- Banking

- Wealth

- NRI Banking

- Customer Services

Related Insights

What is the Advantage of Mutual Funds over ETFs?

Mutual Funds (MFs) help investors, including first-time investors, to diversify their investment portfolio and potentially secure long-term market outperformance on the road to reaching their financial goals. But there are other investment options in the market that are similar in nature - one commonly cited alternative is Exchange Traded Funds (ETFs).

Managed by professional fund managers, both MFs and ETFs promise investors lower inherent risks by offering a single solution that invests into different assets. ETFs may also offer cheaper management fees than MFs. So, what sets MFs apart and why can MFs be considered a better addition to investor portfolios?

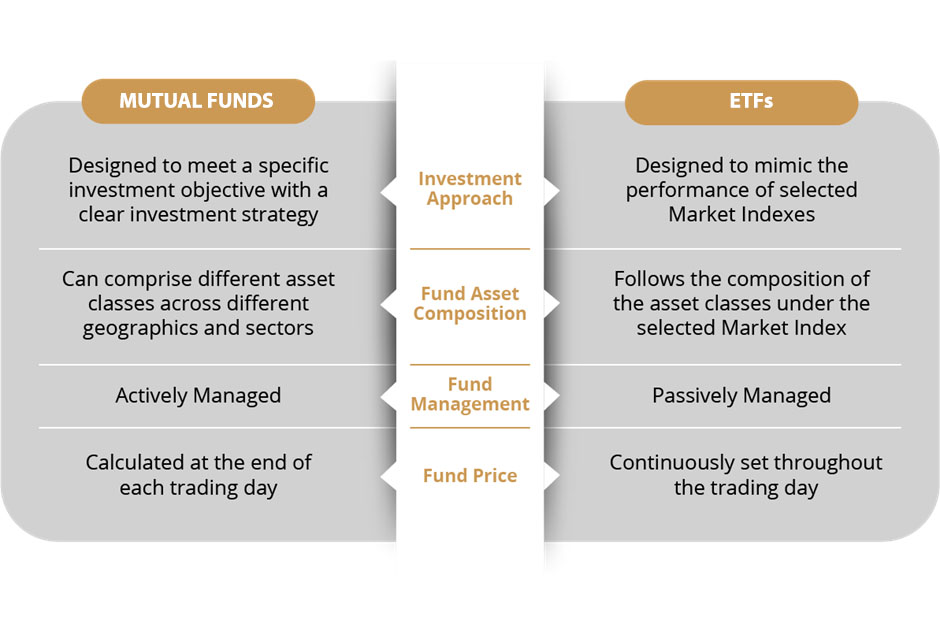

How do Mutual Funds differ from Exchange Traded Funds (ETFs)?

The DBS Advantage

The Security and Exchange Board of India (SEBI) has categorised mutual funds into five broad types, with equity funds being one of the categories. SEBI further classifies equity funds into 11 sub-types like Large Cap, Mid Cap and Small Cap Funds. These equity funds cater to investors with different investments convictions from a risk vs returns perspective. Here are more details about some of these funds:

Large Cap Funds: Large-cap mutual funds are those that invest at least 80 per cent of the corpus in top 100 companies by market capitalisation. These stocks are a prominent name in the market and apply good corporate governance. Most of the stocks have stable performance and profitability and usually pay the investor regular dividends.

Mid Cap Funds: Mid-cap mutual funds are those that invest at least 65 per cent of the corpus in companies lying between 101-250 by market capitalisation. These stocks usually have a cheaper valuation compared to blue chip stocks and offer higher growth opportunity and price appreciation. Mid-Cap Funds are considerably safer than Small-Cap Funds but riskier than Large-Cap Funds. As always, you must consider your risks before investing.

Small Cap Funds: Small-cap mutual funds are equity-oriented and invest in small to medium companies. These companies are considered less stable compared to established companies. They are usually start-ups in the early stages of growth. SEBI has defined small-cap stocks according to market capitalisation. They rank 251 onwards among all listed companies on the stock exchange. These funds need to invest a minimum 65% of their corpus in stocks of mid-cap companies.

But before you dive in and purchase Mutual Funds, it is important to know about investment strategy and why long-term planning can be profitable.

Allow DBS Treasures to help you find a fund that is best suited to your investment planning.

Topic

Explore more

Wealth FeedThis article is for information purposes only. We recommend you get in touch with your investment advisor for any financial advise.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

DBS Bank India Limited – AMFI registered Mutual Fund Distributor (ARN-155319)