- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

In our previous articles about Mutual Fund investments, we looked into why Mutual Funds are better than ETFs and how you can go about choosing the right Mutual Fund for you. Now that you have purchased MFs, how can you go to the next step: building a resilient portfolio by diversifying MFs and securing effective returns or reducing the market risks in the long-term.

Adopting the portfolio approach could be an effective way of doing this.

DIVERSITY IS THE KEY

We know that the way to maximise returns in a risk-reward market is to diversify the portfolio according to your investment goals, preferences, time horizon and risk tolerance. The portfolio approach is aligned with this strategy and helps you assess your goals and invest in different asset classes. It reduces the likelihood that a single asset’s underperformance will affect the performance of your entire portfolio of investments.

In other words, diversifying the MFs will help strengthen your overall portfolio and ensure that your returns are not dependent on a single investment. MFs can be diversified based on geography, fund house, fund sector, or assets held by the fund. As long as they are in alignment with your investment goals and are implemented with a clear strategy, your investment in a diversified MF portfolio could work in your favour.

MAKE MUTUAL FUND INVESTMENTS WORK FOR YOU!

Putting together a portfolio of mutual funds is a matter of personal preference and personal goals. There is no one-size-fits-all approach. But there are some universals you should consider when choosing and combining funds.

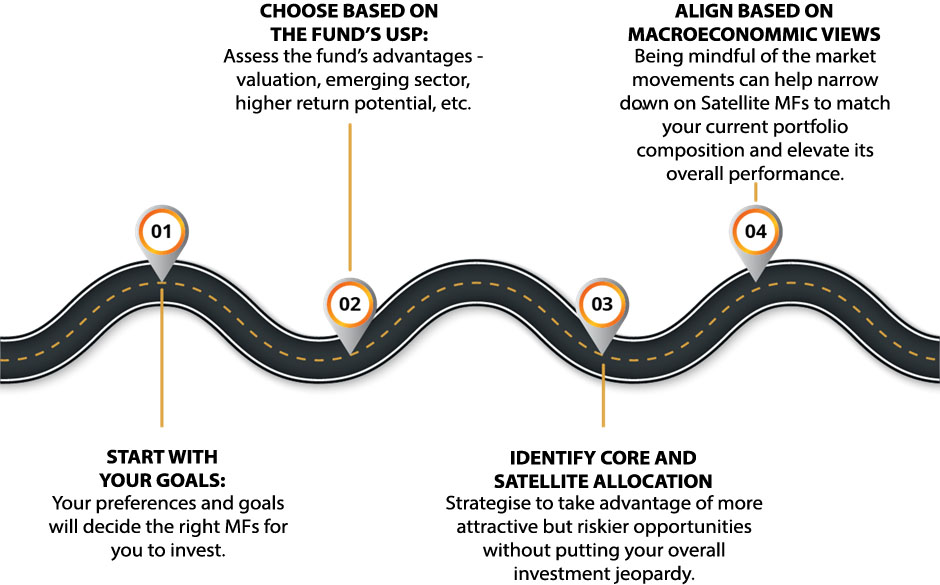

Firstly, an informed fund manager and the right strategic approach can help with fund selections that will align with your goals and preferences.

Secondly, it is advised to be mindful of the current portfolio composition to ensure your new selections complement it.

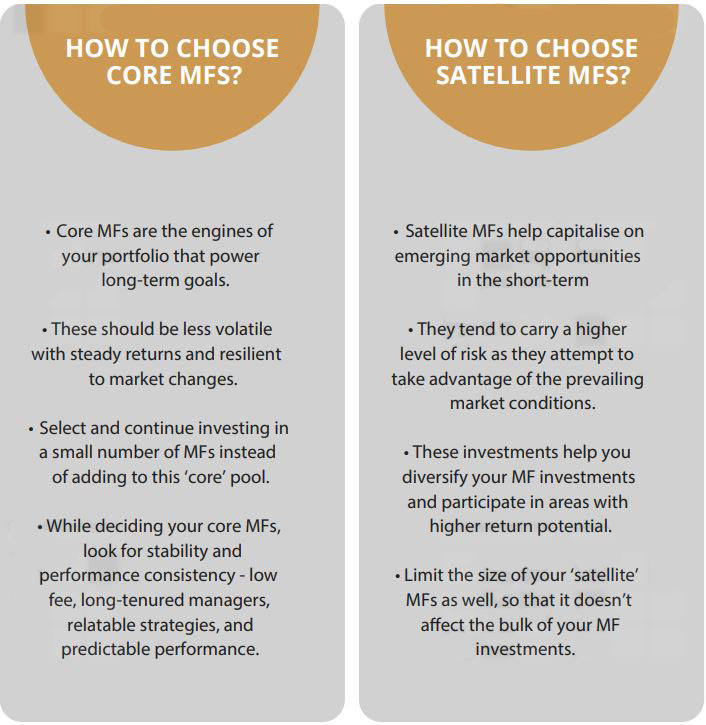

Thirdly, one method of MF fund diversification can be the Core-Satellite Approach:

- The "core" portfolio comprises multi-asset to decrease overall volatility, looks globally to get best in class assets and builds for long-term.

- The "satellite" portfolio of MFs become the more actively managed funds for short to mid-term, by taking the opportunity and advantage of some factors like valuations, trending themes and sectors.

This portfolio construction strategy is designed to provide investors the opportunity to outperform the Market while minimising risks.

'SATELLITE' MF SELECTION FACT SHEET

When looking for possible ‘satellite’ MFs, you could look for emerging industries and markets with higher growth potentials.

The DBS Advantage

Finding the right Mutual Fund that is aligned to your investment objective may seem daunting. But it is not unachievable when done correctly and with a clear strategy for returns and risk management.

To get you started,a Mutual Fund SIP might help you make investing a habit, while lowering potential risks from market fluctuations. DBS Select, our ready reckoner of top performing Mutual Fund schemes can be an option for you to explore and learn more about Mutual Fund portfolio diversification. Contact your RM for more details

For more insights into Mutual Funds and how to grow your portfolio effectively, reach out to DBS Treasures' team of experts.

Topic

Explore more

Wealth FeedThis article is for information purposes only. We recommend you get in touch with your investment advisor for any financial advise.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

DBS Bank India Limited – AMFI registered Mutual Fund Distributor (ARN-155319)