- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

- Balanced Advantage Funds24 Sep 2024

- Systematic Investment Plans: Benefits and Common Misconceptions01 Sep 2024

- The Importance of Portfolio Reviews12 Feb 2024

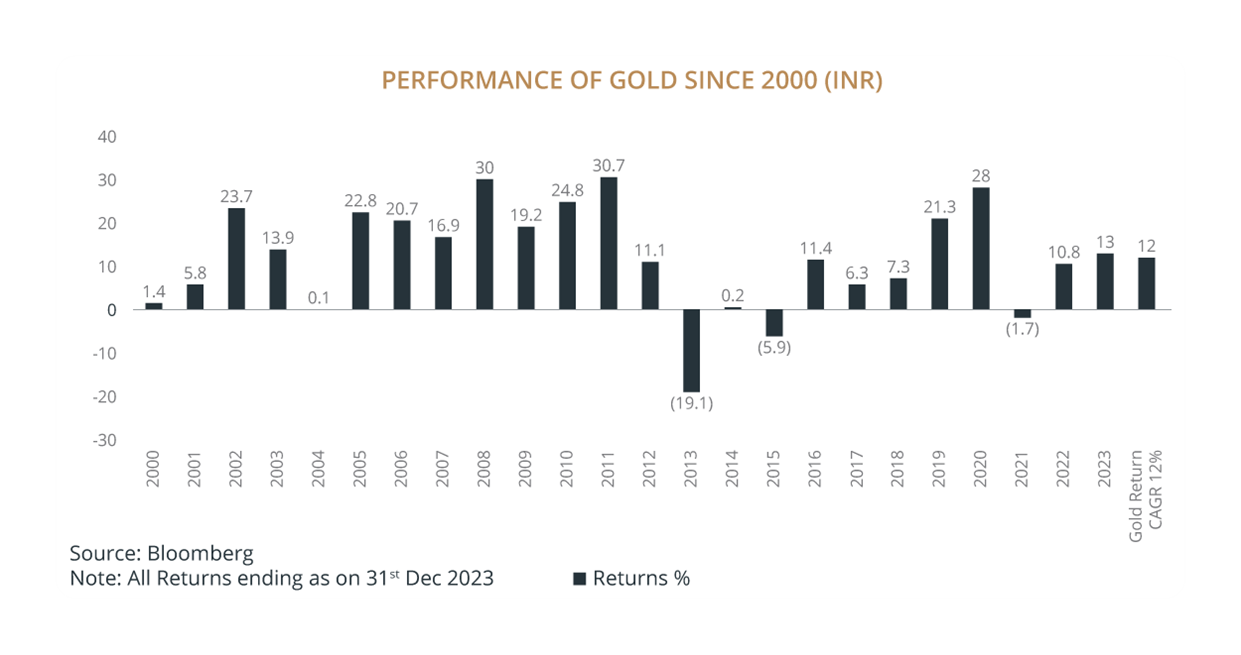

As part of a series on specific investment avenues that could help diversify your financial portfolio, let us look at Gold. We should understand the key reasons to invest in the precious metal and the options available to get started.

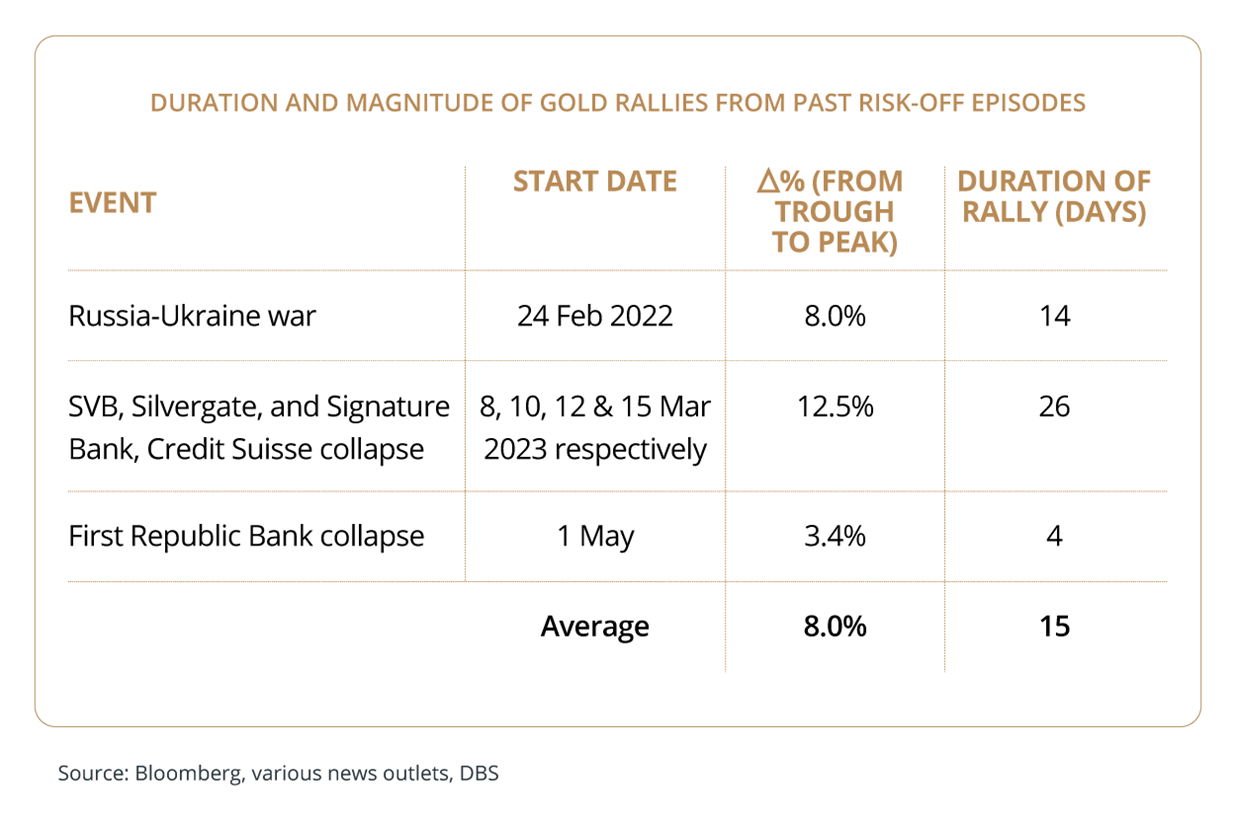

Gold is a popular choice for investors seeking to protect their portfolios from a stock market rout or high inflation — the current situation in the middle east and the Russia - Ukraine war has driven up inflation and the focus on safer investment havens. Gold has plenty of benefits for investors and make sense for long term investment portfolios, especially during periods of economic uncertainty or a looming recession.

Below are some of the benefits which may make buying gold the right decision.

Maintains value

Consumers like to purchase gold because it has low volatility. Stocks and equity funds can be highly volatile, which means that their value can fluctuate at any given time. Gold prices on the other hand, are generally more stable, which makes it a suitable choice for investors looking for a safe haven to park their money.

Inflation Hedge

One of the main reasons investors purchase gold, or add gold into their investment portfolio, is to use it as a hedge against inflation, because during periods of rising inflation, gold prices tend to increase whereas equity and bond prices tend to fall over the same period.

Ease of Liquidation

Gold has been the economic backbone of currencies the world over by way of reserves maintained by the Central Banks. In addition, the precious metal has deep rooted social, and emotional significance that makes it extremely easy to sell. Other gold instruments like gold ETF traded on exchange platform can assist to receive sales proceeds within 2 working days.

You can purchase gold in many forms, such as through Mutual Funds which invest into gold Sovereign gold bonds and even gold futures. Choosing the right gold product to purchase ultimately depends on your personal finances, affordability and how gold can fit into your investment portfolio. Different options for investing in Gold are given below.

1. Gold ETFs, Stocks or Mutual Funds

To invest in Gold ETFs, you only need to open a DEMAT account. Gold ETFs offer many benefits such as allowing you to add gold to your portfolio without the challenges of investing in physical gold, and the potential of earning a profit when the price of the metal appreciates. Gold stocks may sometimes outperform gold bullion when gold prices rise, but it can be difficult to identify which specific stocks will outperform. Gold Mutual Funds offer an option to investors to invest in Gold without having to open a Demat account.

2. Gold Bullion Bars and Coins

Gold bullion is the easiest form of gold to precisely value and carries the lowest premium over spot gold prices; Investing in physical gold offers key advantages such as increased investment security and avoiding counter-party risk. For novice investors, buying gold bullion bars or Gold coins might be appealing since you can see and touch your investments, as opposed to other assets like stocks and bonds.

3. Gold Futures

Gold futures offer a leveraged way to invest in gold prices, but carry the added risk that comes with the fact that leverage amplifies both profits and losses – investors can potentially suffer losses that exceed their total investment capital.

4. Sovereign Gold Bonds

Sovereign Gold Bonds (SGBs) offers a better alternative to holding physical gold. The risk and costs associated are eliminated. The investor is promised the current gold price on maturity and periodic buy back at certain intervals provides liquidity while tax benefits are available to original investors primarily individuals holding Sovereign Gold Bonds on maturity.

Regardless of whichever form you choose to invest in gold. Gold acts as a portfolio risk diversifier and a black swan hedge. One can consider investing up to 10% of your portfolio into Gold to generate superior risk adjusted returns on the portfolio.

You may also reach out to your Relationship Manager to help you understand the options that are most suited for you based on your financial goals by simply clicking on the ‘CONTACT ME’ button and we will get in touch with you. At DBS Bank, we offer option to invest in Gold via Gold Mutual Funds and Sovereign Gold Bonds at time of initial subscription (primary issuance).

Know More articles on mutual funds products to diversify your investment portfolio.

DBS Select our funds fact sheet, with curated information on equity, debt, hybrid, gold and ULIP funds.

Download Now digibank by DBS Application to access these ratios via the mutual fund section.

Topic

Explore more

Wealth FeedThis article is for information purposes only. We recommend you get in touch with your investment advisor for any financial advise.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

DBS Bank India Limited – AMFI registered Mutual Fund Distributor (ARN-155319)

Related Insights

- Balanced Advantage Funds24 Sep 2024

- Systematic Investment Plans: Benefits and Common Misconceptions01 Sep 2024

- The Importance of Portfolio Reviews12 Feb 2024

Related Insights

- Balanced Advantage Funds24 Sep 2024

- Systematic Investment Plans: Benefits and Common Misconceptions01 Sep 2024

- The Importance of Portfolio Reviews12 Feb 2024