- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Equities: Equity markets continue upward trend, supported by resilient labour market and corporate earnings

- Credit: Speculation over a radical US debt restructuring plan has resurfaced; even as the likelihood of implementation remains low, bond investors should stay anchored in a credit duration barbell strategy

- FX: Ongoing improvements in market sentiment may help extend the USD rally, though a sustainable recovery in the USD to prior peaks is unlikely, given recent US data weakness and lingering tariff concerns

- Rates: Combination of rate cuts and increased fiscal support is likely to lead to steeper yield curves across DMs and Asia with Japan remaining an exception

- The Week Ahead: Keep a lookout for US Change in FOMC Rate Decision; China CPI

Related Insights

US equity rally facing crossroads: Labour market strength vs tariff-driven earnings headwinds. US equities posted their ninth consecutive day of gains, driven by a more optimistic macroeconomic outlook and optimism around US-China trade negotiations. The April payrolls report showed job growth of 177k, slightly below prior months, though still indicating resilience in the labour market with the unemployment rate holding steady at 4.2%. This has led to market expectations of a less aggressive rate hike trajectory, while the Federal Reserve is expected to maintain interest rates at current levels this week. On the trade policy front, while some progress in negotiations with China was noted, the ongoing tariff uncertainty remains a significant risk, particularly for sectors exposed to trade policies. More concrete progress is likely needed for sustained gains in markets and the broader economy.

Earnings from Meta and Microsoft fuelled strong momentum in the tech sector with continued capital expenditure growth in AI reinforcing investor confidence in the sector’s resilience. Looking forward, while earnings remain robust, cautious guidance from some sectors, along with lingering macro uncertainties, may continue to induce volatility in the short term.

Topic in focus: Global tech – Secular AI investment anchors constructive Big Tech outlook despite near-term uncertainty. After bottoming on 4 Apr amid reciprocal tariff concerns, Big Tech rebounded 22% in less than a month, fuelled by delayed tariff enforcement and broad-based earnings strength which eased market fears of a protracted trade disruption. As of 1 May, over half of technology companies have reported—with 91% beating earnings expectations—well above the 76% surprise rate across the S&P 500. Big Tech stood out with a 100% beat rate and 29% y/y earnings growth. However, several major firms withheld forward guidance, citing ongoing geopolitical tensions, regulatory uncertainty, and limited visibility around consumer demand and potential supply chain normalisation.

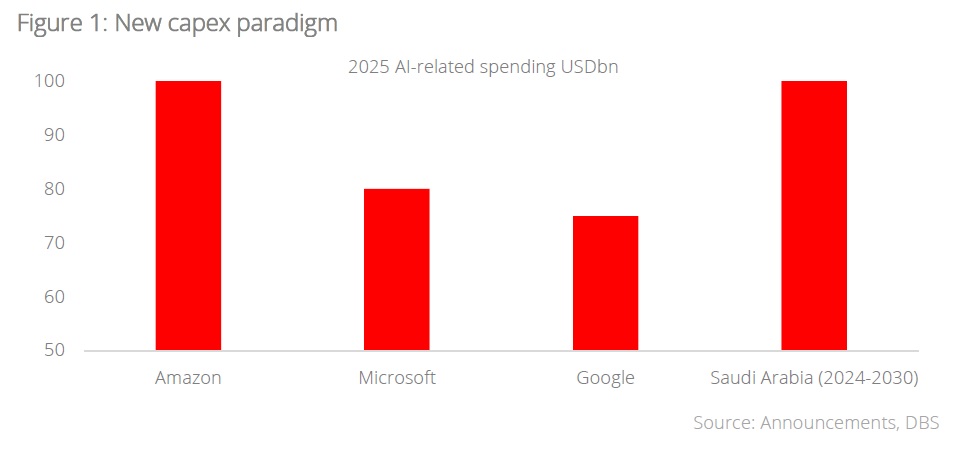

Despite macro headwinds, the long-term outlook for global tech remains highly compelling, powered by sustained AI-driven investment. Leading hyperscalers Microsoft, Amazon, and Alphabet have all reaffirmed their robust capital expenditure plans for 2025—collectively exceeding USD250bn. Notably, Meta has raised its 2025 capex guidance to USD68bn, underscoring its deepening commitment to AI initiatives. Nvidia is also preparing a USD500bn investment in onshore AI infrastructure, while the Middle East has pledged over USD100bn for the remainder of the decade to accelerate its AI capabilities. These long-term capital commitments—spanning East to West—signal that AI development is a broad-based, multi-year structural tailwind for the comprehensive technology ecosystem. In the broader technology universe, we recommend maintaining diversification across key verticals and regions—anchored by the robust CIO I.D.E.A. framework—and staying focused on trendsetters and price makers with proven profit resilience.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.