- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- US: Trump postpones reciprocal tariffs, effectively extending negotiating window by another three weeks and reinforcing Powell’s “wait and see” stance

- ASEAN and India: Most ASEAN-6 countries received tariff letters except Singapore and India; regional central banks are likely to be cautious in 2H25

- Singapore: MAS is likely to defer its third easing to October after a hold in July; we revised down our average 2025 inflation forecast despite uncertainties

- Malaysia: BNM cut its OPR by 25 bps to 2.75% as expected; we anticipate further easing by end of 2025 to boost economic growth from tariff concerns

Related Insights

US: Trump delays reciprocal tariffs to 1 Aug with tariffs rates largely unchanged. Over the week, Trump sent letters to 21 countries, including Japan and emerging markets, informing them that the US would impose blanket tariffs close to the 2 Apr reciprocal tariffs on their exports to the US, effective 1 Aug. Trump has effectively extended the negotiating window by another three weeks, allowing countries to reach limited trade deals on America’s terms with concessionary tariff rates like those offered to Vietnam. He also threatened 50% tariffs on Brazilian goods and an additional 10% tariff on any country aligning with the “Anti-American” policies of the BRICS.

Compared to the 90-day tariff pause on 9 Apr, this shorter 24-day extension to 1 Aug does not necessarily ease global trade tensions. These written “take it or leave it” letters could be viewed as brinksmanship with compressed timelines, hardened positions, and unclear outcomes that reintroduce uncertainty and volatility. Furthermore, the new deadline remains subject to the legal challenges of the unresolved IEEPA tariffs (with a hearing on 31 Jul).

These letters do not resolve trade uncertainty and are likely to reinforce Fed Chair Jerome Powell’s cautious wait-and-see stance. There were no surprises from the FOMC Minutes for the 17-18 Jun meeting. With many Fed officials expecting tariff-driven inflation in the coming months, markets did not revive bets for a rate cut at the upcoming 30 Jul FOMC meeting. The market consensus expects next week’s CPI inflation to rise to 2.7% y/y (0.3% m/m) in June from 2.4% y/y (0.1% m/m) in May. Core inflation is also expected to increase to 3% y/y (0.3% m/m) from 2.8% y/y (0.1% m/m).

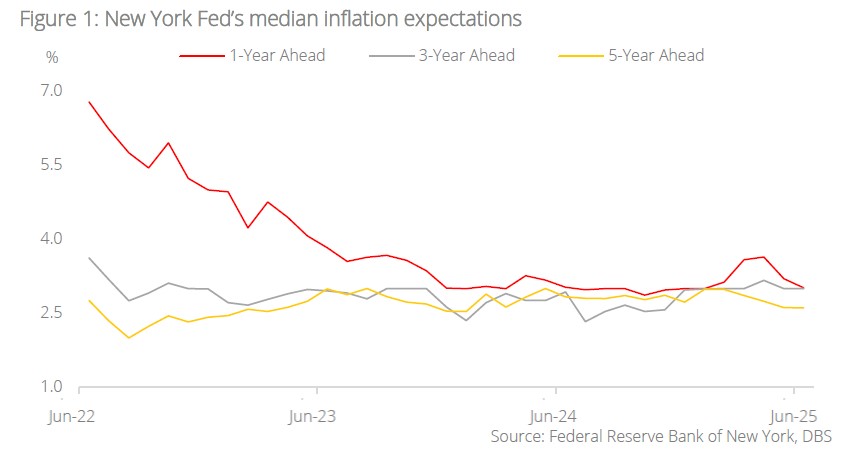

According to the minutes, Fed cuts are possible later in the year if the impact of tariffs on inflation proves temporary, as indicated by the steady readings in the New York Fed’s inflation expectations across the 1Y, 3Y, and 5Y horizons. The future market is keeping the door open for a 25 bps cut in September.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.