- Banking

- Wealth

- NRI Banking

- Customer Services

- US/Japan: US government shutdown imperils jobs report, furloughs federal workers, sparks trimming fears; weak ADP employment data raised market expectations for Fed’s October rate cut; Japan’s LDP election on 4 Oct, with Koizumi currently leading

- India: RBI kept policy rate unchanged while revising up FY26 GDP growth forecast and lowering inflation guidance; we include one additional 25 bps rate cut for rest of FY26

- Indonesia: Trade surplus widened in August from import decline, despite export slowdown; September inflation quickened but is not a major concern for the central bank as their focus shifts to growth stability

Related Insights

- Asset Allocation 4Q25 – The Rise of Fiscal Dominance10 Oct 2025

- Market Pulse: Turning Points06 Oct 2025

- CIO Insights 4Q2503 Oct 2025

US/Japan: US government shutdown risk; Japan LDP election on 4 Oct. The US government has shut down as Republican and Democratic lawmakers remain at an impasse, blaming each other. Aside from delaying today’s critical US monthly jobs report, the shutdown is expected to furlough some 750,000 federal employees, according to estimates by the nonpartisan Congressional Budget Office. The gathering of military leadership in Quantico by US President Donald Trump and Defence Secretary Pete Hegseth just before the shutdown has drawn scrutiny, as has Trump’s warning that the shutdown could lead to massive job losses. Unlike previous shutdowns and the Democratic framing, Trump has not portrayed this one as solely a budget dispute. Speculation has emerged that the administration could use the shutdown as a pretext to permanently trim the federal workforce and align it with Trump’s priorities.

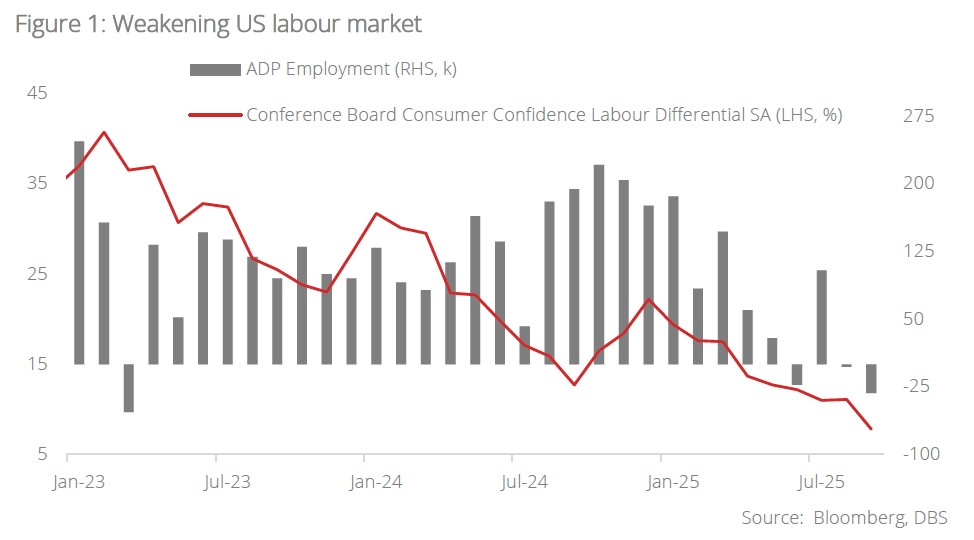

This week’s Automatic Data Processing (ADP) employment data, an alternative to nonfarm payrolls, signalled a sluggish labour market — sharply declining by 32,000 in September, (defying market consensus of a 51,000 gain) with the August figure revised to -3,000 from +54,000. Consequently, the futures market has priced in more than a 100% chance for a 25 bps cut at the FOMC meeting on 29 Oct.

Moreover, increased job insecurity appeared to have depressed the US Conference Board’s consumer confidence index to a five-month low of 94.2 in September, below expectations for a moderation to 96 from 97.8 in August. The labour market differential — a proxy for unemployment rate, measuring the difference between US consumers who think jobs are plentiful and those who are finding it hard to get a job — fell sharply to 7.8% in September from 11.1% in August.

Turning to Japan, the Liberal Democratic Party leadership election is scheduled for 4 Oct. Recent polls suggest that Shinjiro Koizumi has gained momentum against Sanae Takaichi. Markets view a Koizumi win as JPY-positive because he is seen as more pragmatic on fiscal policy and supportive of closer coordination with the Bank of Japan (BOJ) in normalising monetary policy. In contrast, Takaichi is associated with an expansionary growth agenda fuelled by more aggressive fiscal spending and resistance to rate hikes.

On 4 Oct, the candidate who secures a simple majority out of the total 590 votes will win. If no candidate achieves this, the top two vote-getters will proceed to a runoff, which will give more influence to lawmakers (among whom Koizumi holds an advantage). LDP Diet members account for 295 out of the 342 votes in the second round. Following the election, the LDP will convene an extraordinary Diet session on 15 Oct to elect the new prime minister.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Asset Allocation 4Q25 – The Rise of Fiscal Dominance10 Oct 2025

- Market Pulse: Turning Points06 Oct 2025

- CIO Insights 4Q2503 Oct 2025

Related Insights

- Asset Allocation 4Q25 – The Rise of Fiscal Dominance10 Oct 2025

- Market Pulse: Turning Points06 Oct 2025

- CIO Insights 4Q2503 Oct 2025