- Banking

- Wealth

- NRI Banking

- Customer Services

- US: Despite incoming higher tariff-driven inflation, we expect the Fed to pursue two 25 bps rate cuts in 2H25, given the shift in their focus towards weakening US demand

- Singapore: Despite MTI upgrading Singapore’s 2025 GDP growth forecast, the outlook remains tilted towards downside risks

- Thailand: Following a 25 bps rate cut in August, BOT is likely to ease again by another 25 bps by end-2025 to cushion several headwinds

- India: Headline inflation eases to eight-year low, driven by weaker food prices; we revise down our FY26 average CPI inflation to 2.8% y/y in FY26 from 3%

Related Insights

- CIO Market Pulse – Dovish Fed25 Aug 2025

- Market Pulse: Dovish Fed25 Aug 2025

- Economics Weekly: Fed’s Easing Expected Despite Inflation Risk Ahead22 Aug 2025

US: CPI print provides room for modest rate cuts. July’s CPI print (headline: 2.7% y/y, core: 3.1% y/y) was in line with expectations. The data offered a mixed picture—goods prices were broadly well-behaved with tariff-relevant categories like toys and furniture yet to show any spikes, but services prices were on the strong side with airfares, medical care, and recreation picking up pace. There was a rebound in used-auto prices as well. Inflation momentum, measured as the 3-month/3-month rate, annualised, picked up.

If Fed officials remain focused on inflation, they will find areas to worry about. On tariffs, the playbook is clear; US firms are (i) squeezing suppliers, (ii) taking a hit on their balance sheet, and (iii) passing on parts of the tariff to consumers. (i) and (ii) are most visible now, and (iii) is also materialising in a protracted manner.

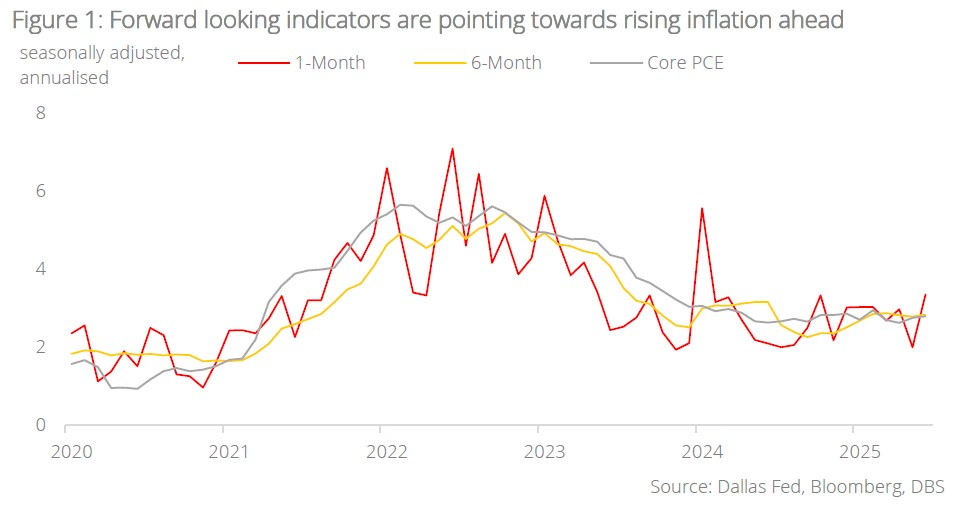

Regional manufacturers are reporting the highest price pressure since the summer of 2022 when inflation was hovering around 9%. Whether measured by Dallas Fed’s trimmed mean inflation on an annualised basis or indicated by the lead-lag relationship with money supply, forward looking indicators are pointing toward rising inflation ahead.

There are other risks to inflation, ranging from a weaker dollar to an apparent bottom in energy prices. Additionally, the ongoing crackdown on undocumented workers is creating a supply crunch in agriculture, fisheries, construction, and recreation. This could feed into higher wage costs first and higher prices shortly thereafter.

Fed officials, however, may be shifting their focus. Looking at the jobs market where the goods sector looks lacklustre, and overall hiring appears to be propped up temporarily by the public sector, there are several pockets of concern. Combine this with weak PMI readings and a loss of momentum in retail sales, the Fed may be heading toward focusing on the demand side of the economy which would push it toward cutting rates. We are looking at two 25 bps cuts before the year is over.

By increasing the odds to 106.8%, the futures market has fully priced in a 25 bps cut while treating a 50 bps cut as a live but minor possibility for an insurance cut. The Trump administration has been on a messaging blitz before the event, overshadowing Fed Chair Jerome Powell’s cautious, data-dependent stance on monitoring the impact of tariffs on inflation. US Treasury Secretary Scott Bessent has gone from calling for a 50 bps cut to stating that interest rates should be 150 bps lower than current levels. Having fired and replaced the Bureau of Labour Statistics Chief and working to fill the Fed with like-minded Fed candidates on rate cuts, President Trump’s playbook will likely continue to involve publicly disputing Powell’s assessment of growth and inflation, positioning any dovish tilt as a victory resulting from his pressure campaign.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- CIO Market Pulse – Dovish Fed25 Aug 2025

- Market Pulse: Dovish Fed25 Aug 2025

- Economics Weekly: Fed’s Easing Expected Despite Inflation Risk Ahead22 Aug 2025

Related Insights

- CIO Market Pulse – Dovish Fed25 Aug 2025

- Market Pulse: Dovish Fed25 Aug 2025

- Economics Weekly: Fed’s Easing Expected Despite Inflation Risk Ahead22 Aug 2025