with confidence.

When Interest Rate Rises

In general, high interest rate cools an overheated economy and reduces inflation.

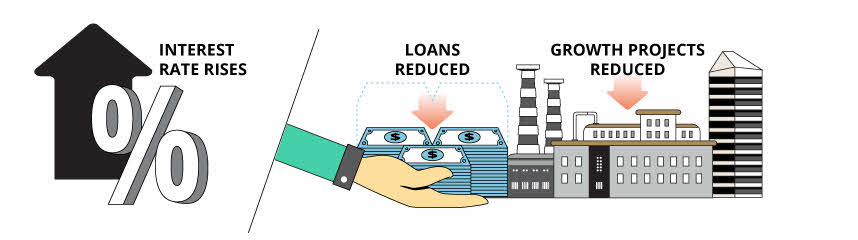

Higher borrowing costs impedes business plans

Higher borrowing costs impedes business plans

Cost for businesses to borrow money is increased, thus businesses will likely halt or reduce growth projects.

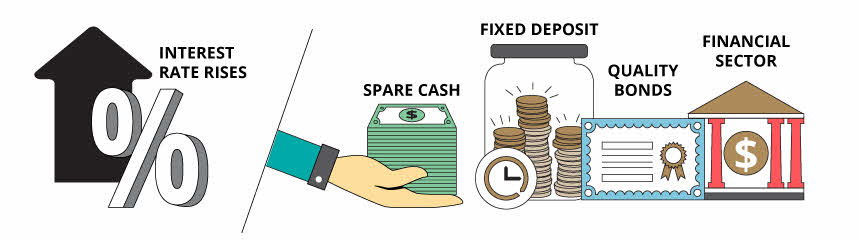

Hunt for quality bonds and companies in Financials sector

Hunt for quality bonds and companies in Financials sector

Savings are more attractive due to higher deposit rates; individuals may consider investing in assets, businesses or sectors that will benefit from rising interest rate.

Investment Opportunities

in the midst of a high interest rate environment

|

Financials sector such as banks, mortgage and insurance companies stand to benefit as interest rate hikes. |

|

|

Attractive fixed deposit rates may entice savers. Investors may be able to pick up quality bonds at a favourable trading price. |

When Interest Rate Falls

In general, low interest rate stimulates economic growth and increases inflation.

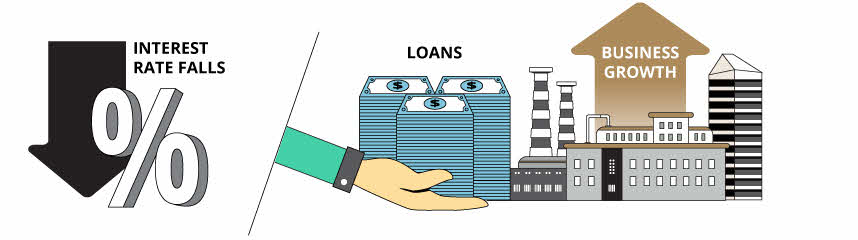

Cheaper for businesses to borrow

The cost for businesses to borrow money is reduced, thus businesses will likely embark on growth projects such as business acquisitions and expansions and product developments.

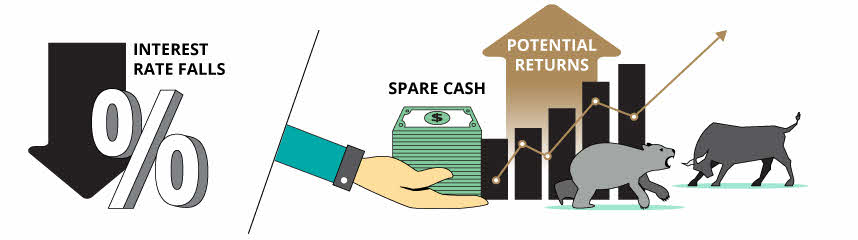

Invest for better returns

Invest for better returns

Savings are less attractive due to lower deposit rates; individuals are likely to invest spare cash into investment instruments for better returns.

Investment Opportunities

in the midst of a low interest rate environment

|

Look for Growth stocks or sectors as researched and curated by our Chief Investment Office and Group Research teams. |

|

|

Seek bonds with attractive coupons or higher dividend paying stocks. If you are holding to such high demand assets, this might be an opportunity to capitalise your assets. |

Disclaimer

This article is for information purposes only. We recommend you get in touch with your investment advisor for any financial advise.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

DBS Bank India Limited – AMFI registered Mutual Fund Distributor (ARN-155319)