- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Crypto markets have been roiled by the recent failures of crypto-related banks

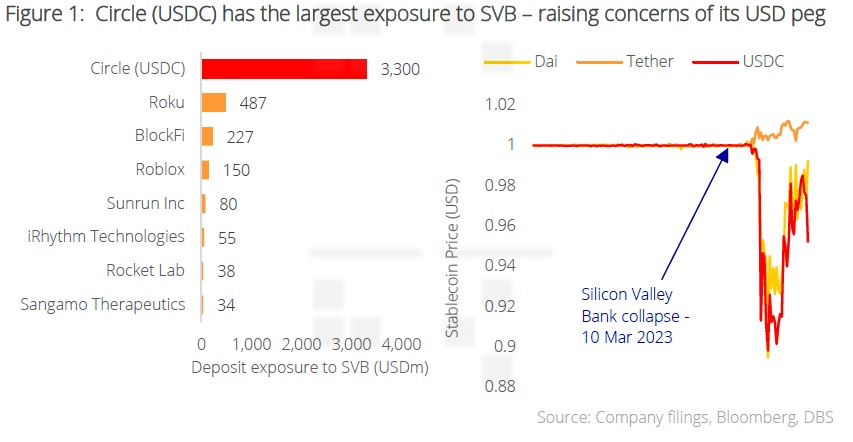

- The USDC stablecoin has one of the largest exposures to SVB, raising concerns of its peg to the USD

- Crypto enthusiasts should not harbour a “buy-the-dip” mentality as institutions in the space fall

- No longer about what cryptocurrencies to buy, but where to buy them

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

Another one bites the dust. The crypto markets have once again been roiled by news of the failure of Silicon Valley Bank (SVB), the innovative financier to frontier sectors such as life sciences, private equity/venture capital, cryptocurrency, and other alternative startups. Concerns centre particularly about Circle – the company behind the issuance of the USDC stablecoin – given that it has been revealed to have c.USD3.3b in deposits in the ill-fated bank prior to its collapse; casting doubt on the degree to which such reserves would ever be recoverable (if at all) in the aftermath, although the Fed has since rolled out emergency measures to support depositors.

Asset-Liability mismatches. Inherent to such systems of fiat-backed stablecoin is the risk of asset-liability mismatches, a risk that we had previously highlighted in light of the collapse of TerraUSD in 2022. Stablecoin issuers hold fiat-based assets (deposits, bills, commercial paper, bonds etc.) to back their liabilities (stablecoin). Should there be any doubt concerning the integrity of such fiat assets (such as Circle’s deposits with SVB), we opined that a “bank-run” like loss of confidence “could pose a systemic risk for the entire cryptocurrency ecosystem given its central role in crypto trading”. Moreover, we also warned that “investors should not take the stability of stablecoins for granted”, and the recent de-pegging of USDC serves once again to remind us that such warnings should be heeded. It is ironic however, that market price action has resulted in Tether – the less reputable stablecoin that is notoriously opaque concerning its reserves – being bid above par in a flight-to-safety response. In the land of the blind as they say, the one-eyed man is king.

Crypto has no central bank to come to its rescue. For those experienced in the financial markets, the failure of SVB, Silvergate, and Signature Bank (cryptocurrency-focused banks) just days prior is reminiscent of the domino-like fall of financial institutions during the 2008 Global Financial Crisis given the intricate cross-exposures between entities. Unlike traditional banks however, the cryptocurrency system does not have a liquidity provider of last resort in the Federal Reserve to bail them out of a systemic crisis. As such, we recommend that cryptocurrency enthusiasts not harbour a “buy-the-dip” mentality while institutions around the space continue to fall, and bide their time in taking outsized risk given that the Bitcoin halving cycle – a relatively reliable catalyst for a crypto bull-market cycle – is still about a year away in 2024.

Not what, but where. At this point, it is no longer about what cryptocurrencies to buy, but where one is buying them. We think it prudent to stick with reputable exchanges with strong balance sheets and character of management to avoid the shock of sudden insolvencies that would render one’s crypto holdings defunct indefinitely.

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024