- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Rapid rate hiking cycle in 2022 has given a plethora of yield expressions for income investors today

- Bonds offer stability of ample contractual payouts while offering a hedge

- We like high quality IG credit as well as select capital securities

- European equities offer attractive, stable income opportunities, with average dividend yields

- AxJ dividend plays are compelling with Chinese banks, S-REITs, and Singapore banks yielding over 6%

Related Insights

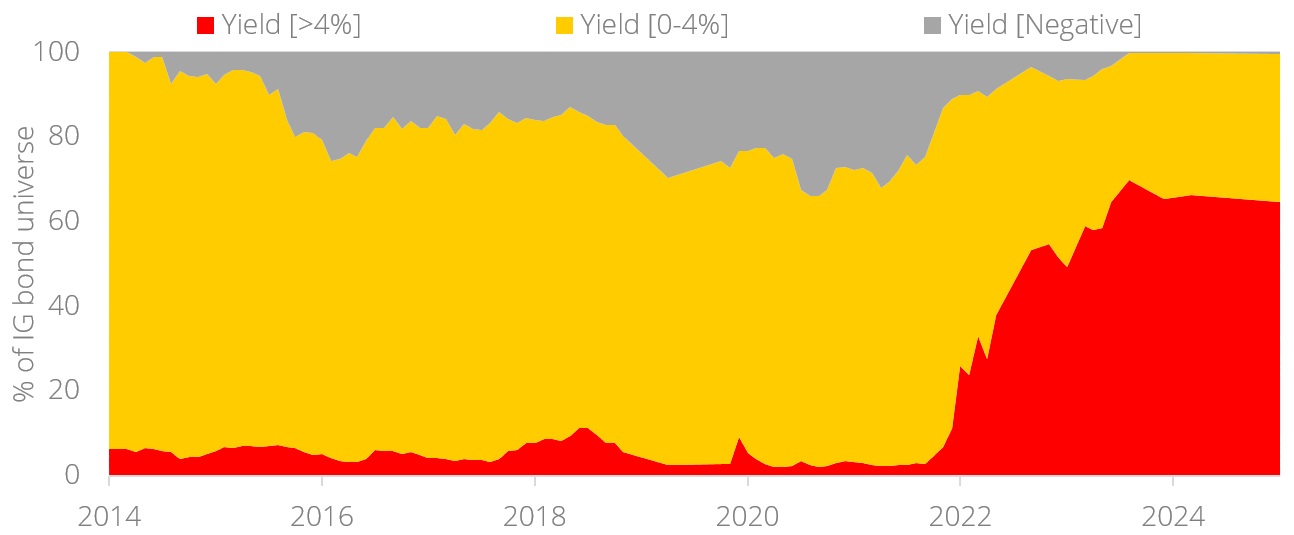

On the horns of a trilemma. It is hard to imagine that barely five years ago, investors had to wrestle not only with the notion that negative yielding bonds existed, but that it amounted to more than USD18tn in notional value at its peak. Cash rates flatlined at zero, while risky assets gave the prospect of capital gains but not without having to undertake large swings in volatility. Moderate investors were caught between a rock, a stone, and a hard place, having to choose either (a) zero-interest cash, (b) volatile equities, or (c) low-yielding bonds that gave no protection against rising inflation. Avenues for ample stable and recurring income on low capital volatility were practically nowhere to be found.

It’s a yield world after all. All it took was one dramatic monetary policy shift to turn that zero-yielding world on its head. Following the post-Covid supply shock, central banks around the world were caught on the back foot, raising rates aggressively to deal with the strong and sticky inflationary impulse. Yields went from nowhere to everywhere all at once – not just in bonds, but dividend equities, swaps, option-linked structures, etc. – leaving investors spoilt for choice at the sudden abundance of available options out there. Despite the renewed attractiveness of yields, we have observed a general inertia towards income generators, likely due to (a) the outperformance of growth equities in the last five years, while (b) uncertainty about inflation and monetary policy has left many income-seekers sidelined.

The income investor’s “greedy when others are fearful” moment. This is not the time to sit on our hands. We opine that income generating assets now deserve more attention than ever, using an illustrative example of how the return distributions have changed pre- and post-rate hiking cycle to make our case.

The return distribution for growth assets generally fit the shape of the grey line; its wider base implies that returns can potentially be exceptionally high or low. Given that profits are often retained in growth companies, its present value would have to be derived from a stream of future earnings, the value of which can change quite dramatically with minute changes in expectations. Income generating assets on the other hand, follow a distribution more similar to the shape of the red line. Dividend paying equities for example, often carry a commitment to stable payouts (or in the case of bonds, contractual payouts), which implies that there is a greater certainty of returns about a long-term average. In general, the average return for growth assets over time would be higher than the average return for income generators; as the adage goes – the higher the stakes, the higher the rewards.

The Fed’s gift to the world – income. Following the 2022 rate-hiking cycle however, the spectrum of expected average returns for income generators have shifted to the right because of the rapid, almost stepwise adjustment in monetary policy. Incidentally, valuations for growth assets did not cheapen in response to the higher rates environment – as a result, we can now observe a rare disequilibrium in the financial markets where bond yields are higher than earnings yields of growth assets (inverse of the PE ratio).

Only while stocks last. This is certainly not to say that growth assets are inferior; they are a necessary allocation in a balanced portfolio to enhance returns over time. However, what this tells us is that investors need to be more discerning on security selection in growth; there are non-profitable companies that are priced to perfection and offer inferior risk-reward. Income generators on the other hand – look fairly priced in the aggregate; investors can seek income in a plethora of expressions while the offers for high yields stand. As the world continues to negotiate complexity and uncertainty under Trump 2.0, and the Fed still signalling intent to bring rates back down, such opportunities might not last for long.

We highlight several expressions below that yield-seekers should capitalise on in this window of opportunity.

Fixed Income

- IG credit. As illustrated above, the high yields available in fixed income are an anomaly in a low growth world. Noting that yields on offer range between 4-6% at present, credit appears to be able to preserve one’s purchasing power even if inflation in this decade rises meaningfully above the 2% average that the world experienced pre-Covid. Observations corroborate that short-duration, high quality credit – what we term the Liquid+ strategy – has outperformed both CPI and cash returns in the long run. Moreover, default rates in IG credit have never exceeded 0.5% in any one year, even in the 2008 GFC; present yields are sufficiently high to buffer against both capital volatility and potential credit losses.

- Bank Capital securities. We have remained positive on bank capital securities for several years now, and the thesis remains intact. The steepening of yield curves under tariffs also implies that the cost of bank liabilities (deposits, influenced by the short end) is now lower than the returns on bank assets (loans, influenced by the longer end). As such, bank profitability is likely to remain resilient. One potential risk is that a steeper than anticipated downturn in growth could see rising NPLs, but we believe that banks are defensively positioned and have made adequate provisions. Total capital ratios remain healthy in the c.19% range – far above regulatory requirements. It comes as no surprise that this segment remains the top performing fixed income market for 2025 to date.

Dividend Equities

European equities. Dividend yields in Europe average around 3.2%. With 10Y bond yields trading at around 2.7% in Eurozone, bond/dividend yield spreads are attractive in Europe, which should attract local long-term investors with preferences for capital preservation as well as income. This is especially attractive now considering that the weak dollar / strong euro backdrop is drawing flows into non-USD assets. Note that dividend income – like bond coupons – if stable and sustainable, can form a cushion for total return during crisis periods.

We favour companies with less cyclical business models that deliver consistent dividends. Our focus is on high-quality businesses with sustainable competitive advantages, strong free cash flow generation, recurring revenue streams, and significant barriers to entry. Importantly, these companies tend to be less sensitive to macroeconomic variables such as interest rates, commodity prices, or broader economic cycles, and hence should have more resilient earnings and free cash flow, thus able to maintain sustainable dividends and support share prices. These include defensive sectors such as utilities, consumer staples, and diversified financials.

- European utilities. The European utilities sector is a core part of any defensive and income-oriented equity allocation. It is particularly attractive now due to structural shifts towards decarbonisation, electrification, and energy security. Many European utilities offer (i) stable, regulated cash flows; (ii) attractive dividend yields; (iii) defensive business models; and (iv) growing exposure to renewables and energy transition infrastructure.

- European consumer staples. A key part of any defensive equity strategy, European consumer staples companies offer stable earnings, global brand reach, and resilient demand regardless of economic conditions. Many also provide attractive, growing dividends and strong cash conversion. Included in the sector are leading companies such as Unilever, Nestlé, Danone, Reckitt Benckiser, Beiersdorf, and Ebro Foods. These are globally recognised household names specialising in F&B, personal care, household products, health, and hygiene products.

- European industrials. European industrials generally have deep engineering expertise and strong recurring, less cyclical business models. These companies embody moat-like, high-barrier-to-entry business models, and specialisation in electrical systems, automation, and infrastructure, such as Schneider, Legrand, Dassault Systèmes, Siemens, and ABB. They are known for technical expertise with recurring business models from licensing, software support, and engineering tools, delivering stable cash flows, resilient margins, and often growing dividend streams.

Asia ex-Japan - Fertile ground for sustainable dividends. In Asia ex-Japan (AxJ), investors are also offered avenues for diversification with income equities. China banks, Singapore REITs, and Singapore banks stand out as compelling choices for investors with sound fundamentals, attractive dividend yields, and policy tailwinds.

- Large China state-owned banks – Candidates for stable dividends. The falling rates and NIM trends in China have not derailed China large state banks' ability and commitment to distribute dividends. Rather, over the past few years, dividend per share has been steadily rising, reinforcing managements’ increasing commitment to shareholder returns, and anchoring the attractiveness of investing in China large state banks. This segment is also insulated from tariff-related risks as their core income is predominantly generated domestically. Importantly, asset quality remains stable and resilient with NPL ratios within manageable ranges. This segment is projected to maintain dividend yields of around 6% at current levels, which is attractive by any standard. As the payout ratio for dividends remains low at 30-40%, we believe these banks’ yields are sustainable.

- Singapore REITs – Beneficiaries of the rate downcycle. US tariffs on Singapore goods are relatively lower, while Singapore’s economy is resilient. With falling interest rates, borrowing costs of REITs are expected to fall, boosting income and creating potential for rerating. Current yields are appealing north of 6% on most occasions, supported by recurring rental income from diversified property portfolios across commercial, industrial, logistic, and retail properties. Furthermore, the sector is trading at c.0.8x price to book which provides a margin of safety to investment returns.

- Singapore banks - High-quality yield with growth optionality. Singapore banks' valuations are supported by their superior ROE and earnings outlook, with attractive dividend yields of around 6%. Importantly, the rising income contribution from fee-based businesses will more than compensate for any NIM pressure in the backdrop of declining rates. We expect this segment to remain an attractive income generator within the equity universe.

Figure 1: Yield has returned with a vengeance

Source: Bloomberg, DBS

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")