- Banking

- Wealth

- NRI Banking

- Customer Services

Related Insights

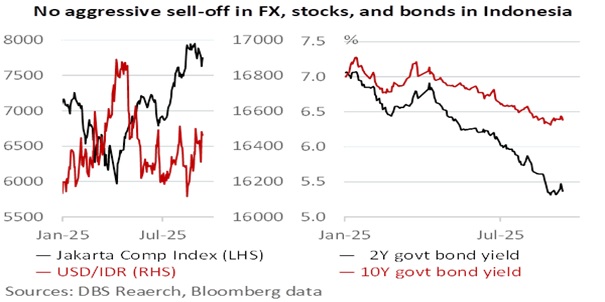

The Indonesian rupiah (IDR) has been remarkably stable despite weeks of protests and the unexpected dismissal of former Finance Minister Sri Mulyani Indrawati. After an initial knee-jerk sell-off, the IDR’s downside was limited to 16500 per USD, supported by Bank Indonesia’s active interventions in the foreign exchange and bond markets. The absence of aggressive follow-through selling suggests that investors see the current unrest as domestic politics rather than a systemic economic shock.

The resilience of the Indonesian markets reflected the country’s relatively sound macro fundamentals. For example, CPI inflation is well contained in the lower half of the official 1.5-3.5% target range; the trade surplus is 46% YoY higher in the first seven months of this year; and foreign reserves were 2.3 times short-term external debt in 2Q25. Still, questions linger about how fiscal and monetary policy will align to achieve the president’s ambitious 8% economic growth target. Yet, in a world unsettled by US-led trade uncertainty, Indonesia is also increasingly viewed as a potential growth engine, leveraging its status as the world’s fourth most populous nation and ASEAN’s largest economy.

Externally, it was striking that other countries did not criticize the Prabowo government over its handling of domestic political challenges. ASEAN has treated Indonesia’s unrest as a domestic political affair, unlike Myanmar, where systemic military abuses have been deemed a regional crisis requiring a collective response. What matters now is the government’s actual policy direction – whether Prabowo can balance his ambitious growth agenda and fiscal discipline acceptable to rating agencies, while keeping trade partners confident in Indonesia’s openness and stability. Until that balance becomes clearer, markets may reserve judgment, viewing the recent turbulence as a political episode rather than a structural break in Indonesia’s growth story.

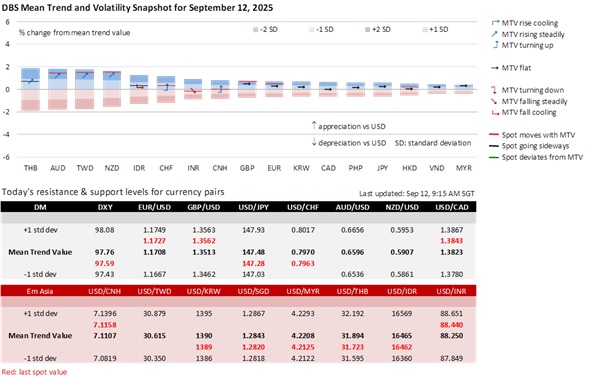

Next week, we expect Bank Indonesia to further support the IDR by keeping its policy rate unchanged at 5% on September 17. Later the same day, the Fed is widely expected to resume its rate-cutting cycle with a 25-bps cut to 4.00-4.25% and signal more rate cuts into 2026.

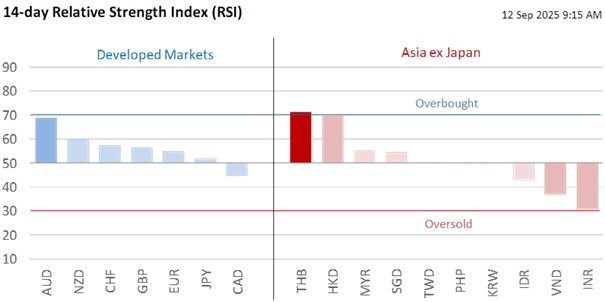

Similar lessons can be drawn from the EUR and GBP for the IDR. EUR/USD, despite headwinds from the collapse of the Bayou government and fiscal slippage worries in France, rebounded by 0.3% to 1.1734 overnight after the European Central Bank guided that no further easing is likely this year. GBP/USD also rebounded by 0.3% to 1.3574 overnight, as UK fiscal concerns eased alongside lower 30-year Gilt yields, mirroring declines in US Treasuries on dovish Fed expectations. The delay in the UK Autumn Budget to November 26 gives the Office for Budget Responsibility (OBR) more time to refine its forecasts, especially after UK GDP surprised with a 0.4% MoM expansion in June and offset the 0.1% MoM contractions in the previous two months; GBP will welcome another surprise increase in today’s July GDP. Next week’s CPI data should reinforce the Bank of England’s guidance for inflation to keep rising to 4% YoY in September from 3.8% in July, and its stance to hold rates for the rest of this year. Prime Minister Kier Starmer’s latest cabinet reshuffle, following the resignation of Deputy Prime Minister Angela Rayner, reflected the government’s intention to retake control of the narrative, with a focus on delivering long-term economic stability through tough budget decisions.

Quote of the Day

“The only way to discover the limits of the possible is to go beyond them into the impossible.”

Arthur C. Clarke

September 12 in history

In 2013, NASA confirmed that its Voyager 1 probe became the first manmade object to enter interstellar space.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Asset)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.