- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

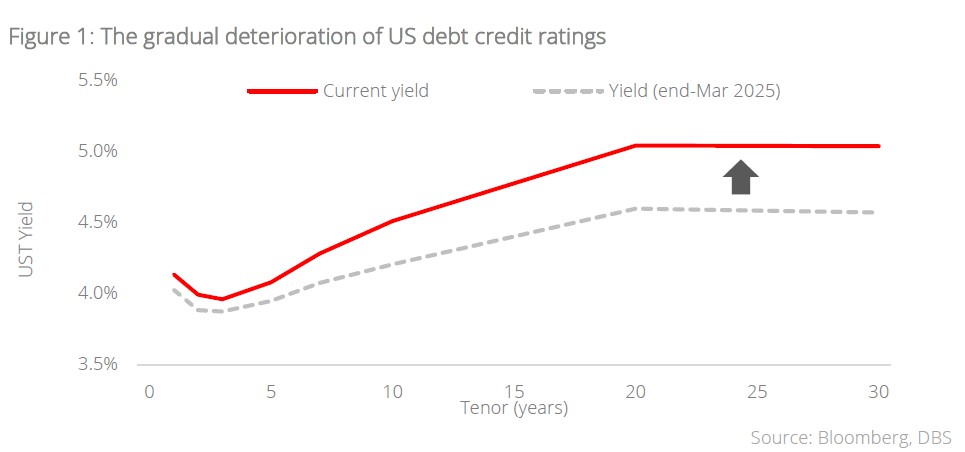

- Long-end JGBs have surged to historical highs on the back of sticky inflation and weak demand. Together with the downgrade of US credit ratings and Trump’s tax bill, long-dated Treasuries remain vulnerable, and further yield overshoots are likely.

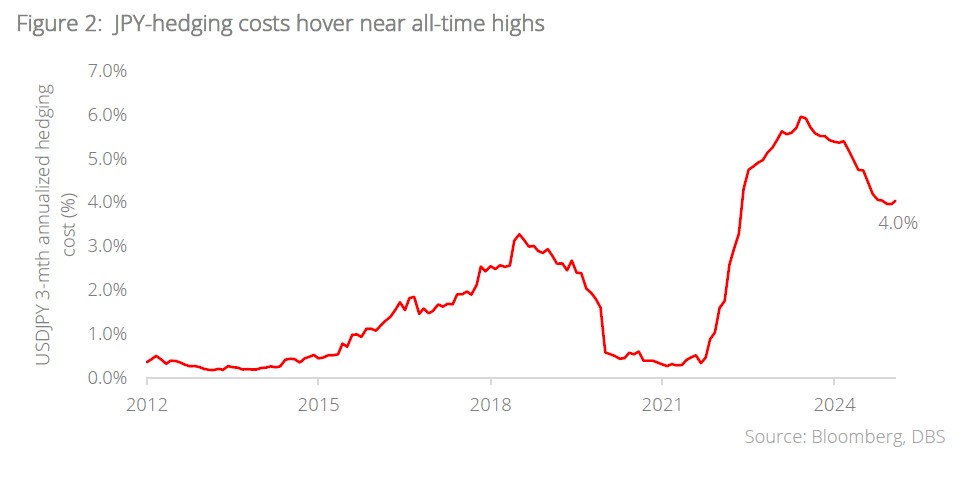

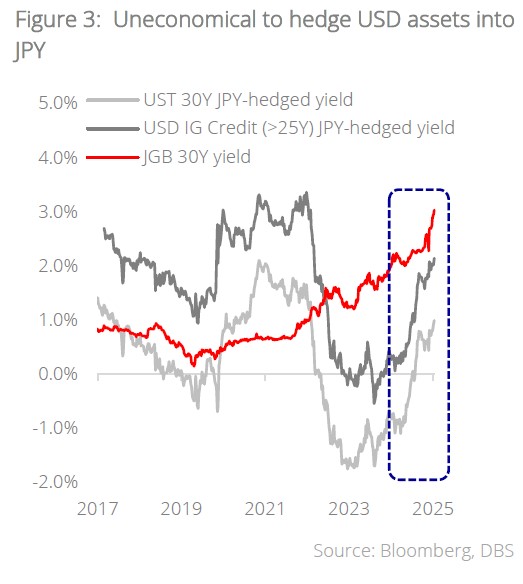

- An unwinding of the JPY carry trade portends risk in global markets, potentially reigniting a flight from USD assets last seen in the April “tariff tantrum” and higher term premiums. However, we think that Japanese investors would be cautious before making such a large pivot back to domestic assets.

- Equities: Despite risk of yen carry trade unwind, low likelihood of contagion risks in equities as sentiments remain underpinned by tariff de-escalation and sweeping tax cuts by Trump administration.

- Bonds: Avoid ultra-long duration bonds. Maintain a duration barbell of 2-3Y and 7-10Y credit, although rates volatility implies that investors can pick entry points to 7-10Y bonds when 10Y UST enters the range of 4.5-5%. We continue to like TIPS and MBS for government risk exposure, away from treasuries.

- Gold: Steeper yield curves are symptomatic of more geopolitical uncertainty, a widening US fiscal deficit, de-dollarisation, and fiat currency debasement; all of which are tailwinds for hard assets such as gold.

Related Insights

What happened

No end in sight for the long end. 30Y JGBs surged past the 3%-handle last week following a string of weak debt auctions amid sticky domestic inflation prints, while 10Y JGBs hover around 1.5%, the highest levels since 2008. Coupled with the recent downgrade of US debt by Moody’s and the passage of President Trump’s deficit-expanding “big, beautiful” tax and spending bill to the Senate, it appears that a week of time is not too short to accumulate bad news for long duration bonds. QTD, yield curves have steepened across the globe; unless market dysfunction forces the Fed’s hand, long-dated Treasuries remain vulnerable, and further yield overshoots are likely.

What it means

Japan is the single-largest foreign holder of US Treasuries, with more than USD1.1tn on its books. For decades, Japanese investors have borrowed yen to buy into higher-yielding US debt and equity assets, a strategy known as the carry trade. Both (a) rising JGB yields and (b) strengthening JPY would eventually shift the calculus for domestic investors and lure that money home, potentially reigniting a flight from USD assets last seen in the April “tariff tantrum” and higher term premiums. However, given that (a) inflation remains sticky in Japan, while (b) the BOJ remains poised to "significantly" scale back its JPY6tn monthly bond-buying program, risks remain in a premature pivot back to onshore JPY assets. We expect that domestic investors would watch for turning points in inflation and monetary policy signals from the BOJ for more certainty before hastily making any significant asset allocation decisions.

How to invest

Equities

- With Japan being a major source of global liquidity, surging JGB yields inevitably ignite concerns of liquidity-shock sell off in global equities as Japanese investors seek to obtain higher yield at home. Above all, yen appreciation on the back rising JGB yields also pose the risk of yen carry trade unwind.

- But despite these concerns, we see limited chance of contagion risks in the equities space as sentiments remain underpinned by tariff de-escalation (notably between US and China) and sweeping tax cuts by Trump administration. Renewed fiscal impulse in Europe (particularly Germany) are additional tailwinds supporting equity sentiments.

- Latest flow data suggests cautious tilt in investors' positioning with rotation into consumer staples and healthcare. Maintain Neutral stance but seek opportunities in structural winners. Favour US Technology, European defence plays and Asia REITs.

Bonds

- We maintain that ultra-long duration bonds (>10Y) are not a suitable play for this rate cutting cycle as fiscal risks remain a clear and present danger. While we have favoured a barbell duration expression of 2-3Y and 7-10Y bonds, investors should time the opportunities when extending duration – picking entry points when 10Y UST comes within the range of 4.5-5%; such outsize rate swings imply that investors can add 7-10Y IG credit at much more favourable levels.

- We also prefer corporate to government risk, as we think that credit spreads provide an adequate cushion to rates volatility. If we had to pick within a government bond allocation, we prefer opportunities in (a) mortgage-backed securities (MBS) given wider spreads, and (b) long-dated TIPS as a hedge against inflation.

Gold

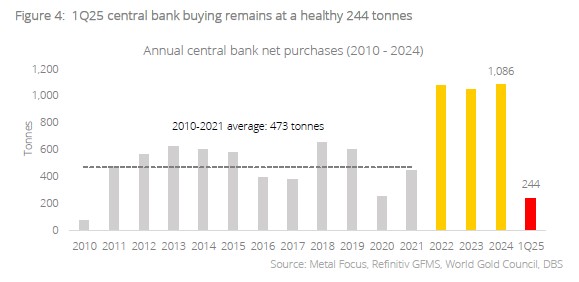

- We remain overweight gold, and have recently upgraded our price forecast to USD3,765/oz. Steeper yield curves are symptomatic of more geopolitical uncertainty, a widening US fiscal deficit, de-dollarisation, and fiat currency debasement; all of which are tailwinds for hard assets such as gold.

- Other tailwinds include rising recession/stagflation risk in the US, while the deterioration of geopolitical alliances under the Trump presidency raises the urgency to diversify reserves away from US Treasuries towards more neutral assets. Central bank buying remains consistent – underpinning the price-insensitive nature of gold demand.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.