- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Germany’s economy has stagnated post-Covid, slowdown worsened by structural weaknesses

- A new government under Friedrich Merz will take office in March, aiming for economic revitalisation

- Defence spending set to rise due to NATO pressure, may require modifications to strict debt rules

- Germany's IfW economic institute has revised its 2026 growth forecast to 1.5% from 0.9%

- Germany’s stock market has shown resilience, with optimism growing after a recent DAX breakout

Related Insights

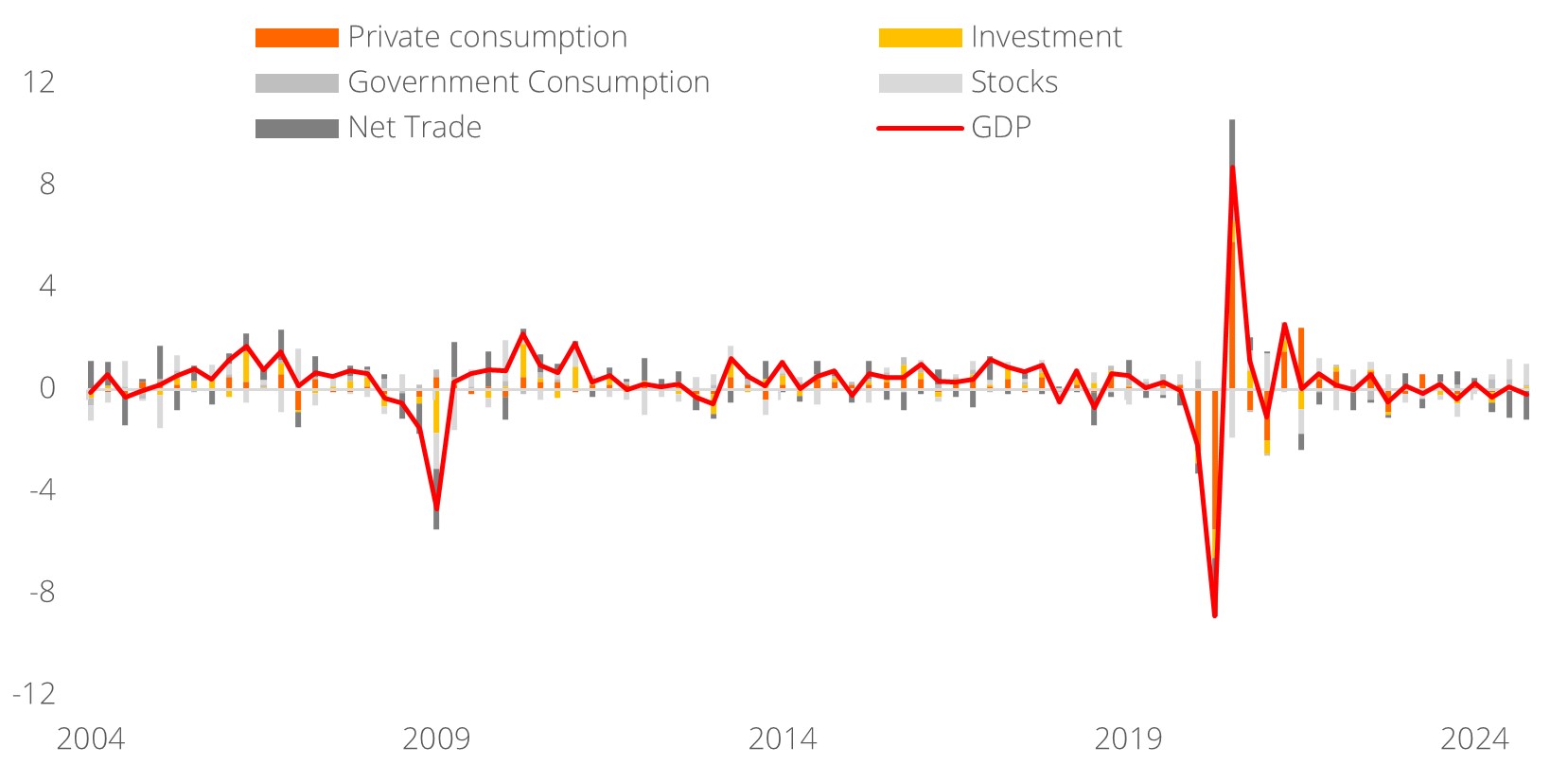

Challenges, opportunities, and the path to economic renewal. Germany, the world’s third-largest economy after the US and China, boasts a highly advanced, export-driven industrial sector specialising in automotive, chemicals, engineering, and research. However, structural weaknesses have become increasingly apparent due to global shifts such as digitalisation, rising trade protectionism, and intensified competition from China. Additionally, the Ukraine-Russia conflict has triggered energy supply shocks, leading to the decline of energy-intensive industries. As a result, Germany’s economy has stagnated post-Covid, contracting by approximately 5% compared to where it would have been had pre-pandemic growth trends continued.

New government, new possibilities. A new coalition government, led by Friedrich Merz, is set to take office at the end of March, following two consecutive years of negative GDP growth. This transition creates a strong impetus for economic revitalisation. A bold, transformative strategy may be necessary to address Germany’s structural challenges, as these issues will not resolve themselves. However, investment spending remains constrained by the debt brake—a constitutional rule introduced in 2009 that limits the annual budget deficit to 0.35% of GDP.

Rising defence spending and fiscal constraints. During the recent Ukraine-Russia peace talks, NATO members faced pressure from former US President Trump to allocate at least 3% — and potentially up to 5% — of GDP to defence. Accommodating this expenditure may require modifying Germany’s debt brake. Current proposals include off-budget spending and an EUR800bn infrastructure fund exempt from debt constraints.

Urgency and political challenges. Germany must approve any such measures before the Bundestag’s new session on 25 Mar. However, the results of the 23 Feb elections complicate this effort. The CDU/CSU, Social Democrats, and the indecisive Green Party lack the two-thirds majority required for a constitutional amendment. Meanwhile, the far-right Alternative for Germany (AfD), which has doubled its representation, opposes the ReArm EU plan if it involves increased national debt or relaxed fiscal rules. The AfD has even petitioned the Federal Constitutional Court to block major fiscal decisions by the outgoing Bundestag, arguing that they bypass the electorate’s latest mandate. Given the fragmented coalition, negotiations to lift the debt brake will be challenging—but not impossible. Germany's IfW economic institute has revised its 2026 growth forecast for Europe's largest economy upward, citing expected benefits from increased public spending.

A shift in fiscal strategy. Increasing debt would mark a significant departure from Germany’s traditionally conservative fiscal policies, signalling a shift toward a more pragmatic, investment-driven strategy. If managed wisely, this could enhance economic resilience, strengthen technological leadership, and bolster Germany’s influence in shaping European and global economic policies.

A shift toward higher debt levels in Germany could also set a precedent for the European Union (EU). Germany’s historically cautious fiscal stance has significantly influenced EU policies, particularly through the Stability and Growth Pact. A more flexible German approach could pave the way for looser EU-wide debt and deficit rules, fostering greater coordination in European investment efforts.

Growing stock market optimism. The Deutsche Börse is well-diversified across sectors such as insurance, energy, defence, telecommunications, and technology. The top 10 stocks collectively account for 61% of the DAX 40’s total market capitalisation, with strong representation in preferred sectors such as technology, healthcare, and industrials. With the recent breakout in the DAX index, there is growing optimism that Germany’s economic downturn may have reached its nadir. As the second-largest stock market in the Eurozone after France, Germany’s market performance could provide a boost to the broader STOXX Index.

Europe raised to Overweight. In response to the new fiscal stance and the positive momentum it brings, we are upgrading the Eurozone to Overweight on a 3-month tactical basis. However, pending further developments in the Ukraine-Russia ceasefire talks and the implementation of fiscal expansion, we are maintaining a 12-month Underweight in the Eurozone due to its structural weaknesses. Our preferred sectors are technology, healthcare, industrials, and luxury.

Figure 1: Lack of investments and exports slowdown stagnated the economy

Source: LSEG, DBS

Download the PDF to read the full report.

Topic

Explore more

CIO PerspectivesThis information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")