- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

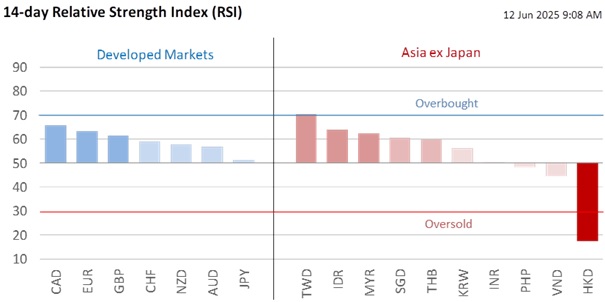

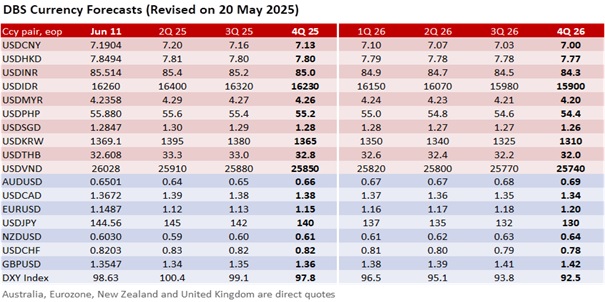

IUS CPI inflation turned out to be lower than expected and weakened the DXY Index overnight by 0.5% to 98.6. With EUR/USD pushing slightly above 1.15 this morning, markets are alert to more USD weakness, especially if the DXY breaks decisively below this month’s 98.4-99.4 trading range. EUR/USD did not break below 1.14 on the European Central Bank’s rate cut on June 5. ECB President Christine Lagarde has been positioning the EUR as a safe, stable, and rule-based alternative global currency that would not default on its institutions.

Despite Trump’s higher tariffs, headline and core inflation increased by only 0.1% MoM each in May vs. the consensus of 0.2% for the former and 0.3% for the latter. Trump’s tariff policy is different from that of his first term. First, The Trump administration sought to expedite trade deals with countries in three months compared to the 1-2 years to arrive at the Phase One Trade Deal with China in January 2020. That was why the Liberation Day tariffs were followed by 90-day pauses for most nations to July 9 and for China to August 10. The administration may extend the July deadline for some countries negotiating in good faith, probably at this weekend’s G7 meeting. Second, supply increased from US companies frontloading imports to beat tariffs, and US consumer demand was dampened by Trump’s erratic tariff policy implementation, heightening uncertainty and keeping businesses cautious about investing and hiring.

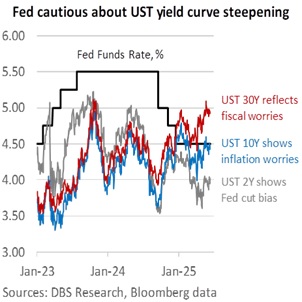

However, the lower US inflation readings were not enough for the futures market to price in rate cuts by the Fed at next week’s FOMC meeting or the one in July. Before this week’s Fed blackout period, Fed officials had signalled patience in awaiting more clarity on Trump’s tariffs and fiscal policies this summer, i.e., by the end of the 90-day tariff pause on China around August 10 and the target to lift the federal debt ceiling before the X-date deadline of August. Nonetheless, Fed officials should be encouraged by the lower inflation expectation readings across the 1Y, 3Y, and 5Y horizons. The futures market increased the odds for a Fed cut in September to 65% overnight from 50% on Tuesday.

Worries about the Fed’s independence have emerged again. Trump has become impatient and wants the Fed to lower rates by 100 bps next week, warning also that he would Speculation increased that Trump may soon announce Powell’s successor. Vice President JD Vance has joined in to criticize the Fed’s decision not to cut rates as monetary malpractice.

US fiscal deficit worries limited the declines in the 10Y and 30Y bond yields to 5 bps and 1 bps, respectively. US Treasury Secretary Scott Bessent testified in Congress that the current year budget deficit to come in at 6.5-6.7% of GDP, exceeding the 6% mark for a third straight year. The Trump administration is struggling to get the One Big Beautiful Bill passed by Independence Day. Following Moody’s decision to axe America’s third triple-A debt rating on May 16, the OBBB was passed by the House by a tight 215-214 margin and is facing resistance by fiscal hawks in the Senate.

Quote of the Day

“Every organization should tolerate rebels who tell the emperor he has no clothes.”

Colin Powell

June 12 in history

US President Donald Trump and Kim Jong-un of North Korea held their first meeting in Singapore in 2018.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.