- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- US: Looming prospect of a capital war prompts concerns over divestment from US assets; weak ISM manufacturing and services data signals economic slowdown

- Korea: Lee’s election ends political uncertainty and sets the stage for fiscal expansion and a shift toward more diversified trade ties

- Japan: Despite political debate over tax cuts, Japan’s fiscal position has improved significantly, driven by reflation and stronger nominal growth

- India: India is set to cut rates further amid soft inflation and slowing growth with early GDP strength likely to fade as policy transmission and weak capex weighing on the outlook

Related Insights

- CIO Market Pulse – Risk Reprieve09 Jun 2025

- Market Pulse: Risk Reprieve09 Jun 2025

- Market Pulse: Gradual Fissure02 Jun 2025

US: Capital war risks emerge. Even as the market frets over the flip flops on Trump’s tariffs, we think investors should increasingly focus on the prospect of capital war. From our perspective, tariffs are here to stay. The need to shift manufacturing back to the US, gain revenues, protect key industries, and help in negotiations mean that Trump has a strong incentive to keep tariffs in place. In any case, even if the Supreme Court does not rule in Trump’s favour, tariffs would still be implemented, though it would not be via the International Emergency Powers Act (IEEPA). News on this front should largely be treated as noise.

Investors would likely keep an eye on Section 899, a provision in Trump’s spending bill that is now making its way through the Senate. This provision allows the Treasury to impose up to 20% in extra taxes on dividends and interests earned by investors from countries which are deemed to have tax tariffs that are “discriminatory” or “extraterritorial” to US companies. This development appears aimed at the services sector which certain countries (especially in the Eurozone) are imposing or considering taxes on some of the US tech giants. For now, US Treasuries are exempt from this provision. There are a few considerations from a rates angle at this point.

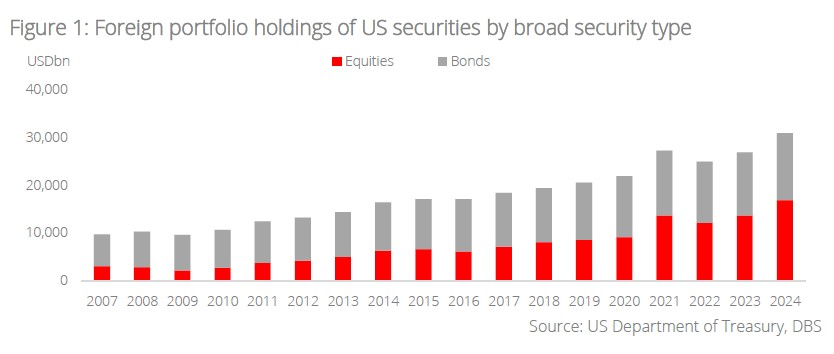

First, the trade war is likely to widen out into a services war and now, the prospect of a capital war is gaining traction. Second, at the very least, foreigners (at least those who are perceived to be less friendly to the US) would likely face more urgency to divest private sector USD assets. Further diversification away from US capital markets appears likely. Third, even if a similar rule is not considered for USTs at this point, investors will likely have the worry in mind.

To put things into perspective, foreigners hold about USD17tn in US equities and about USD13tn in US bonds (including Treasuries). Insofar as foreign investors are overweight on USD assets, recent developments add to decoupling worries which can be disorderly if large amounts of capital shift in a very short time.

The US ISM Manufacturing PMI declined to 48.5 in May 2025 from 48.7 in April, falling short of consensus estimate of 49.5. This marks the third straight month of contraction and the steepest drop since Nov 2024, underscoring rising economic uncertainty and persistent cost pressures, fuelled in part by Trump-era trade volatility.

Also, the stagflation tone of the ISM Services PMI aligned with the Fed’s Beige Book findings. The Fed reported that the US economy contracted slightly since the previous report on 23 Apr due to tariff-related uncertainty holding back business and consumer activities. The Fed’s 12 districts witnessed lower labour demand, declining hours worked and overtime, hiring pauses, and staff reduction plans. Although prices rose moderately, a few districts expected the higher tariff rates to add significant pressure to costs and prices in the future. Although May was also the first time since Jun 2024 that both the ISM services and manufacturing PMIs contracted, the Fed lacked the disinflation scenario that led to the rate cut in Sep 2024.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- CIO Market Pulse – Risk Reprieve09 Jun 2025

- Market Pulse: Risk Reprieve09 Jun 2025

- Market Pulse: Gradual Fissure02 Jun 2025

Related Insights

- CIO Market Pulse – Risk Reprieve09 Jun 2025

- Market Pulse: Risk Reprieve09 Jun 2025

- Market Pulse: Gradual Fissure02 Jun 2025