- Banking

- Wealth

- NRI Banking

- Customer Services

- US/Eurozone: Weaker labour data overshadows higher headline inflation; market expects Fed to prepare rate cuts next week while ECB concludes its easing cycle, marking a notable divergent path

- Japan: LDP election is likely to be held in early October as PM Ishiba resigns; there is a slim possibility that an opposition party leader could become the next PM

- Vietnam: We delay Vietnam’s rate cut forecast of 50 bps to 2026 as the economy has held up well despite US tariffs and cooling exports, driven by domestic strength and FDI

Related Insights

- CIO Market Pulse – Risk Equilibrium15 Sep 2025

- Market Pulse: Risk Equilibrium15 Sep 2025

- Market Pulse: Beautiful Tariffs08 Sep 2025

US/Eurozone: As ECB concludes easing, Fed prepares rate cuts. The Fed is anticipated to resume rate cuts next week despite higher August headline inflation as weak labour market data takes precedence. Last week’s August nonfarm payrolls disappointed at a paltry 22k vs July’s 79k, and US jobless claims jumped to a nearly four-year high of 263k for the week ending 6 Sep. Preliminary revisions from the Bureau of Labor Statistics also brought down payrolls by 911k in the year ending Mar 2025, signalling that the labour market has been weak for some time. On the other hand, overall August inflation numbers were in line with expectations, except for the headline CPI rising 0.4% m/m faster than the market consensus’ 0.3%.

Regarding tariffs imposed under the International Emergency Economic Powers Act (IEEPA), the Trump administration has petitioned the Supreme Court to expedite its review of a federal appeals court ruling that struck down most of its tariffs, proposing oral arguments in early November. The Supreme Court must decide whether to take the case by 14 Oct which is the appeals court’s deadline for Trump’s tariffs to stay.

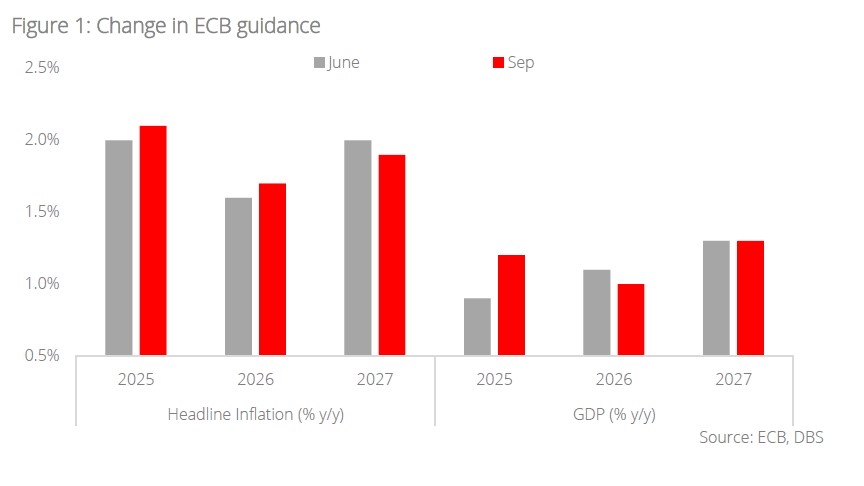

Shifting to the Eurozone, ECB left deposit facility rates unchanged at 2%, aligning with expectations, given well-contained inflation around its 2% medium-term target. Updated forecast sees headline inflation slightly rising to 2.1% in 2025 and 1.7% y/y in 2026, while 2027 inflation is lowered to 1.9% y/y, below the ECB’s target. 2025 GDP growth has been revised up to 1.2% y/y (from 0.9%), driven by a strong 1H25 performance, though 2026 growth sees a slight downward revision to 1% y/y.

Meanwhile, French PM Francois Bayrou was ousted by a 364-194 vote of no-confidence in the National Assembly on Monday (8 Sep). President Emmanuel Macron has been tasked with appointing a replacement, though the deeply fractured National Assembly, which lacks a majority for any single party or coalition following the July 2024 snap election, points toward continued political instability and gridlock.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- CIO Market Pulse – Risk Equilibrium15 Sep 2025

- Market Pulse: Risk Equilibrium15 Sep 2025

- Market Pulse: Beautiful Tariffs08 Sep 2025

Related Insights

- CIO Market Pulse – Risk Equilibrium15 Sep 2025

- Market Pulse: Risk Equilibrium15 Sep 2025

- Market Pulse: Beautiful Tariffs08 Sep 2025