- Banking

- Wealth

- NRI Banking

- Customer Services

Related Insights

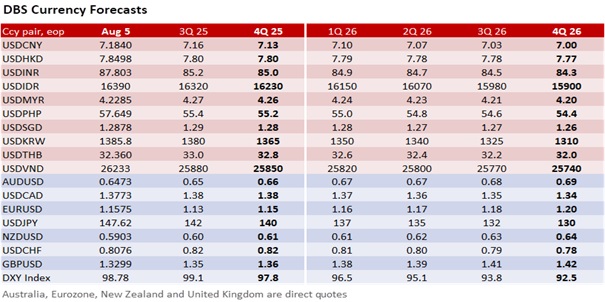

The DXY Index retreated a second day by 0.4% to 98.8 overnight, after last Friday’s bruising 0.8% sell-off on the weaker-than-expected US jobs report. The employment indices in both the ISM Services and Manufacturing PMI surveys retreated further below the breakeven 50 level in July, backing the significantly weaker 73k and 14k nonfarm payrolls in July and June. Despite the highest ISM Services prices paid index since October 2022, the overall Services PMI retreated to 50.1 in July from 50.8 in June, keeping investors alert to US economic slowdown risks. Investors brushed aside the rebound in 2Q25 GDP as a non-recurring rebound from the trade-related distortions driven by US President Donald Trump’s tariff policy and focused on the soft underlying demand in the GDP report.

Investors are reassessing their US growth assumptions that drove the S&P 500 Index to record highs and the USD’s upward correction in July. Having wiped out July’s rise from 3.70% 3.95%, the US Treasury 2Y yield is staying low and backing the futures market’s bet for a 90% chance of a Fed cut in September. President Trump is keeping up the pressure with plans to nominate his replacement for departing Fed Governor Adriana Kugler while narrowing his shortlist to four candidates to succeed Fed Chair Jerome Powell, whose term ends in May 2026. The Fed’s Jackson Hole Symposium on August 21-23 is shaping up as a significant event for Powell to assert the cautious hold stance or signal readiness to lower rates.

USD/JPY is in focus after its spectacular 2.2% plunge on August 1, returning it inside the 142-149 range seen in May to mid-July. Speculators abandoned their attempt to break USD/JPY above 150 after the shockingly weak US jobs report narrowed the positive US-Japan 2Y bond yield differential to below 300 bps again. Speculators are assessing whether the Bank of Japan will bring forward its next rate hike, which the OIS market currently only prices in toward the end of 2025. Finance Minister Katsunobu Kato’s warning over excessive FX volatility, reinforcing official discomfort with further JPY weakness in the wake of voter frustration demonstrated at the Upper House elections. The Japanese policymakers’ concern about higher JGB yields may lessen if the Fed cut expectations, dampening global yields, provide them the window to push for economic revitalization measures while maintaining public trust in fiscal management. To revisit the 142 level, USD/JPY needs to break a critical support level at 146, near the 50- and 100-day moving averages.

USD/CHF may find near-term stability within a 0.80-0.82 range on the Swiss government’s steps to defuse the risk to its export-driven economy from Trump’s planned 39% tariff. Swiss President Karin Keller-Sutter is in Washington to pursue a strategic diplomatic reset with President Trump, presenting a more attractive offer that could narrow the disparity with lower 15% tariff for the EU and Japan, and 10% for the UK. Trump will be seeking meaningful concessions from his Swiss counterpart, who is acting without falling back on Brussels or multilateral frameworks. Keller-Sutter has bipartisan backing, which gives her some latitude to offer concessions without looking politically weak at home. The outcome will ultimately rest on whether her attempt at reasoned negotiation can provide Trump the political win that he is looking for. Any agreement to extend the tariff deadline to advance negotiations should be viewed as a relief, though markets will prefer tariff rollbacks to the levels of other US allies.

Quote of the Day

“Beauty is worse than wine, it intoxicates both the holder and beholder.”

Aldous Huxley

August 6 in history

Prometheus, the world's oldest tree, aged at least 4,862 years, was accidentally cut down in Nevada, USA in 1964.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.