Introduction

Choosing a credit card can feel overwhelming, especially with so many options in the market. But here's a simple truth: your ideal credit card should match your life stage and lifestyle. Whether you're just earning your first paycheck, planning a honeymoon, starting a family, or managing retirement expenses — there's a card built for you.

In this guide, we decode the best credit cards in India based on different life stages and daily needs — so you can spend smart, earn rewards, and save more.

If you are wondering, ‘Which is the best credit card for me?’ Choose one that complements your everyday spending, adds value to your routines, and grows with your financial journey.

Credit Cards That Evolve with Every Life Stage

Your lifestyle changes as you grow — and so should your credit card. The way you spend at 25 is very different from how you spend at 45 or 60. That's why choosing a credit card that aligns with your life stage is key to maximizing its benefits.

From building credit to funding family needs to elevating luxury experiences, the right card should adapt to your needs — not the other way around. For example, a fuel credit card in India is perfect for those in their working years, while a lifetime free credit card can benefit those looking for more simplicity.

Matching Credit Cards to Life Stages

As your financial priorities evolve, so does your need for the right financial tools. Knowing how to choose the right credit card at each life stage can help you maximize your benefits while fitting perfectly with your lifestyle and goals.

A quick visual guide to help you identify the right card based on your age, lifestyle, and goals.

Credit card recommendations by life stage in India – first job, family, travel, and more

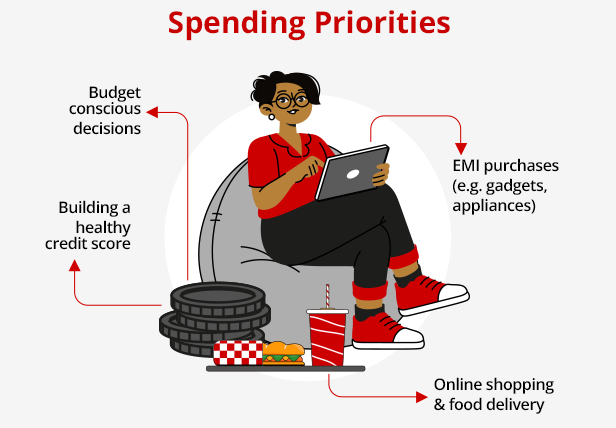

1. Early Earners (25–30 years)

This stage marks your entry into financial independence, where you’re managing expenses, planning EMI purchases, and building a credit history. A credit card for beginners is designed for first-time users. Offering simple reward structures, manageable credit limits that help you spend wisely while improving your credit score.

Best Fit:

For the perfect first credit card, consider entry -level credit cards that offer rewards on food, entertainment, and e-commerce. Look for EMI flexibility and low annual fees.

2. Young Professionals (30–40 years)

With evolving lifestyle needs, this is the time to plan your spending. For frequent travellers, a credit card with lounge access adds more value with perks like milestone rewards, insurance cover and offers on flights and stays.

Best Fit:

The best rewards credit card for salaried person should offer generous travel rewards, lounge access, and flexible EMI options along with added perks on dining and utility bill payments.

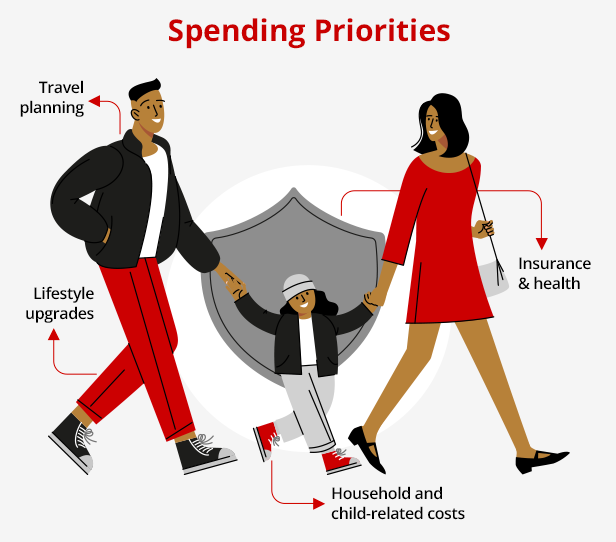

3. Young Families | 40 – 50 yrs.

With family expenses taking priority, the need for value driven spending becomes essential for your finances. A credit card for groceries in India can help maximise savings on essential daily purchases, along with added benefits like utility bill payment offers, and fuel surcharge waivers.

Best Fit:

Choose credit card with milestone-based rewards on groceries, utility bills, and fuel along with added travel perks and family protection features.

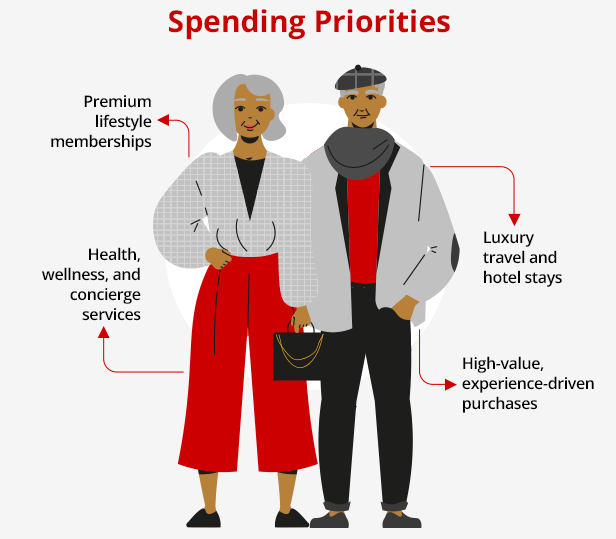

4. Professionals Nearing Retirement (50–60 years)

As retirement nears, a premium credit card in India offers exclusive benefits like travel perks and concierge services, helping enhance your lifestyle with added convenience and rewards.

Best Fit:

Premium or co-branded travel cards offering exclusive privileges like golf access, hotel memberships, luxury retail discounts and personal concierge.

The One Card for Every Chapter: DBS Spark Credit Card

While many cards cater to specific life stages, DBS Spark Credit Card is designed to accompany you through all of them.

Whether you're starting out or stepping into your next chapter, this card adapts to your evolving needs, offering:

- Generous rewards across spends

- Easy EMI conversions

- Complimentary airport lounge visits

- Exclusive partner offers

- Milestone bonuses

In short, it’s the only card you need as life progresses.

Want more? Try the DBS Vantage Card.

If you're looking for premium, experience-first benefits, the DBS Vantage Card delivers elevated privileges for travel, lifestyle, and rewards — built for those who want more, at every stage.

Choose smart. Choose seamless.

Selecting the right card doesn’t need to be overwhelming. Start by identifying your life stage and spending habits and then explore options like the best travel credit card in India, which offers tailored rewards for your lifestyle.

With the DBS Spark and DBS Vantage Cards, you’re always one step ahead — no matter where life takes you.