- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Equities: Falling US inflation not enough to keep markets buoyant as markets fall for a second week

- Credit: We continue to favour high quality IG credit amid volatile markets

- FX: DXY finds a firm footing with weekly 1.5% appreciation to 102.7

- Rates: With Fed entering into pause mode, UST yields remain stable with 2Y UST in 3.80-4.20% range

- The Week Ahead: Keep a lookout for US Initial Jobless Claims; Japan Industrial Production Numbers

Equities: US debt ceiling negotiations weigh on markets

Inflation eases up but market weakness persists. Markets notched another week of losses on debt ceiling worries despite US inflation coming in lower than expected for the month of April (4.9% actual vs 5.0% consensus). Global equities were down 0.5% for the week, with Developed Markets and Emerging Markets falling 0.5% and 0.9% respectively.

US equities traded flat for the week; the tech-heavy NASDAQ responded well to the tamer-than-expected inflation report, gaining 0.4% while the S&P 500 and Dow Jones fell 0.3% and 1.1% respectively as concerns around regional banks persisted. Europe fell marginally as UK inflation remains above 10% and the services sector contracted 0.3% in March; the FTSE 100 lost 0.3% while the Stoxx 600 remained flat for the week. China equities also showed weakness during the week amid lackluster trade data (imports contracted while export growth slowed in April); the HSI & HSCEI fell 2.1% and 2.0% respectively.

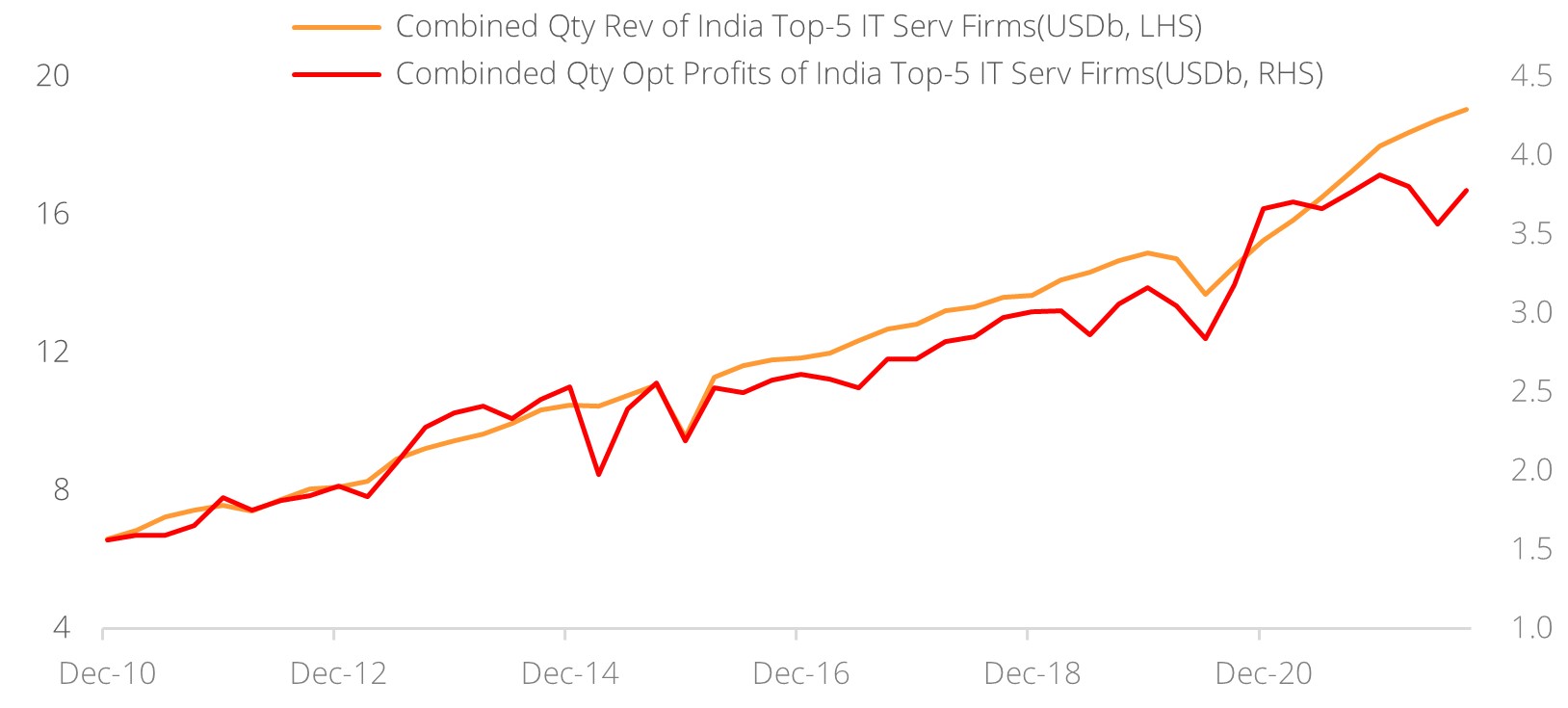

Topic in focus: India – Resilient services sector amid global tightening. India’s services sector has remained robust despite growth concerns and increasing incidence of risk events globally. The net service trade under the balance of payments has jumped from a monthly average of USD7.3b in late 2019 and is on course to hit USD13.5b in early 2023. On a full-year basis, service exports rose to a new high of USD320b. This service trade surplus is in large part due to resilience in the computer and IT services sector, which makes up nearly half (USD125b) of the country’s services exports.

A large part of the success of the IT services sector lies in growing demand for Business Process Outsourcing (BPO) as companies in developed markets seek to rationalise cost structures amid global financial tightening. A strong dollar has also helped the sector’s performance as c.60% of its revenue comes from the US. In the longer term, the sector will be buoyed by secular digitalisation trends, which will see companies, irrespective of region or sector, moving more of their business operations online. India is currently responsible for 40-45% of the global BPO market and this figure is only set to grow, aided by India’s skilled workforce, technological know-how, improving infrastructure, and supportive regulatory backdrop.

Figure 1: India’s IT sector - Resilient revenue and profits for over a decade

Source: Bloomberg, DBS

Credit: High quality credit offers safety in an environment of rising default risks

IG credit offers investors the comfort of safety in today’s uncertain environment. Against a backdrop of bank failures, tightened credit conditions, and financial stability concerns as the impact of elevated rates works its way through the system, investors would do well to seek the safety of high quality credit. Historical data demonstrates global investment grade (IG) corporates’ stellar record of an average annual default rate below 0.1%. Despite a challenging environment, IG corporates have maintained a clean sheet with no defaults since 2020. Even during peak corporate default periods such as during the GFC, IG credit defaults remained below 0.5%. In contrast, high yield (HY) defaults surged to nearly 10% in 2009, and have now begun to show a slight uptick since 2022. This suggests that should the economy weaken and default risks escalate, high quality IG credit would benefit from flight-to-quality sentiment.

Moreover, investors are generously rewarded for taking on modest default risks, with global IG yields close to 5% (more than 2 s.d. above their 10Y average). However, with peak rates likely upon us, the window could soon be closing to lock in generous yields in IG credit. We continue to recommend that investors capitalise on this narrowing window for higher yields by shifting excess cash towards high quality credit in what we term the Liquid+ Strategy, to capture yields while stocks last.

FX: USD finds a firm footing

The DXY’s 1.5% appreciation to 102.7 was the strongest weekly gain this year. However, DXY is wedged between 100.8 and 102.9, its 100- and 20-week moving averages, respectively. On 19 May, Fed Chair Jerome Powell and former chair Ben Bernanke will take part in a panel discussion on monetary policy. Last year, the Fed delivered back-to-back “jumbo” hikes because US rates needed to catch up with rising inflation. After headline inflation peaked and fell, the Fed reduced the size of hikes to “normal” 25 bps. Except for CPI inflation excluding food and energy prices, most US inflation gauges had fallen below the 5-5.25% Fed Funds rate. However, Powell and Bernanke will emphasise that the Fed has not taken its foot off the brakes because inflation remained high above its 2% target. They will push back the market’s bets for rate cuts later this year, clarifying that any hawkish pause simply meant that the Fed need not hike at every meeting. For example, the Reserve Bank of Australia hiked this month after keeping rates unchanged in April. Markets continue to take in stride the US debt ceiling issue.

Having depreciated 1.5% to 1.0850 last week, EUR/USD must take out the support at 1.08 (100-day MA) to extend its downside. The European Central Bank’s (ECB) hawk-dove divide should undermine the monetary policy divergence that supported the EUR vs USD. Governing Council member Joachim Nagel’s (Germany) longstanding desire to keep tightening beyond summer is well documented. What’s new was ECB Vice President Luis de Guindos’ (Spain) comment about the “normal” 25 bps hike signalling the hiking cycle was in the final stretch. GC member Francois Villeroy de Galhau (France) sees “marginal” distance left to cover in raising rates while Ignazio Visco (Italy) saw the ECB closing in the peak of the hiking cycle. Like Fed, the ECB says future policy decisions will be meeting-by-meeting and data-dependent. Meanwhile, the European Parliament is worried the European Union (EU) Budget may run out of funds for EU programs that assumed interest rates in a 0.55-1.15% range over 2021-2027. Today (15 May), the EU Commission will deliver its economic forecasts. Tomorrow (16 May), consensus expects Eurozone’s preliminary GDP growth in 1Q23 to stay at the flat 0.1% q/q sa pace as 4Q23.

GBP/USD could extend its fall to 1.2250 or 20-week MA. Last week (ended 12 May), GBP depreciated 1.4% to 1.2460 despite the Bank of England’s (BOE) twelfth hike to 4.50% and more optimistic economic outlook. BOE Governor Andrew Bailey and Chief Economist Huw Pill hinted the BOE could pause soon on falling inflation from base effects and higher interest rates hurting domestic demand. Pill speaks again on monetary policy today. Bailey, together with deputy governors Ben Broadbent and Dave Ramsden, will testify to the Treasury Select Committee on Quantitative Tightening on Thursday (18 May).

USD/CNY is near the year’s high of 6.9774 (on 8 March) ahead of the G7 Summit on 19-21 May. G7 nations will likely issue a communique over China’s “economic coercion”. Last Friday, EU ministers backed a plan to reduce the Eurozone economy’s dependence on China. In early May, US Trade Representative Katherine Tai reported progress on the proposed US-Taiwan Initiative on the 21st Century, a move seen to reduce US’s reliance on China. USD/CNY could test 7 if the USD extends its appreciation against other currencies this week.

Rates: Rangebound 2Y and 10Y

With the Fed expected to have entered into pause mode (FF target range to have peaked at 5.00-5.25% range), UST yields are likely to be stable for now - 2Y UST in a 3.80-4.20% range and 10Y UST in a 3.30-3.60% range.

There are three scenarios that are most likely to drive a breakout from current ranges. One, in the near-term, a possible US default could see 2Y and 10Y USTs rally as safe haven demand flows to USTs (T-bills should sell off though due to uncertainty over repayment).

Two, US economic data (especially inflation) could turn out to be more resilient and markets would have to recalibrate (reduce) the timing and extent of priced Fed rate cuts. We would thus see 2Y and 10Y USTs sell off in a curve-flattening move.

Three, if US banking sector conditions worsen or other unknown-unknown risks surface, the Fed would be expected to cut rates earlier. We would hence see 2Y and 10Y USTs rally in a curve-steepening move.

In terms of timing, the possible US default scenario is the closest that markets have to confront with, while the other two scenarios are likely further out in 2H.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.