- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

- FX Tactical Ideas: Rising Global Bond Yields23 May 2025

- Pressure on DXY to continue 22 May 2025

- USD wrestles to square Trump’s multi-layered agenda circle 21 May 2025

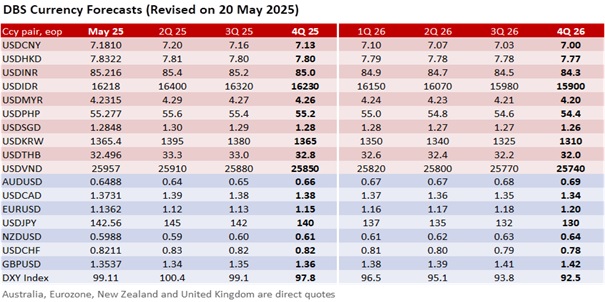

Fiscal worries are weighing on the USD. The DXY Index depreciated by 2% last week and extended its decline below 100. The US Treasury 30Y yield increased above 5% for the first time since late October 2023. The Trump administration faces resistance from fiscal hawks in the Senate to pass US President Donald Trump’s sweeping tax cut agenda. The narrow 215-214 vote on May 22 in the US House of Representatives to pass Trump’s “Big Beautiful Bill” reflected US lawmakers’ worries about Moody’s rationale – the lack of progress by successive US administrations to reverse the trend of large annual fiscal deficits and growing interest costs – for axing America’s final triple-A debt rating on May 16.

Fears of an escalation in US-EU trade tensions have subsided. Following a phone call with European Commission Ursula von der Leyen, Trump has agreed to Brussels’s request to revert to the original tariff deadline on EU imports to July 9. Brussels indicated its willingness to hasten trade talks with Washington after Trump threatened a 50% tariff on June 1. However, the trade talks will not be easy. EU wants bilateral discussions to be based on mutual respect and not threats. Brussels wants to focus on the bilateral trade deficit. However, Trump is more interested in reshoring manufacturing operations to the US, as reflected by his tariff threats on Apple and Samsung mobile phones. With an imminent escalation in US-EU trade tensions averted for now, the DXY will likely continue depreciating, mirroring its present decline started on May 12, when the US and China de-escalated global trade tensions by scaling back tariffs on each other and entering a 90-day pause to facilitate trade talks.

Pay attention to US data. On May 27, we will be cautious about the expectations for the US Conference Board’s consumer confidence index to improve to 87 in May from 86 in April. Over the same period, the University of Michigan’s (UoM) consumer sentiment index declined from 52.2 to 50.8, its second-lowest reading on record. On May 30, PCE inflation is expected to mirror CPI inflation in slowing to 2.2% YoY in April from 2.3% in March, with core inflation moderating to 2.5% from 2.6%. However, the UoM survey saw Trump’s tariffs lifting inflation expectations to 7.3% in May from 6.5% in April for the next 12 months and to 4.6% from 4.4% over the next 5-10 years.

Expect this week’s Fed speakers to lean towards inflation or stagflation in their assessment of US tariffs. More Fed officials may join Atlanta Fed President Raphael Bostic in supporting only one rate cut this year vs. the two reductions pencilled in the March Summary of Economic Projections.

Overall, the greenback has been finding it difficult to revive its haven status because of Trump’s conflicting policy agenda for higher tariffs and large tax cuts and his desire for lower interest rates and a weaker USD.

Quote of the Day

“A lie with a purpose is one of the worst kind, and the most profitable.”

Josh Billings

May 26 in history

In 1896, the Dow Jones Industrial Average started with an average of 12 industrial stocks.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- FX Tactical Ideas: Rising Global Bond Yields23 May 2025

- Pressure on DXY to continue 22 May 2025

- USD wrestles to square Trump’s multi-layered agenda circle 21 May 2025

Related Insights

- FX Tactical Ideas: Rising Global Bond Yields23 May 2025

- Pressure on DXY to continue 22 May 2025

- USD wrestles to square Trump’s multi-layered agenda circle 21 May 2025