Financial markets have been thoroughly roiled in 2022, and selecting a suitable investment strategy may seem extra challenging when markets are this volatile. At times like this, recognising strategies in the bull and bear markets can help you navigate your portfolio.

Whatever type of market we are in, there are personal and market factors to consider before investing. Once you’ve identified some companies as potential candidates to invest in, shortlist them by assessing these factors:

Take the Covid-19 pandemic as an example. Many businesses were adversely affected by the halt in tourism and air travel, and by safe distancing measures. These include airlines, tour agencies, cruise companies and food & beverage firms.

On the other hand, several businesses such as healthcare equipment manufacturing companies, online service providers and e-commerce boomed amid the lockdowns.

Some investors may be tempted to invest in the badly-hit businesses, believing that their low valuations would rebound and be beneficial in the long-run. But with the severity of the pandemic’s impact, you need to deepen your research. Assess which companies’ stock prices may never return to their previous highs, and if you have already invested in them, consider investing in those with stronger financials instead.

3 ways to invest in bull and bear markets

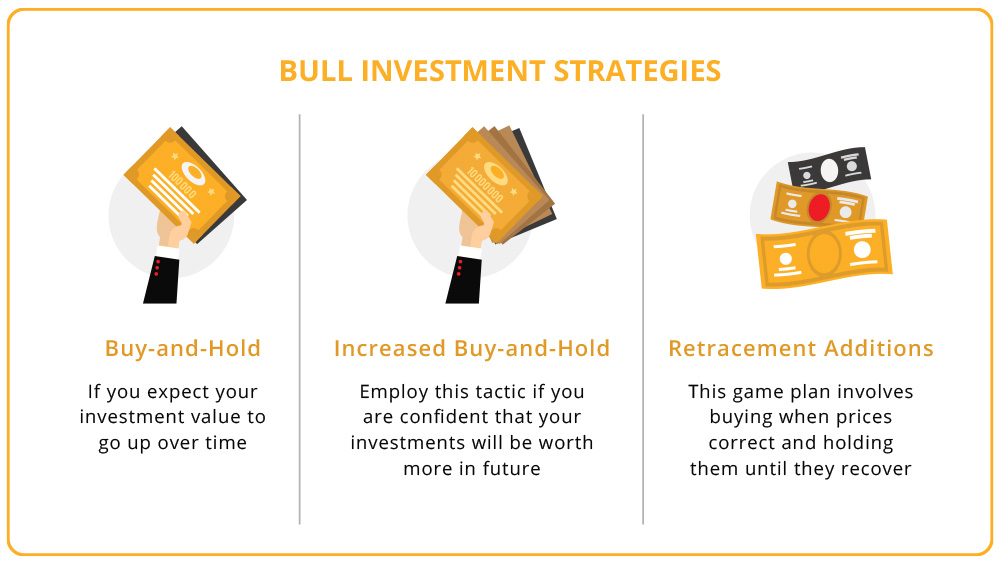

In a bull market, you would be investing as prices are going up.

If you believe prices will continue to go up, you could opt for a buy-and-hold investment strategy. This means that you buy and you hang on, expecting that the longer you stay invested, the higher the value of your investment.

An alternative is the increased buy-and-hold strategy, which is a variation of the buy-and-hold strategy where you continue to buy even as prices increase. Consider this strategy only if you are confident that your investments are still undervalued and will be worth more in future.

However, there will still be periods of volatility and price fluctuations even in a bull market.

To invest amidst such volatility, consider the retracement additions strategy, in which you buy when prices correct and hold them until they recover.

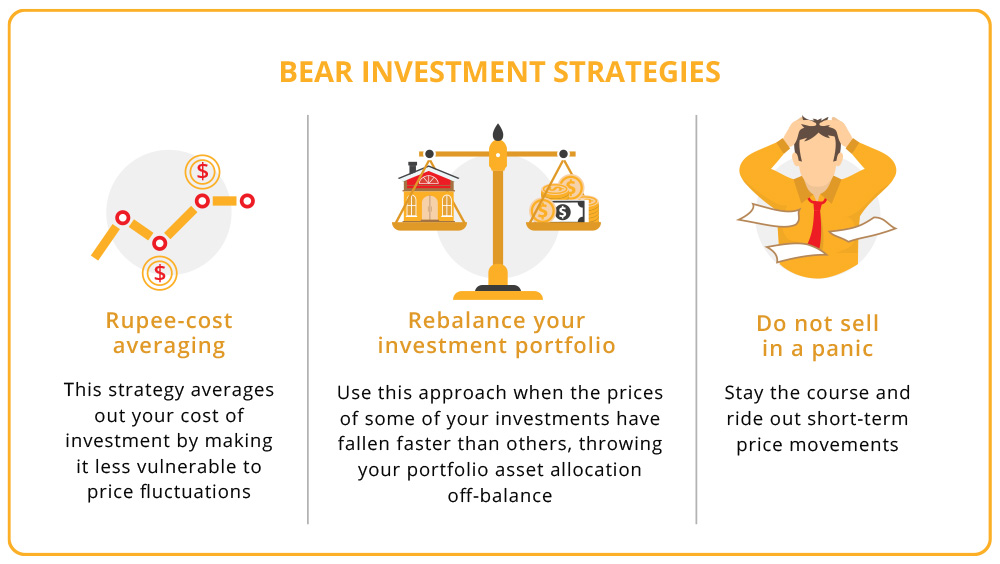

When investing in a bear market, dips in the markets are often more difficult to identify than the highs. It is also more challenging to make sound judgement calls when affected by pessimism and negative news.

So, when investing in a bear market, the key lies in maintaining a long-term view.

Consider the rupee-cost averaging (RCA) investment strategy, which divides your funds into bite sized portions, and investing each portion at fixed intervals. Doing so buys you more shares when prices are lower, and fewer shares when prices are higher. This helps to lower your average purchase price and makes your investment less vulnerable to price fluctuations. When your cost is lower, your returns will improve too.

It also helps to rebalance your investment portfolio back to its long-term asset allocation target. Rebalancing is especially important to maintain shape in a bear market, as the prices of some of your investments would have fallen faster than others, throwing your overall portfolio asset allocation off-balance.

For example, if your fixed income assets now have a higher allocation than originally planned, rebalancing means selling some of them in favour of equities. Rebalancing your portfolio during a bear market can also help you reap the gains from a market recovery.

Lastly, investors should be careful not to sell in a panic. If you have sufficient cash to ride out the bear market, try not to be affected by short term price movements.

<< Return to Part 1

Let smart wealth management be your guide

Your investment journey is unique to you, and at DBS Treasures we are in the business of managing your wealth the smart way.

Whatever your needs for today or tomorrow, access smart wealth solutions that work for your preferences and risk appetite, even as your needs change. From tailored products to ready-made managed investments, choose from mutual funds, digiPortfolio, structured products, fixed income, equities, and currencies to deliver the results you need for your goals.

Stay in control with the DBS digiBank app’s complete suite of features and alerts that anticipate your needs.

And get smart personalised advisory from your Relationship Manager who taps on digital intelligence to help you decide on your investments with confidence.

Get in touch for smart solutions to grow your wealth