- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- US: Moody’s downgrade, coupled with Trump’s push to extend tax cuts, raises concerns over a worsening debt path and future inflation pressures

- China: Continued policy easing warranted amid weak credit growth, fragile household sentiment, and subdued private investment

- India: India remains well-positioned to benefit from trade diversion flows and shifting global supply chains, supported by bilateral agreements and a stable tariff outlook

- Thailand: While Thai GDP remained resilient in 1Q25, rising trade tensions, weak private demand, and industrial headwinds have prompted a downgrade in the 2025 growth outlook

- The Week Ahead: Keep a lookout for US Change in FOMC Rate Decision; China CPI

Related Insights

US: Macro risks reignite. Moody’s joined its ratings peers on Friday (16 May) to downgrade the US senior unsecured ratings to Aa1 from Aaa. It also changed the US fiscal outlook to stable from negative. Moody’s rationalised its action on the basis of an already large debt (98% of GDP) and deficit (6.4% of GDP) situation, coupled with President Trump’s plans to make the 2017 tax cuts permanent, on top of providing additional tax cuts. Moody’s sees trillions in added deficit and debt ahead, projecting debt/GDP to rise to nearly 135% by 2035. The US seems destined for higher yields.

Globally, outside of the US, inflation risks have been muted. Demand is soft and the investment environment is facing uncertainties around trade wars. Sustained currency appreciation against the USD and a marked decline in commodity prices have added to the fading of inflation concerns. One major exception to that narrative is the US which is facing a striking policy-induced upward risk to the price level.

As noted by Fed Chair Powell at a speech last week, policies undertaken by the Trump administration have led to a fundamental shift in price expectations. Recent favourable developments in the US-China trade talks mask the fact that this year’s trade policy measures have taken US import tariffs to levels not seen since the 1940s. These tariffs—even if settled at 30% on China and 10% on the rest of the world, along with assorted rates on selected sectoral imports—will contribute to margin compression for firms and/or price passthrough at the retail level. Thanks to on-again, off-again tariffs and other trade restrictions, there have been episodes of sudden stop and resumption of orders and shipments. These are bound to affect sentiments and prices.

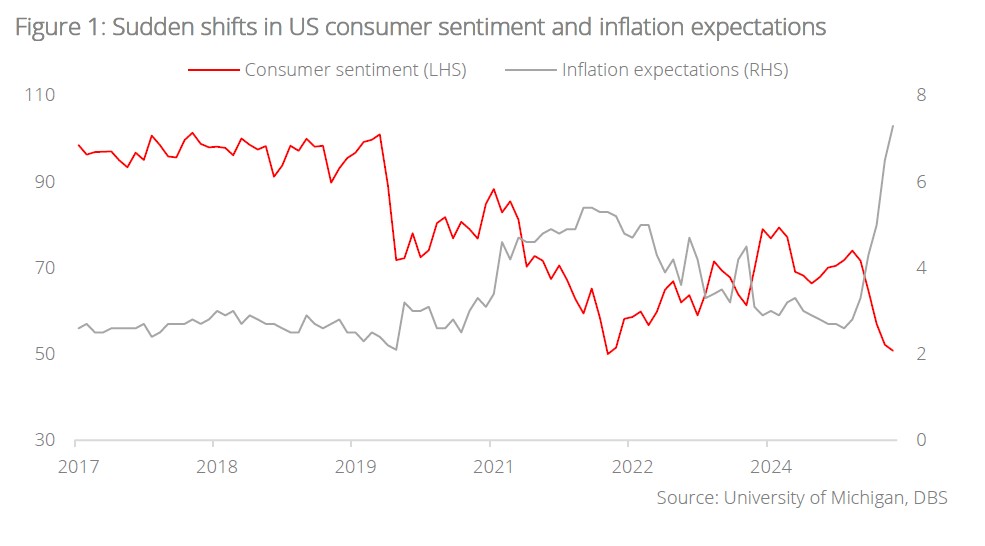

The University of Michigan’s latest readings are dramatic. The recent jump in inflation expectation and correction in consumer sentiment reflect crisis-type magnitudes. The fact that these shifts have yet to materialise in higher inflation or lower purchases should not be a cause for complacency—it may well be just a matter of time.

A combination of tight labour market and rising money growth would have caused some upside risks to inflation in any case. Combine this with trade war matters and firms have a few excuses to raise prices in the near term.

The fact that weakness in commodity prices has not managed to dent inflation expectations or consumer sentiment is troublesome. Equally concerning is the fact that businesses are already reporting a sharp rise in input prices. The survey readings reflect pressures akin to 2022 which was a time of much higher inflation. Regional manufacturers’ surveys warrant particular attention as they are likely to be at the frontline of the tariff mayhem.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.