- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Equities: Tech run-up on Thursday not enough to prevent another losing week for global equities

- FX: Upcoming US jobs data vital to extend the DXY’s uptrend in upper half of 101-106 range

- Rates: USD rates space turned decidedly hawkish amidst optimism over debt ceiling

- Thematics: Rising EV sales of foreign OEMs in China prove positive on the auto parts company sector

- The Week Ahead: Keep a lookout for US Change in Nonfarm Payroll; Japan Industrial Production Numbers

Equities: Markets mixed as US reaches debt ceiling deal

Global equities ended mixed amid debt ceiling negotiations. Markets were once again weighed down last week (ended 26 May) by US debt ceiling negotiations and the worsening economic outlook in Europe as Germany slips into recession for 1Q. Global equities were down 0.5% for the week, with Developed Markets and Emerging Markets losing 0.5% and 0.4% respectively.

US equities rallied higher last Thursday (25 May), after higher-than-expected forecasts from Nvidia triggered a frenzied run up in the technology-heavy Nasdaq composite, which was up 2.5% for the week and +24% YTD. S&P 500 and Dow Jones ended the week up 0.3% and down 1.0% respectively. Europe closed lower for the week as optimism weakens after its largest economy, Germany fell into recession after reporting -0.3% GDP growth for 1Q; the Stoxx 600 and FTSE 100 lost 1.6% and 1.7% respectively. China equities closed lower across the board with industrial output, retail sales, and fixed asset investments all growing at weaker than expected pace, prompting investors to question if the post-pandemic recovery is losing momentum; the SHCOMP and HSCEI lost 2.2% and 3.9% respectively.

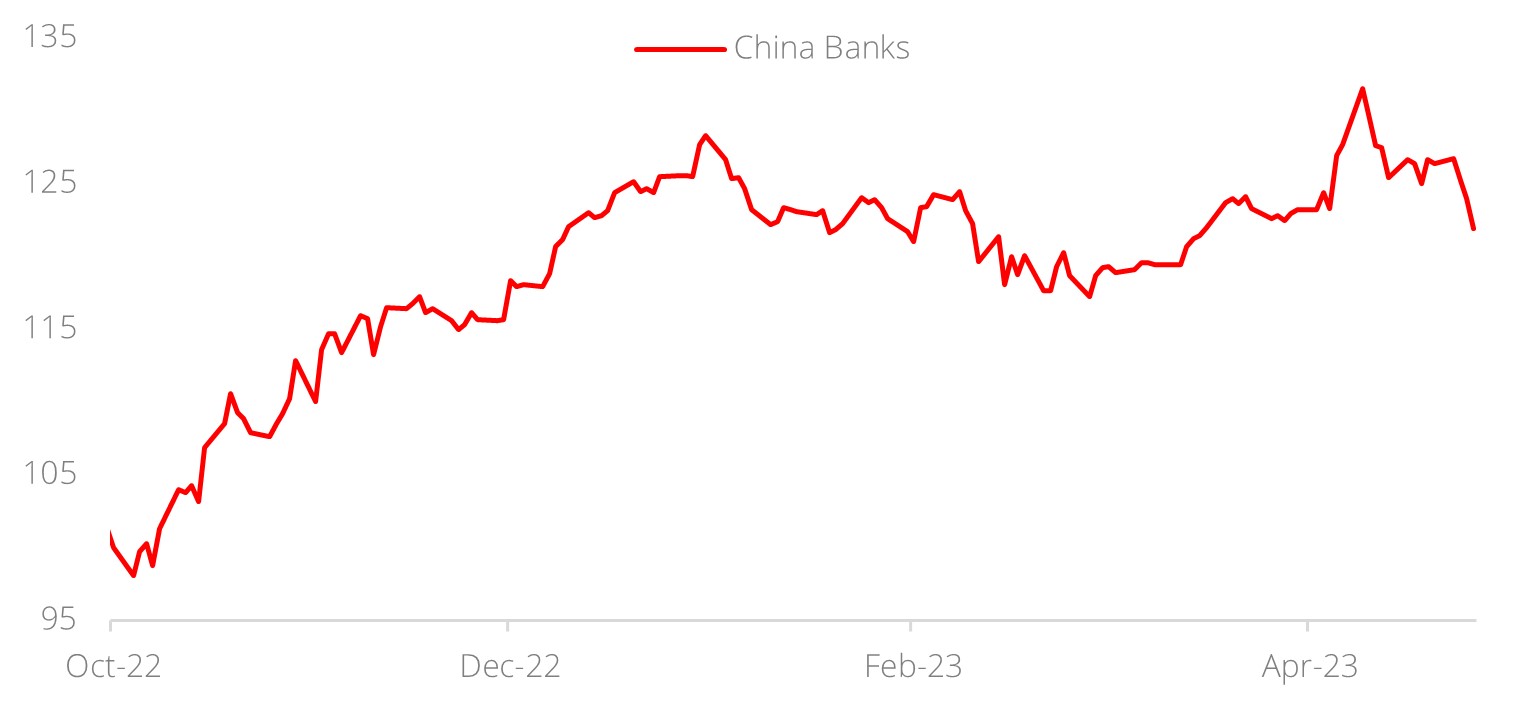

Topic in focus: Favour China State-owned Banks. China financials have delivered good performance since the conclusion of China’s Party Congress in end October 2022 where regulators strengthen oversight of the USD60t financial system. Since 2017, deleveraging campaigns pushed by regulators meant that Chinese banks have healthier balance sheets and higher liquidity. YTD, China’s banking index has returned c.22% gains driven by:

- Expectations of US rate hikes coming to an end. This development should reverse the yield compression between China large banks and bonds

- Narrowing of steep valuation discounts

- Resumption in total social financing growth to 11.7%, back to the level last seen in January 2022

We remain constructive on China’s state-owned enterprise (SOE) banks as the strong balance sheets and sustainable dividend yields (8.46% in 2023) makes them an attractive income generating building block within the barbell portfolio.

Figure 1: China Banks performance

Source: Bloomberg, DBS

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.