- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Equities: Global equities notched another winning week as investors take cue from falling treasury yields and moderating inflation

- Credit: High quality, short duration credit remains most attractive. Long-end of the duration spectrum remains most at risk given US debt sustainability concerns, while the short duration would enjoy tailwinds from Fed pause

- FX: Fed and ECB narrowed policy gap; EUR/USD continues to hover near the 1.10 resistance level

- Rates: UST rally running out of steam; 2Y yields are fair but decline in long-end rates may be overdone

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; Japan Industrial Production Number

Global equities rose on rate pause bets. Global equities reported gains for the week ending 24 Nov on the back of moderating US Treasury yields. Global equities were up 0.9% for the week, with both Developed Markets and Emerging Markets rising 1.0% and 0.9% respectively.

US equities notched another week in green as treasury yields hit multi-month lows on lowered inflation expectations. The major averages notched their 4th consecutive week of gains; S&P 500, Dow Jones and NASDAQ were up 1.0%, 1.3% and 0.9% respectively.

Europe equities were mixed during the week as macro data showed a decline in business activity (PMI remained contractionary in November and employment fell for the first time in three years); the FTSE 100 and DAX registered -0.2% and +0.7% respectively. The China market was also ambiguous the past week with the SHCOMP falling 0.4% whilst the HSCEI and Hang Seng Index gained 1.1% and 0.6% respectively as investors weighed the impact of further stimulus measures for private property developers.

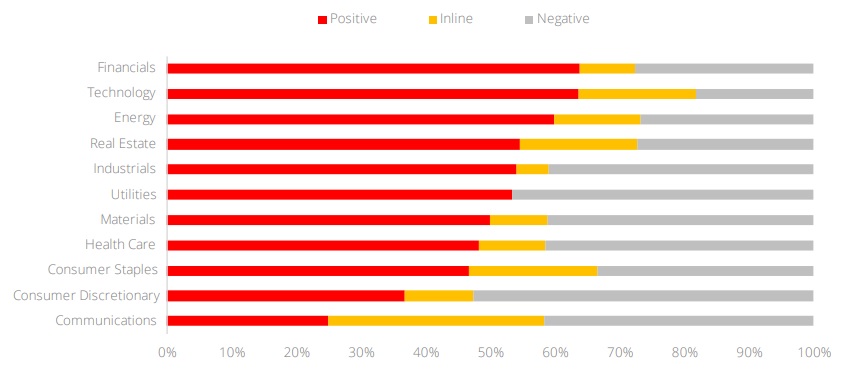

Topic in focus: Muted earnings surprise for STOXX 600. As we approach the end of the current earnings season, with c.93% (as of 24 November) of the companies on STOXX 600, the complex economic landscape has impacted a broad range of industries. With only 53.3% of the index reporting positive earnings surprise, 10.7% inline and 36.1% reporting negative earnings surprise, this is the worst earnings season since pandemic lows.

Out of the companies that have reported, Technology and Financials shared the top spot with 65% reporting earnings upside, followed by Energy at 60%. This stellar earnings momentum broadly ties to the outperformance of the two sectors. Europe Financials rallied c.18% and Europe Technology stocks rallied c.27% this year against c.12% gain for STOXX 600.

From a sectoral perspective, we continue to advocate maintaining exposure in Europe Technology, especially in the semiconductor space (i.e., Infineon and ASML). These industry leaders boast strong IP and near monopolistic positioning within the semiconductor landscape. Furthermore, we believe the semiconductor space is poised to benefit from the Artificial Intelligence (AI) boom due to the pivotal role that chipsets, as integral components, plays in propelling the advancements of AI.

Figure 1: Europe current quarter earnings surprise

Source: Bloomberg, DBS

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.