- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- With US national debt surging past USD33t, interest expenses comprise a larger portion of budget

- High Fed Funds rates imply high costs of maintaining large reserve balances at banks

- Accelerating QT may be more effective than raising rates in tightening conditions

- Remain up in quality (A/BBB) and short-duration (3-5 years)

Related Insights

- USD Rates: Waiting is the right strategy for the Fed 06 May 2025

- JPY rates: A slower path to normalisation 02 May 2025

- CNY rates: Weakening PMIs and outward shipments 02 May 2025

Broken record of US debt breaking records. It was not long after the US had raised the debt ceiling that treasury issuances have gushed forth as though the house no longer had a roof. The US national debt was reported to have surged past a record USD33t this month (>120% of GDP), pushing us far beyond the Rubicon of what is conventionally acceptable as “sustainable levels of debt”. While government largesse is an obvious scapegoat for the ills of indebtedness, it would be perhaps surprising to learn that the Fed hiking cycle – left unchecked – would eventually make Federal interest expenses a predominant cause of deficit spending, making the Fed Chair more consequential to fiscal responsibility than Congress or the President himself.

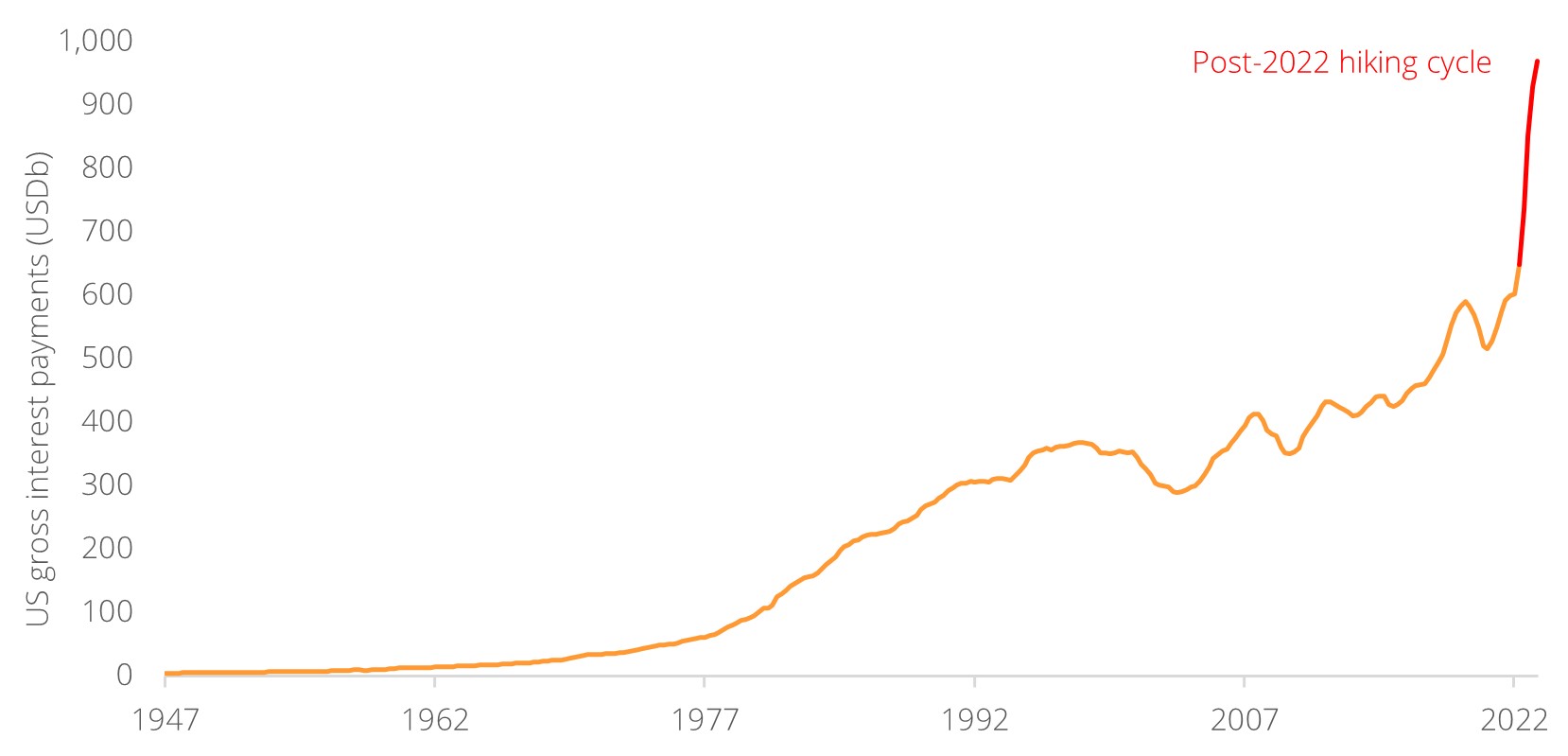

Interest expenses to the moon. The data itself is staggering. Since the Fed had embarked on the first 25 bps hike in 2022, gross interest payments on US debt have increased by c.50% to c.USD970b within a span of one year, according to data from the Federal Reserve Bank of St. Louis (Figure 1). Interest is in all likelihood going to surge past the ominous USD1t mark, given that a sizeable 34% of interest-bearing treasuries are maturing within 12 months; the sharp rise in rates over the past year all but ensure that costs of refinancing have nowhere to go but up.

Interest payments becoming a budget constraint. Granted, the Treasury does account for some interest receipts (in the form of social security, retirement benefits, student loans, etc.) to mitigate interest payments on a net basis, but such offsets are no panacea to the overwhelming force of higher rates. Based on interest projections under various yield scenarios, a prevailing 4-5% interest rate environment would eventually see net interest payments still rise towards the USD1t level, almost with an air of inevitability.

The US Congressional Budget Office (CBO) is also acutely aware of this risk, projecting that net interest payments would surge to c.USD835b by 2025 (the deadline for the debt ceiling suspension). Ceteris paribus, this would make net interest payments a larger component of the budget than other mandatory categories such as National Defense and Medicare. Given that a non-negligible portion of such interest payments go to foreign (some perhaps not US-friendly) holders, congress may eventually be called into question regarding why certain foreign parties are benefitting at the cost of higher domestic US liability.

Figure 1: US gross interest payments have risen exponentially in light of the hiking cycle

Source: Federal Reserve Bank of St. Louis, DBS

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

- USD Rates: Waiting is the right strategy for the Fed 06 May 2025

- JPY rates: A slower path to normalisation 02 May 2025

- CNY rates: Weakening PMIs and outward shipments 02 May 2025

Related Insights

- USD Rates: Waiting is the right strategy for the Fed 06 May 2025

- JPY rates: A slower path to normalisation 02 May 2025

- CNY rates: Weakening PMIs and outward shipments 02 May 2025