- Banking

- Wealth

- NRI Banking

- Customer Services

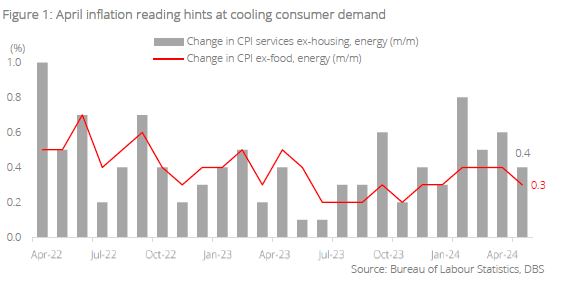

- US: Core inflation cools to 0.3% m/m in April after holding at 0.4% for three months, providing relief that the Fed’s last mile towards its 2% inflation target may become less complicated

- Japan: 1Q GDP shrinks -2.0% in weaker-than-expected result with private consumption registering the fourth straight quarter of decline

- China: PBOC keeps key policy rate unchanged; fixed asset investments projected to increase on government support for equipment renewal in advanced manufacturing sectors

- India: April CPI moderates slightly as expected; with 1Q24 GDP growth suggesting c.7% y/y print is within reach, India’s growth prospects are firm

Related Insights

- US Equities 4Q25 | Navigating Cross-currents15 Oct 2025

- Video 4Q25: Ride the Trend13 Oct 2025

- CIO Market Pulse – Twin Fears13 Oct 2025

US: CPI inflation brings relief rally over the Fed’s last mile on inflation. Core inflation cooled to 0.3% m/m in April after holding at 0.4% for three months. The energy component saw the biggest increase at 1.1%, shelter inflation remained at 0.4% m/m. Advance retail sales were unchanged in April vs the consensus for a 0.4% m/m increase; the March figure was revised to 0.6% from 0.7%. On their own, these numbers still point to relatively firm price pressures. In our view, the shelter component may need to disinflate before core CPI can trend lower. At the very least, it does not look as if inflation is re-accelerating. The miss in retail sales is arguably a greater point of concern, but we take a nuanced view on this – retail sales figures are notoriously volatile, and a single print should not be taken as a clear signal that the US is slowing. That said, it does add to a string of recent downside data surprises in the US.

The above data are consistent with Fed Chair Jerome Powell’s recent comment that inflation would decline again on a monthly basis, and that monetary policy was restrictive and working to weigh on consumer spending. Last Thursday’s (9 May) unexpected surge in initial jobless claims also aligned with Powell’s view that demand for workers was cooling and a recent New York Fed survey that consumers had depleted their surplus pandemic savings.

Overall, the Fed needs inflation to keep cooling on a monthly basis to gain sufficient confidence for inflation to return to the 2% inflation target. Until then, we see the Fed reducing the three rate cuts it projected in March at the June Federal Open Market Committee meeting. We forecast the Fed delivering two rate cuts in the second half of this year.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- US Equities 4Q25 | Navigating Cross-currents15 Oct 2025

- Video 4Q25: Ride the Trend13 Oct 2025

- CIO Market Pulse – Twin Fears13 Oct 2025

Related Insights

- US Equities 4Q25 | Navigating Cross-currents15 Oct 2025

- Video 4Q25: Ride the Trend13 Oct 2025

- CIO Market Pulse – Twin Fears13 Oct 2025