- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

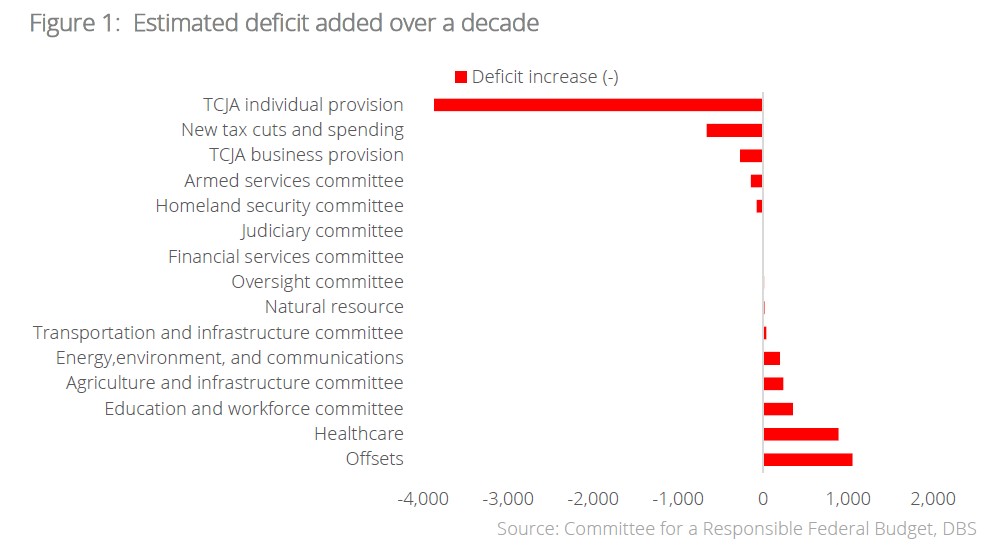

- US President Trump signed into law the “One Big Beautiful Bill”, a major fiscal package involving substantial tax cuts and welfare reductions, projected to add USD3.3tn to US deficit by 2034.

- The rise in fiscal excesses is unfortunately coming at a time when yields are no longer stuck at the zero-bound; instead, they have risen back to pre-Subprime crisis levels.

- Equities: Fiscal boost from OBBB benefits both consumer spending and corporate earnings; But the eventual impact on equity markets will be muted as most positives are already priced in.

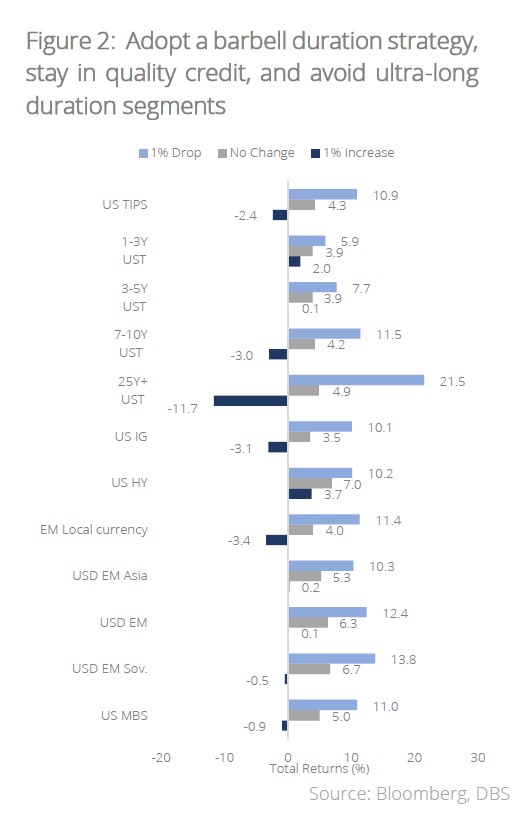

- Credit: The OBBBA USD3.3tn debt impact steepens the yield curve and precipitates disproportionate risks in ultra-long bonds. Stay in quality in a duration barbell strategy, overweighting 2-3Y and 7-10Y duration segments.

- Currencies: The main channel of impact will be via enlarged fiscal deficits and increased government debt. This reduces confidence in the sustainability of US debt and should undermine the USD in the long-term.

Related Insights

- Market Pulse: Tariff Burden14 Jul 2025

- Asset Allocation - The Era of Big Beautiful Fiscal Excesses08 Jul 2025

- CIO Insights 3Q25: The Global Pivot07 Jul 2025

End of fiscal conservatism. US President Trump has finally signed into law his “One Big Beautiful Bill (OBBB)”, which entails massive tax breaks and sharp welfare cuts that will add more than USD3.3tn to the US fiscal deficit by 2034. Such fiscal largesse marks the perpetuation of a familiar pattern seen across the developed world, from cash handouts and tax cuts in Japan to increased NATO spending in Europe. Yet, unlike the Covid era, such excessive spending is coming at a time where interest rates are no longer stuck at the zero-bound. Instead, yields are back to pre-Subprime crisis levels and unless productivity/economic growth surges from here, developed economies will inevitably face difficulties in repaying this massive debt.

The inability to cut fiscal spending has obvious political underpinnings. In the US, the much-touted Department of Government Efficiency (DOGE) has only managed to cut spending by USD190bn – a far cry from its stated aim of slashing USD2tn a year. And while the Trump administration has managed to foreseeably reduce healthcare spending by USD1.1tn over ten years via the OBBB, it is highly doubtful if future administrations can maintain such reduction without suffering at the ballot box. The same difficulty in cutting cost is evident across France and Britain as parties involved failed to reach a compromise. We believe this will be a persistent trend in the years ahead as governments of the day bow to populist pressure and prioritise short-term electoral gains over long-term fiscal discipline.

Kicking the fiscal can down the road. A highly regressive legislature, analysis from Yale Budget Lab suggest that the OBBB will reduce income for bottom 20 percent of the population by USD560 while increasing the income for top 1 percent by USD32,265. Based on estimates by the Congressional Budget Office (CBO), tax cuts of USD4.5tn delivered by OBBB will only be partially offset by spending cuts. This translates to an additional USD3.3tn for the US fiscal deficit by 2034, with US debt-to-GDP hitting 130% and interest payments reaching USD1.9tn. A deteriorating fiscal outlook will only ensure further portfolio diversifications beyond US assets as investors question its safe haven status.

How to invest?

Equities:

- From a fundamental standpoint, the OBBB provides a moderate fiscal boost with the extension of tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA), along with new deductions for both individuals and corporations. This is a plus for both consumer spending and corporate earnings. However, the eventual impact on equity markets will likely be muted as most of the positives are already reflected in prevailing valuations. From a sectoral perspective, listed herewith are the potential winners and losers:

- Potential Winners:

- Energy (Traditional): To “Unleash American Energy”, oil, coal and gas are expected to receive a boost through expanded oil leases and drilling permits, reduction of royalty rates from coal miners, along with incentives for corporate producers and direct subsidies. The legislation also includes over USD1bn in Department of Energy loans earmarked for fossil fuel infrastructure, grid reliability and nuclear modernisation. Methane emissions fees have also been halted for 10 years, reducing regulatory costs for upstream producers.

- Defence: The OBBB includes substantial appropriations for the Department of Homeland Security (DHS) to strengthen American border security, facilitate mass deportations and enhance immigration enforcement. The Department of Defence has also been allocated USD150bn in new defence funding covering new shipbuilding, military modernisation efforts, and the development of the “Golden Dome” advanced missile defence system.

- Potential Losers:

- Energy (Renewables): The OBBB delivers a substantial blow to the renewable industry with the phasing out of tax credits on utility-scale wind and solar projects, EV purchases and residential clean energy upgrades. This move increases US reliance on fossil fuels.

- Healthcare: The bill introduces more stringent eligibility criteria for Medicaid, such as the requirement for beneficiaries to demonstrate a minimum of 80 hours of work per month. These newly introduced criteria will reduce the number of Medicaid beneficiaries. That said, we believe that the healthcare sector will stay resilient given demand inelasticity in an ageing society.

Credit:

- While the removal of Section 899 from the OBBB keeps foreign demand for US Treasury temporarily intact, the bill in its entirety is set to add c.USD3.3tn to the nation’s debt.

- The deficit expansion will result in increased treasury supply and drive higher term premiums and steeper curves.

- Credit spreads have remained relatively sanguine since “Liberation Day”, which is in line with our view that the distressed borrowers are more likely governments than corporates. We think the extension of tax cuts is credit positive and remain sanguine on spreads, despite presently tight levels.

- Until the Fed is driven by growth risks to cut rates, yield curve steepening will invariably amplify risks in ultra-long duration bonds. Our sensitivity analyses reveal that shorter duration bonds can better withstand such dual headwinds.

- In all, investors should stay up in quality with A/BBB credit, and only make selective picks in the better quality HY BB segment in the 1-3Y duration segment. Portfolio duration should remain in a barbell, with a core focus on 2-3Y quality credit (Liquid+ strategy) and adding 7-10Y segments when rates volatility pushes 10Y yields above 4.5%. Overall portfolio duration should be 5-7 years.

Currencies:

- The OBBB is seen as a fiscal stimulus, which typically should be USD-positive. However, the design of the OBBB tax cuts, which are mainly temporary or targeted at very specific groups, will limit this stimulative impact on growth. Thus, the USD-positive impact for the OBBB may be correspondingly reduced.

- In contrast, the main channel from the OBBB to the currencies space will likely be via enlarged fiscal deficits and the long-term accumulation of government debt. This channel is especially poignant of late, given that the US is already facing record government debt to GDP ratios in recent years. Reducing government revenue at a time where the country is heavily indebted does not come across as prudent. This raises the question of US fiscal sustainability and could undermine global confidence in the USD as a reserve currency. This will result in a structural negative impact on the USD.

- Following the logic of reduced confidence in the USD as a reserve currency, the other major currencies may benefit as a USD-substitute in global foreign currency reserves. Here, the RMB is the most well-positioned to benefit. The share of RMB in global reserves has been steadily climbing over the past decade. Other alternatives, like the JPY, CHF and EUR, should also see increased demand among central banks as part of reserves.

Gold:

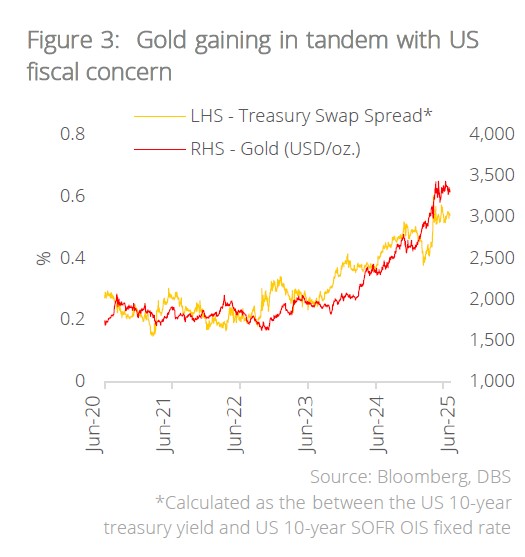

- One of the key outcomes of OBBB is more deficit and more debt. To that end, gold is expected to be a long-term beneficiary. We have shown in the past how gold prices are positively correlated with US indebtedness.

- Additionally, the US Treasury swap spread, which many believe to be at least partially linked to US fiscal concerns, appears to have a similar positive correlation with bullion. This is intuitive – when fiscal concerns increase, investor confidence in the US administration is eroded, and the dollar and dollar-denominated assets become relatively less attractive.

- In turn, investors will likely seek out the relative safety and stability of gold, driving its price higher. To summarise, it is likely that Trump’s BBB will benefit gold in the long run as it will reinforce de-dollarisation and fiat currency debasement tailwinds for the precious metal.

Oil:

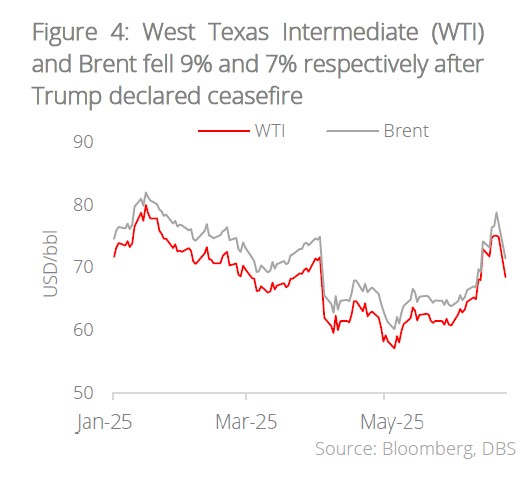

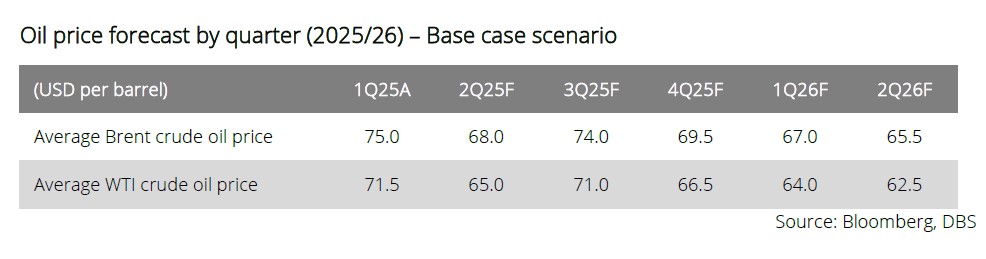

- The OBBB would shift US energy policy sharply toward fossil fuels by lowering barriers for O&G activities (e.g. looser regulation and increased tax breaks) and scaling back clean energy tax credits from the Inflation Reduction Act (IRA).

- While oil prices will ultimately depend on demand-supply dynamics, lower regulatory barriers for US drillers and OPEC+ supply cut reversals should keep supply plentiful and prices subdued in the short to medium term. On clean energy, uncertainty around related policies could delay investment and reduce US competitiveness in global clean technology markets.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Market Pulse: Tariff Burden14 Jul 2025

- Asset Allocation - The Era of Big Beautiful Fiscal Excesses08 Jul 2025

- CIO Insights 3Q25: The Global Pivot07 Jul 2025

Related Insights

- Market Pulse: Tariff Burden14 Jul 2025

- Asset Allocation - The Era of Big Beautiful Fiscal Excesses08 Jul 2025

- CIO Insights 3Q25: The Global Pivot07 Jul 2025