- Banking

- Wealth

- NRI Banking

- Customer Services

Related Insights

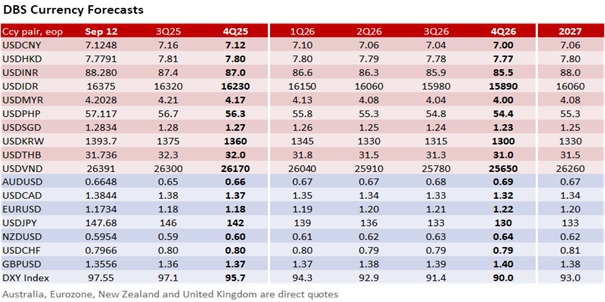

The DXY Index held below 98 throughout last week ahead of this week’s FOMC meeting. Apart from markets fully pricing in a 25-bps rate cut to 4.00-4.25% on September 17, the expectation for further rate cuts is also weighing down on the USD. Even if Fed Chair Jerome Powell keeps his cautious stance on tariff-led inflation, the greenback could depreciate. The extremely low US nonfarm payrolls on September 5 have not only undermined the US exceptionalism narrative, but also increased recession worries. US equities have held up largely because markets expect deeper rate cuts to cushion growth risks. Hence, we won’t be too hasty in betting on the USD’s haven status.

The Fed’s independence will be a significant factor in this FOMC meeting that could hurt the USD. US President Donald Trump is seeking greater influence over the seven-member Fed Board of Governors. Lisa Cook’s voting rights remain suspended under a federal appeals court ruling in favour of her reinstatement. At the same time, Stephen Miran would gain a vote if the Senate confirms his nomination to the Board. Fed Governor Michelle Bowen and Christopher Waller, who dissented at the last meeting’s hold decision in favour of a 25-bps cut, could push for a larger 50-bps cut.

USD/CAD could retreat from the ceiling of its month-long range of 1.3720-1.3930. On September 17, we expect the Bank of Canada to lower its target for the overnight rate by 25 bps to 2.50% after keeping it unchanged for three meetings. Real GDP contracted by 1.6% QoQ sa in 2Q25 while 1Q25 growth was revised down to 2% from 2.2%. CPI inflation declined to 1.7% YoY in September from 1.9% in August, in the lower half of the official 1-3% target. The labour market shed 65.5k jobs in August, worse than the 40.8k loss in July, while unemployment rose to a four-year high of 7.1% in August. Hence, the BOC keeps the door open for another easing. However, it may not hurt the CAD if the BOC stresses that its easing cycle would halt at the floor of its nominal neutral rate range of 2.25-3.25%.

Keep a close eye on GBP/USD, which may break above its month-long range, mostly between 1.36 and 1.38. On September 18, the market widely expects the Bank of England to keep the bank rate unchanged at 4% and affirm the market’s expectations to delay cuts to next year. At the August 25 meeting, the decision to lower rates to address growth concerns was highly divisive – four voted for a 25-bps cut, one for a larger 50-bps reduction, while four opposed, favouring a 25-bps hike due to sticky inflation. Specifically, the BOE explicitly noted that “the restrictiveness of monetary policy has fallen as the bank rate has been reduced,” stressing that the timing and pace of further reductions will depend heavily on how underlying inflation and disinflation pressures evolve.

GBP’s downside pressures from UK budget concerns have eased. Fed cut expectations helped pull down long-term bond yields, including the 30-year Gilt yield. The delay of the Autumn Budget to November 26 and Prime Minister Keir Starmer’s cabinet reshuffle reflected the government’s intention to retake control of the narrative, with a focus on delivering long-term economic stability through tough budget decisions. Chancellor Rachel Reeve’s fiscal challenges should not be confused with Liz Truss’s mini-budget crisis in 2022- the debate today is about navigating fiscal credibility and growth priorities, while Truss lost credibility by announcing unfunded tax cuts without oversight by the Office for Budget Responsibility amid a global inflation problem.

USD/JPY has been consolidating in a 146-149 range since early August, driven by a weak US jobs market weighing on the greenback. The Bank of Japan is widely expected to keep its target rate unchanged at 0.50% on September 19. On the same day, consensus expects National CPI inflation to decline to 2.8% YoY in August, below 3% for the first time since November. However, the BOJ will likely keep the door open for more hikes; high nominal wage growth remains weak in real terms.

USD/JPY will also pay more attention to the Liberal Democratic Party (LDP) leadership election on October 4. Leading candidate Sanae Takaichi is considered harmful for the JPY because she supports increased fiscal spending and opposes further BOJ rate hikes to stimulate economic growth. While Takaichi is more popular with the public, Shinjiro Koizumi has significant backing from LDP supporters. Koizumi is more aligned with targeted fiscal measures rather than broad fiscal stimulus and is respectful of the BOJ’s independence, suggesting a potentially more stable-to-positive outlook for the JPY.

In summary, the USD’s relative appeal is at risk if the Fed affirms further rate cuts, while the BOC signals its easing cycle is nearly over, the BOE pushes rate cuts into 2026, and the BOJ keeps its hiking bias intact.

Quote of the Day

“It is easy to sit up and take notice. What is difficult is getting up and taking action.”

Honore de Balzac

September 15 in history

In 2008, Lehman Brothers filed for Chapter 11 bankruptcy, the largest bankruptcy filing in US history.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Asset)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.