- Save

- Invest

- Borrow

- Pay

- More

- NRI Banking

- Customer Services

Personal Loan For Women

Apply for a Personal Loan for Women easily. Find out the eligibility criteria and documents needed.

Key Takeaways

- Women can apply for special Personal Loans for Women to fund their various expenses.

- Salaried and Self-employed women can apply for the loan.

- Personal Loans for women are unsecured loans.

- There are no end-use restrictions on these loans.

- You can apply for the loan online by submitting scanned copies of your documents.

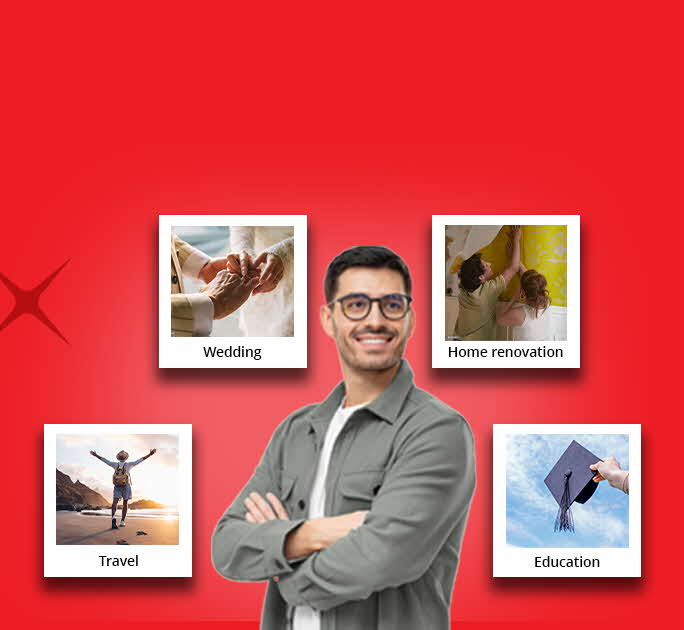

If there ever was a time to be a woman, it is now. Today, women are shattering glass ceilings while they take on the world with confidence in their high-heeled shoes. They are winning on every front, be it in their personal or professional lives. Women who wish to fulfil their little to big goals, be it travelling worldwide or running a company, can do so now by availing of Personal Loans. Here is a brief guide on Personal Loans for women.

Eligibility Criteria

- As is apparent from the term, Personal Loans are specially designed for women.

- You need to be an Indian woman in the age group of 21 to 60 years.

- You can be a salaried individual or a self-employed individual to be eligible for a loan

- You need to draw a minimum net monthly income of INR 20,000.

Personal Loan for Women – The Salient Features

- Personal Loans for women are unsecured loans, which means the applicant does not have to provide collateral.

- These loans come with repayment tenures lasting from 1 to 5 years.

- Applicants can repay the loan in easy equated monthly instalments through post-dated cheques or the Electronic Clearance system.

- The principal amount and interest rate offered depends on the credit score, repayment behaviour, and income of the applicant.

- There is no specific restriction on the end-use of the loan amount. You can use it to fund personal purchases, go on domestic or international trips, invest in your business, etc.

Documents Required for Submission

You need to submit the following documents if you are eligible for the unsecured Personal Loan for women.

- A copy of any one identity proof document, e.g., PAN Card, Aadhaar Card, Voters ID, Passport, or Driving license

- A copy of any one address proof documents - e.g. Passport, Driving License, Voter ID, the latest utility bills, Leave and License Agreement, etc.

- To avail of a Personal loan for salaried women, the applicants must provide their Income Proof documents like last 2 months' Salary Slip or the previous 3 months' Bank Statement.

- Self-employed individuals must provide their latest ITR, Form 16 or last 3 months bank statement, and a certified copy of degree or licence to further authenticate their income.

How to apply for a Personal Loan?

Whether you are applying for a salaried personal loan for women or as a self-employed applicant, you can apply online on the DBS Bank website. Download and fill the loan application form and submit it with scanned copies of your documents as mentioned above. You can also apply for the loan in person by visiting your nearest DBS Bank branch.

So do not postpone your dreams any longer. Get the cash you need to fulfil your various life aspirations with Personal Loans for women.

Download the digibank mobile app on your smartphone. Launch the app and click on the "Get Personal Loan" link on the login page.

*Disclaimer: This article is for information only. We recommend you get in touch with your income tax advisor or CA for expert advice.