- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Market has turned risk on in anticipation of end of Fed hiking cycle

- However, we do not believe investors should go down spectrum of credit rally to chase HY credit

- Credit issuers have mitigated pressure of higher rates by extending duration of their bonds

- For HY issuers however, pressure of refinancing and higher rates are likely to kick in come 2024

- IG issuers remain better positioned due to stronger balance sheets & high interest coverage

Related Insights

- Malaysia: Dovish BNM hold opened the door for rate cuts in 2H25 09 May 2025

- HKD rates: Volatile HIBORs in the rest of 2Q25 09 May 2025

- USD Rates: The Fed stays on hold 08 May 2025

From hikes to holds. It is with cautious optimism that the markets digested the outcome of the July FOMC meeting, allowing some hope that the most aggressive rate hiking cycle in decades has come to an end. We share this optimism, keeping a mind a couple of observations:

- Divergence between short and long rates. Even as the interest rates across the curve were rising aggressively last year, there came a point near the end of 2022 where further increases in the policy rate had no effect on 10Y rates. Longerterm rates – which tend to look through short-term hiking cycles – began to signal that the absolute levels of rates would likely become a drag to the economy, implying that conditions were becoming adequately tight.

- Downgrade of US debt rating. More recently, Fitch (a credit ratings agency) downgraded the rating on US debt from AAA to AA+, citing growing government debt burdens and fiscal deterioration as reasons for the change. Rates should not push much higher from here, as it would only serve to aggravate these fiscal sustainability concerns, with risks that the US would never be able to repay their ballooning levels of debt if taxes are only sufficient to cover mandatory spending and interest expenses.

Time for credit risk taking? Markets have certainly cheered this perceived end of the hiking cycle, judging from the stellar performance of risky assets this year. For fixed income investors, the temptation is to leap into riskier High Yield (HY) markets given that (a) the headwinds of rate hikes are likely to abate, while (b) HY markets have generally outperformed Investment Grade (IG) this year. We, however, remain steadfast in our belief to stick to quality in one’s fixed income portfolio – noting that we are already in the later phases of the credit cycle; and as such, credit risks are likely ahead of us, not behind.

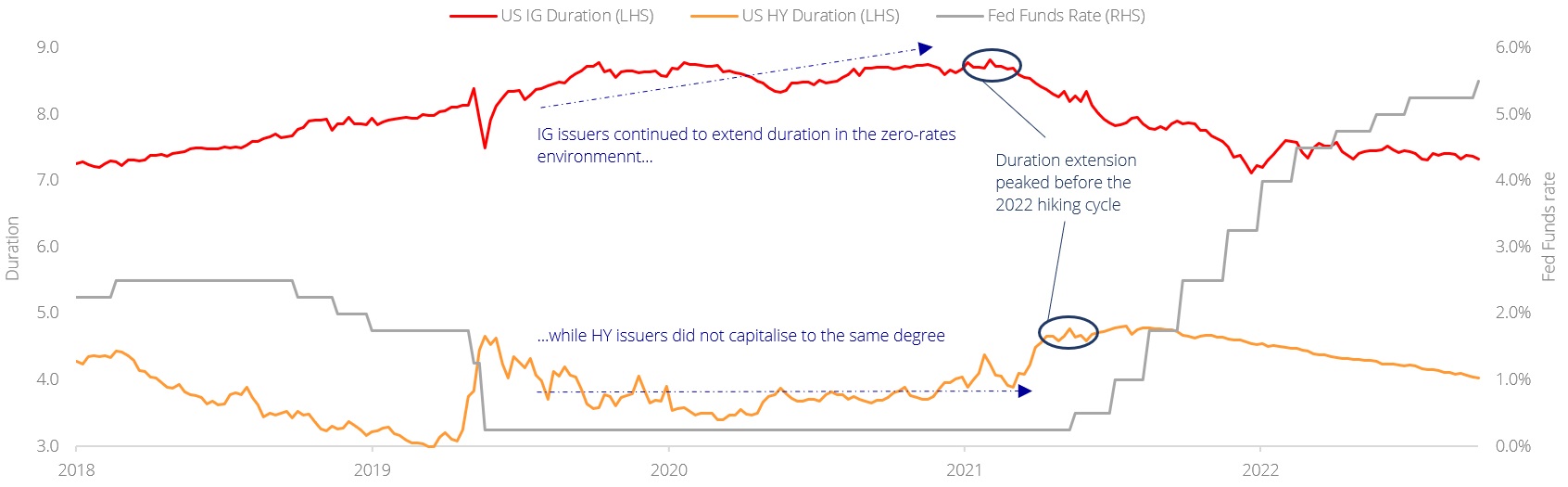

Figure 1: IG issuers are better insulated from rising interest rates, having extended duration

Source: Bloomberg, DBS

Duration extension mitigated the effect of higher rates. One reason why credit spreads had been so sanguine was the fact that corporate issuers had taken advantage of the zero-rates environment to lock in low funding costs for the long term. The average duration of IG issuers in the US peaked as high as 8.8 years during the low-rates environment of 2021, meaning that on aggregate, these companies would not face refinancing strain in their bonds for much of the remainder of this decade. Spreads have in a way reflected these benign risks.

The same however, could not be assumed for HY markets. We note that HY issues have on average half the duration of IG issues, as investors prefer not to have long duration exposure to junk risk. Moreover, these issuers did not meaningfully extend duration during the low-rate years of 2020-2021, implying that refinancing risk is likely approaching in the years of 2024-2025.

Quality is still key. Noting that HY default rates are likely to rise in the year ahead, we continue to reiterate a quality bias for a fixed income portfolio. Investors in a 60/40 balanced portfolio can reap the benefits of a pro-risk environment through their equity allocations, while bonds should continue to serve purposes of (a) downside protection and (b) steady income generation. On the back of the downgrade of US debt, we do not expect a wave of downgrades in IG credit, given that only two US corporate issuers have ratings in line with the sovereign (Microsoft and Johnson & Johnson); investors can take comfort that the best yield and safety balance still lies with IG credit in the 3-5year duration segment.

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

- Malaysia: Dovish BNM hold opened the door for rate cuts in 2H25 09 May 2025

- HKD rates: Volatile HIBORs in the rest of 2Q25 09 May 2025

- USD Rates: The Fed stays on hold 08 May 2025

Related Insights

- Malaysia: Dovish BNM hold opened the door for rate cuts in 2H25 09 May 2025

- HKD rates: Volatile HIBORs in the rest of 2Q25 09 May 2025

- USD Rates: The Fed stays on hold 08 May 2025