- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Significant hedging gains under cross-currency swap arrangements of AAA-AA rated government bonds

- This has resulted in yield pickups that make US treasuries pale in comparison

- Such domestic bonds would become increasingly attractive for investors with a home-currency bias

- USD bonds may see greater supply from issuers taking advantage of the CCS basis

- Local currency bonds could be a good opportunistic play

Related Insights

- USD Rates: Waiting is the right strategy for the Fed 06 May 2025

- JPY rates: A slower path to normalisation 02 May 2025

- CNY rates: Weakening PMIs and outward shipments 02 May 2025

All eyes on BRICS. The recent BRICS summit in Johannesburg saw more than 60 countries in attendance, and expansion was all but certain with the invitation of new member states – Argentina, Ethiopia, Iran, Saudi Arabia, Egypt, and the UAE into the club. Despite obvious diplomatic challenges compared to the more unified democracies of the G7 bloc, the summit nonetheless elicits provocative notions of USD decline, transitions to a multipolar world order, and local currency settlement of commodities trade. From a fixed income perspective, does this geopolitical transition paint a rosy picture for the future of local currency bonds?

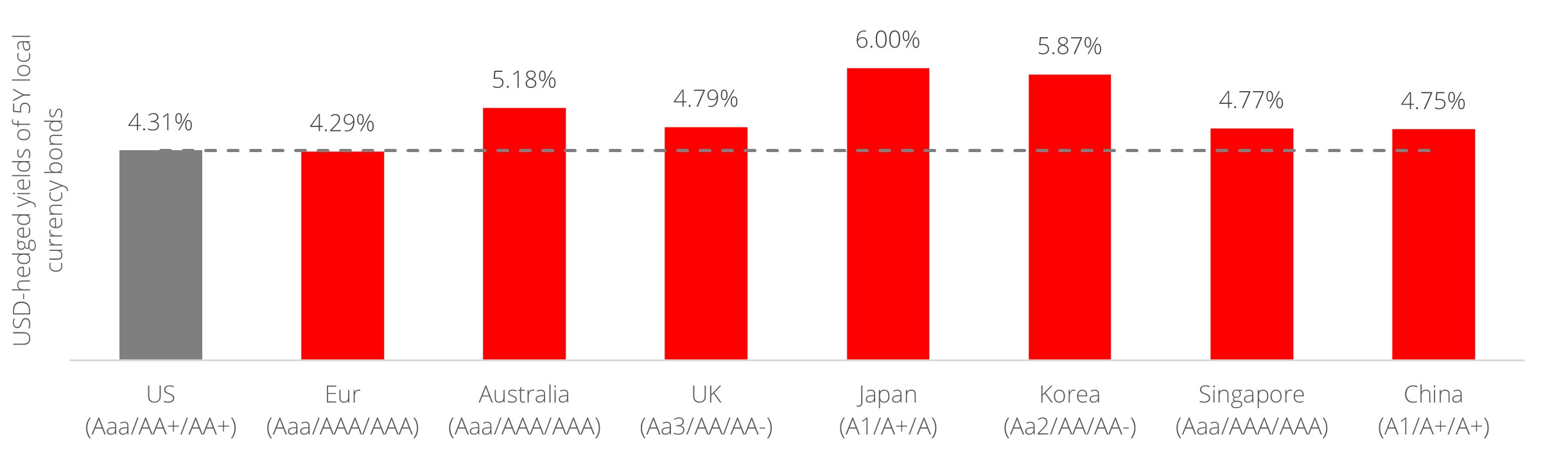

Non-USD bonds already in vogue. Certainly, should net settlement in trade be conducted in non-USD terms, it would naturally rouse global reserve managers to hold more non-USD currencies, a tailwind for non-USD bond flows in the long run. Yet one need not even wait that long to notice the obvious advantages of such bonds today. High short-term US rates have resulted in significant hedging gains under cross-currency swap (CCS) arrangements of a broad swathe of AAA-AA rated government bonds into USD, resulting in yield pickups that make US Treasuries pale in comparison. For the uninitiated, a CCS for a non-USD bond involves selling future cash flows in local currency for USD using FX forward rates; current gains are predicated on expectations that the USD would depreciate against these currencies.

Figure 1: US Treasuries losing their shine against USD-hedged domestic bonds

Source: Bloomberg, DBS

Note: Yields are approximated via 3-month FX hedges

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

- USD Rates: Waiting is the right strategy for the Fed 06 May 2025

- JPY rates: A slower path to normalisation 02 May 2025

- CNY rates: Weakening PMIs and outward shipments 02 May 2025

Related Insights

- USD Rates: Waiting is the right strategy for the Fed 06 May 2025

- JPY rates: A slower path to normalisation 02 May 2025

- CNY rates: Weakening PMIs and outward shipments 02 May 2025