- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

- USD faces summer heat02 Jun 2025

- FX Tactical Ideas: Heightened Tariff Uncertainties30 May 2025

- USD falters again on increased risks for Trump’s agenda30 May 2025

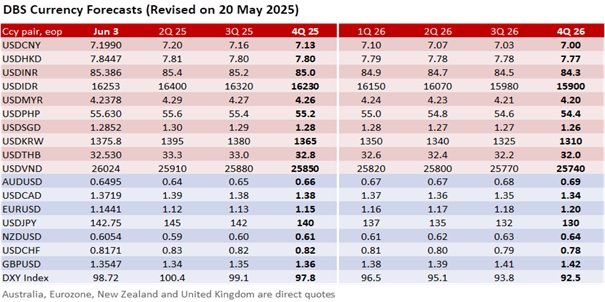

The DXY Index depreciated by 0.6% to 98.71 in the first session of June, approaching the 97.9 low seen on April 21. Despite the US and China accusing each other of violating the trade truce agreed on May 12, the S&P 500 and Nasdaq Composite indices rose by 0.6% and 0.7% overnight. The market’s narrative, “Trump Always Chickens Out” or TACO, has gained traction. Markets remained hopeful that Presidents Donald Trump and Xi Jinping would engage in direct talks to address the trade disagreements. Investors were also awaiting the appeals court’s decision on whether to uphold or throw out the filing against Trump’s Liberation Day tariffs, pending the plaintiffs’ responses by June 5 and that for the Trump administration by June 9.

US ISM manufacturing fell again to 48.5 in May, bucking the consensus for an increase to 49.5 from 48.7 in April. Despite the softer headline number, new orders improved to 47.6 from 47.2, and employment rose to 46.8 from 46.5. Prices paid slowed to 69.4 from 69.8, but not enough to prevent the US Treasury 30Y yield from increasing another 3.5 bps to 4.966%. Tomorrow’s ISM Services PMI survey will matter more, given the sector’s more significant contribution to the US economy. This week’s US jobs data will be closely watched because the futures markets have increased bets to more than 50% for the Fed to lower rates in September.

Fed Governor Christopher Waller believed the Fed could lower interest rates later this year. He brushed aside the higher long-term inflation expectations reported in the University of Michigan’s consumer survey. Waller’s base scenario is one-off inflation pressures from Trump’s tariffs, taking comfort in the trade negotiations to avoid the significantly higher tariffs proposed on Liberation Day, and was less worried about the kind of supply chain disruptions seen during the Covid-19 pandemic. Instead, Waller paid more attention to downside risks to US economic activities and the labour market.

However, the US Treasury 30Y yield rose another 3.5 bps to 4.966%, inching closer to the 5% pain threshold that reflected US fiscal worries. Bloomberg reported that Senate Republican leaders pushed for permanent tax changes to Trump’s “One Big Beautiful Bill.” Apart from resistance by the fiscal hawks in the Senate, the bill would need to return to the House (which passed the original bill by a tight 215-214 vote on May 22) for approval again. The Trump administration aims to get the bill to the president’s desk by Independence Day for signature before the estimated X-date in August.

Quote of the Day

“The elevator to success is out of order. You'll have to use the stairs, one step at a time.”

Joe Girard

June 3 in history

The initial 1958 State of Singapore Constitution was brought into force on June 3, 1959, granting Singapore full self-government.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- USD faces summer heat02 Jun 2025

- FX Tactical Ideas: Heightened Tariff Uncertainties30 May 2025

- USD falters again on increased risks for Trump’s agenda30 May 2025

Related Insights

- USD faces summer heat02 Jun 2025

- FX Tactical Ideas: Heightened Tariff Uncertainties30 May 2025

- USD falters again on increased risks for Trump’s agenda30 May 2025