- Banking

- Wealth

- NRI Banking

- Customer Services

Frequently Asked Questions for Remittance

Frequently Asked Questions

Tax Collected at Source (TCS) is an income tax collected in India on some transactions given in the Section 206C of the Income Tax Act 1961.

From 1st October 2020, Banks, being an Authorised Dealer (‘AD’), are required to collect TCS on certain remittances made under the Liberalised Remittance Scheme.

LRS is a scheme of RBI which allows a resident individual to freely remit money out of India up to USD 2,50,000 per financial year for any permissible current account transactions such as travel, medical treatment, studies abroad, etc. For details on LRS, you may refer to the Master Directions and FAQs on RBI’s website https://www.rbi.org.in/

The Union Budget 2020 has mentioned that "As authorized dealers, Banks are required to collect tax at source (TCS) @5% u/s 206C on foreign remittances exceeding ₹7 lakh under Liberalized Remittance Scheme (LRS) of RBI."

The tax collection at source will be effective Oct 1, 2020 on all LRS transactions including international debit card transactions.

Below transactions are under the purview of TCS applicability -

- LRS outward remittance transactions through DBS branch or digibank app.

- Foreign Currency Demand Draft or Cash issuance from domestic resident account under LRS purpose.

- International transactions, on Debit cards transactions (including transactions done on Foreign Merchants).

- Transfers from domestic resident customers to NRO account under LRS (Loan to NRI or Gift to NRI).

We would like to inform you that a recent announcement has clarified the below on TCS:

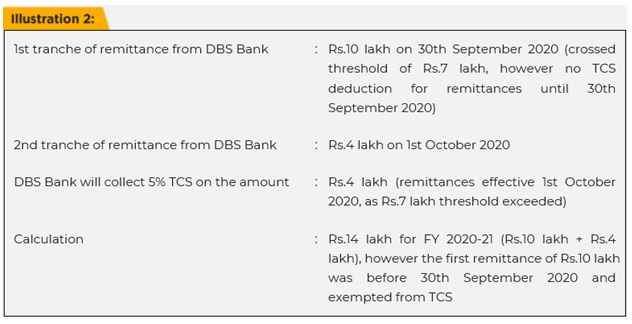

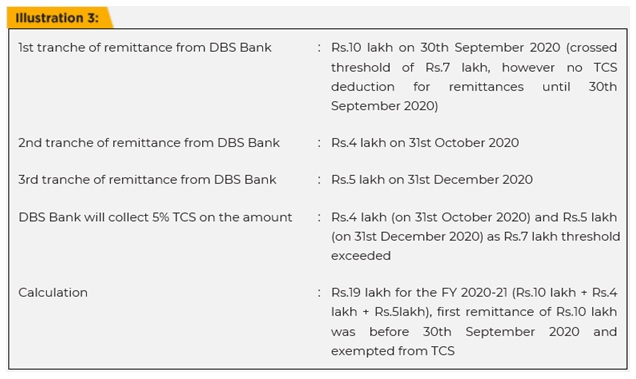

- While the Rs.7 lakh threshold is applicable for the entire financial year, TCS has now been deferred to 1st October 2020. Therefore, TCS will not be collected on any amount of foreign remittances until 30th September 2020.

- In case the remittances cumulatively exceed Rs.7 lakh for the FY 2020-21, any remittances made post 1st October 2020 will attract TCS.

- The bank will collect TCS for any amount remitted for overseas tour program packages, unless the same has already been collected by the seller of the overseas tour package.

- TCS will be applicable @0.5% in cases where the source of the remittance amount is through an educational loan (u/s 80E).

Below is the TCS charging grid for remittances and transactions under LRS –

|

LRS Purpose/Type of transaction |

Applicable Tax (TCS) |

|

1. Travel A. Business travel B. Travel for pilgrimage C. Travel for medical treatment D. Travel for education (including fees, hostel expenses etc. E.Other travel (including holiday trips and payments for settling international credit cards transactions) 2. Debit Card A. International transactions on Debit Cards (including transactions done on Foreign Merchants) |

5% of the transaction / remittance amount from INR 1. |

|

LRS Purpose - Studies abroad, where the source of funds is Education loan |

0.5% of the remittance amount above INR 7 lacs during the financial year. |

|

Other LRS purposes |

5% of the remittance amount, above INR 7 lacs during the financial year. |

Important note - Please ensure the account is sufficiently funded to cover the remittance amount, TCS amount, remittance charges, correspondent bank charges and other taxes/charges as applicable. In case of insufficient balances, transactions will not be processed.

Illustrations

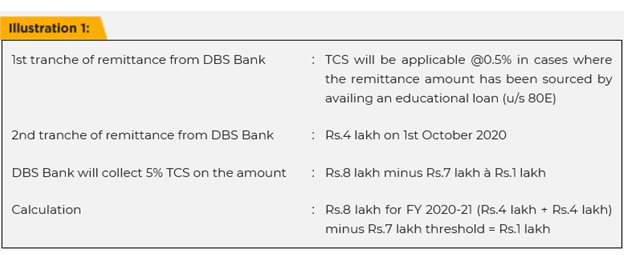

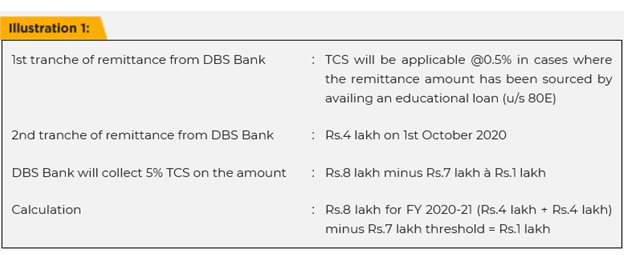

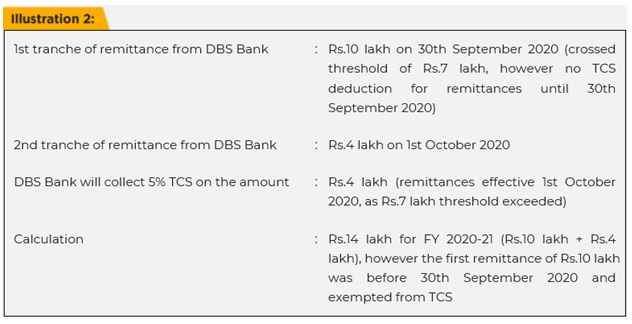

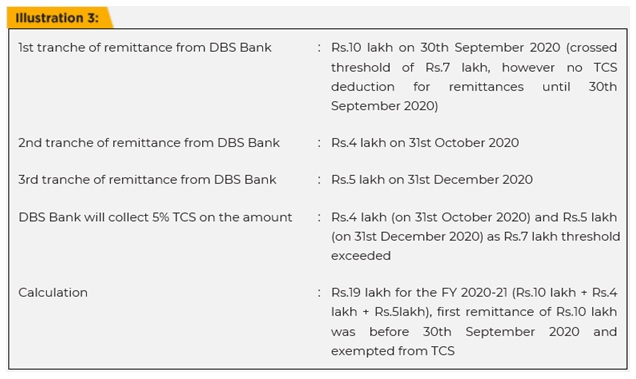

Sharing a few illustrations for your reference :

- The aggregate amount of remittance made by customer during the financial year is INR 500,000. Whether TCS applicable to this customer?

No, since the aggregate amount of remittance made during the financial year is less than INR 700,000, TCS is not applicable to this customer. - The aggregate amount of remittance made by customer during the financial year is INR 1,000,000. Whether TCS applicable to this customer?

Yes, since the aggregate amount of remittance made during the financial year is more than INR 700,000, TCS is applicable to this customer. In such case TCS will be applicable @5% on INR 300,000 (on amount exceeding INR 700,000). - The aggregate amount of remittance made by customer upto 30 September 2020 is INR 500,000 and from 1 October 2020 to 31 March 2021 is INR 500,000. Whether TCS applicable to this customer?

Yes, since the aggregate amount of remittance made during the financial year is more than INR 700,000, TCS is applicable to this customer. In such case TCS will be applicable @5% on INR 300,000 (on amount exceeding INR 700,000). - The aggregate amount of remittance made by customer upto 30 September 2020 is INR 1,000,000 and from 1 October 2020 to 31 March 2021 is INR 500,000. Whether TCS applicable to this customer?

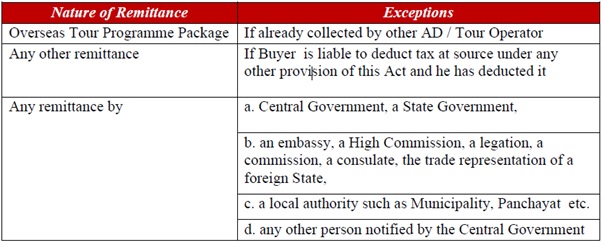

Yes, since the aggregate amount of remittance made during the financial year is more than INR 700,000, TCS is applicable to this customer. However, in this case threshold limit is already exceeded prior to 1 October 2020, therefore, the TCS would apply @5% on every amount remitted after 1 October 2020 i.e. on INR 500,000. - Customer Mr. A has made remittance of USD 6,500 towards Overseas Tour Package to M/S. Thomas Cook, USA. Whether TCS applicable to this customer?

Yes TCS @5% would apply in this case even if the amount of remittance is INR 481,000 (USD 6,500*INR 74), as there is no threshold amount on remittances towards ‘Overseas Tour Package’. - Customer Mr. A has made remittance of USD 20,000 towards education fees out of India out of his loan borrowed from Scheduled Bank (qualified loan under Indian Income Tax Act). Is TCS applicable to this customer and at what rate?

Yes. In this case, since the amount of remittance is INR 14,80,000 (USD 20,000*INR 74) and made toward pursuing education out of India out of loan qualified under the Indian Income Tax Act, TCS @0.5% would apply on the amount exceeding INR 700,000. - Customer, the US embassy in India, has made remittance of USD 20,000 for official purpose to USA. Is TCS applicable to this customer?

No. TCS is applicable on remittances made by an embassy, a High Commission, a legation, a commission, a consulate, the trade representation of a foreign State etc.

If the purpose of transfer is under LRS (Loan to NRI or Gift to NRI), TCS will be applicable on transfers from domestic account to NRO account.

TCS paid can be adjusted against tax payable when individuals who would have paid TCS file income tax returns (ITR) in India. Please consult your tax advisor/consultant for further information.

TCS is applicable on all LRS transactions. LRS permits Rupee loan and gift to a NRI/PIO who is a close relative. In this case, for such rupee transactions, TCS will be applicable.

- Education loan sanction letter with student name and parent who is the co-borrower

- Declaration on the LRS application from client that the source is from loan

- Bank statement showing the source of funds as unutilized disbursed Education loan by a financial institute

TCS is applicable at PAN level. The LRS limit maintenance, TCS charging and TCS reporting is consolidated at customer level i.e. at PAN level.

Please note TCS once deducted cannot be refunded by the bank in case of any return of transaction/remittances. Remitter can approach for refund from tax authority while filing Income Tax Returns or consult with tax advisor for refund/adjustment.

Overseas tour program package is “any tour package which offers visit to a place outside India and includes expenses for travel or hotel stay or boarding or lodging or similar expenses”

Thus, even the expenses for travel such as ticketing, hotel stay, or boarding or lodging etc. are included in the overseas tour package.

TCS is to be collected at the time of debiting the amount payable by the remitter or at the time of receipt of such amount from the remitter, by any mode, whichever is earlier.

For remittances up to USD 25,000/day, you may explore and avail instant transfers from the comfort of your home by using digibank by DBS https://www.dbs.com/in/treasures/nri-banking/remittance/remittance-services.

Customers can call their Relationship Managers for Remittances above USD 25,000 upto USD 2,50,000 in a financial Year.

Illustrations

Sharing a few illustrations for your reference :

- The aggregate amount of remittance made by customer during the financial year is INR 500,000. Whether TCS applicable to this customer?

No, since the aggregate amount of remittance made during the financial year is less than INR 700,000, TCS is not applicable to this customer. - The aggregate amount of remittance made by customer during the financial year is INR 1,000,000. Whether TCS applicable to this customer?

Yes, since the aggregate amount of remittance made during the financial year is more than INR 700,000, TCS is applicable to this customer. In such case TCS will be applicable @5% on INR 300,000 (on amount exceeding INR 700,000). - The aggregate amount of remittance made by customer upto 30 September 2020 is INR 500,000 and from 1 October 2020 to 31 March 2021 is INR 500,000. Whether TCS applicable to this customer?

Yes, since the aggregate amount of remittance made during the financial year is more than INR 700,000, TCS is applicable to this customer. In such case TCS will be applicable @5% on INR 300,000 (on amount exceeding INR 700,000). - The aggregate amount of remittance made by customer upto 30 September 2020 is INR 1,000,000 and from 1 October 2020 to 31 March 2021 is INR 500,000. Whether TCS applicable to this customer?

Yes, since the aggregate amount of remittance made during the financial year is more than INR 700,000, TCS is applicable to this customer. However, in this case threshold limit is already exceeded prior to 1 October 2020, therefore, the TCS would apply @5% on every amount remitted after 1 October 2020 i.e. on INR 500,000. - Customer Mr. A has made remittance of USD 6500 towards Overseas Tour Package to M/S. Thomas Cook, USA. Whether TCS applicable to this customer?

Yes TCS @5% would apply in this case even if the amount of remittance is INR 481000 (USD 6500*INR 74), as there is no threshold amount on remittances towards ‘Overseas Tour Package’. - Customer Mr. A has made remittance of USD 20,000 towards education fees out of India out of his loan borrowed from Scheduled Bank (qualified loan under Indian Income Tax Act). Is TCS applicable to this customer and at what rate?

Yes. In this case, since the amount of remittance is INR 14,80,000 (USD 20000*INR 74) and made toward pursuing education out of India out of loan qualified under the Indian Income tax Act, TCS @0.5% would apply on the amount exceeding INR 700,000. - Customer, the US embassy in India, has made remittance of USD 20000 for official purpose to USA. Is TCS applicable to this customer?

No TCS is applicable on remittances made by an embassy, a High Commission, a legation, a commission, a consulate, the trade representation of a foreign State etc.

Dynamic currency conversion or cardholder preferred currency is a process whereby the amount of a Visa transaction is converted by a merchant or ATM to the currency of the payment card's country of issue at the point of sale.

NRI Banking

Resident Indian Account

Need Help?

Contact us 1860 267 1234 / 1800 209 4555

Only from SG 800 852 6186

For Int'l +91 44 6685 4555

Or have someone contact you

Others

- Other Banking Accounts

- Currency Exchange Rate

- Related Links

- Changes in ODI

- Changes in LRS

- RTGS / NEFT Facilitation centre

- Security and You

- Careers

- Social Good

- Cyber Security

- Sitemap

- Annual Report

- Banking Forms

- Commission Structure for Investments Products

- Commission Structure for Insurance Products

- Grievance Redressal

- Important Announcements

- Unclaimed Deposits - RBI's UDGAM

- Unclaimed Deposits - Search Customer

- Regulatory Disclosure

- Time limit for loan disposal & service delivery

- Treasures Savings Account Charges & Fees

- Current Account

- Interest Rates

- Unparliamentary Language

- List of Repossessed Properties