- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Despite being crypto’s answer to volatile prices, stablecoins are at the centre of the recent crash

- The collapse of the Terra ecosystem highlights the "Impossible Trinity" applies to crypto & fiat

- Investors must not take the stability of stablecoins for granted

- Higher-than-average yields also come with commensurate risks

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

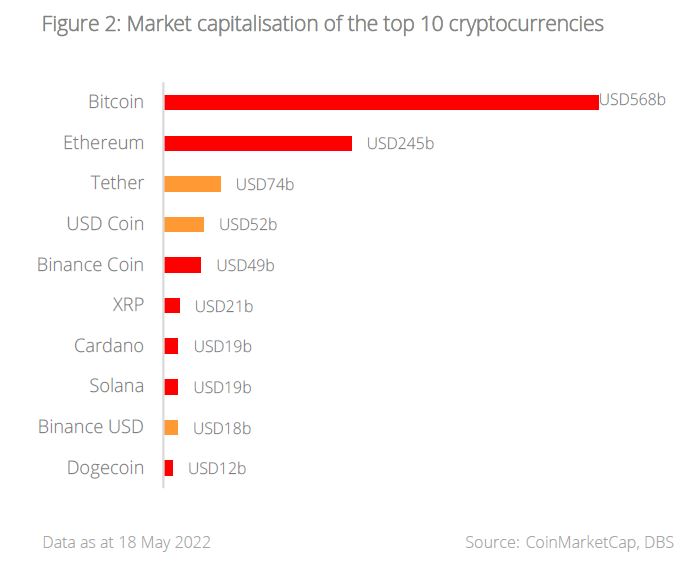

Cryptocurrency, but without the volatility? There are few risk assets that are more synonymous with volatility than cryptocurrency. As crypto adoption became widespread over the last decade, so had the demand for analogous digital currencies that could maintain fiat-like stability to facilitate both trading and saving. Enter stablecoins, which, as their name implies, were designed to maintain fixed pegs with major fiat currencies like the USD. Acting as a bridge between the realms of fiat and crypto, stablecoins have become a bedrock of the ecosystem, with around 90% share of crypto trading volume, and a total market capitalisation of USD160b, comprising about 10% of the total cryptocurrency market (as of 18 May 2022).

When stable coins are not stable. It came therefore to the surprise of many that certain stablecoins saw a breaking of their fiat currency pegs as outsized volatility engulfed the cryptocurrency space in recent weeks. Risks first emanated from the unexpected collapse in what was previously the fourth largest stablecoin – TerraUSD – after losing its peg against the USD, spiralling into abyss alongside its sister coin, Luna, which plunged by more than 98% within a 24-hour period. Unlike most other stablecoins which are backed by collateral such as cash or financial assets, TerraUSD was an algorithmic stablecoin which was collateralised not by traditional financial assets, but by its aforementioned sister cryptocurrency – Luna. Its value was kept as close as possible to USD1 using an algorithmic system. In essence:

- An investor can exchange 1 TerraUSD for USD1 worth of Luna, its sister coin, which has a floating price.

- Traders can profit from fluctuations in either TerraUSD or Luna. For example, if TerraUSD drops below USD1, traders will buy Terra and exchange it for USD1 worth of Luna.

- This creates a self-regulating system in which market activity should maintain TerraUSD’s value at USD1. In theory, should the value of one coin crash, traders would exchange their holdings for the sister coin, restoring the peg.

The emperor has no clothes. Given the absence of fiat-based reserves, the value of the TerraUSD-Luna system was fundamentally based on investor sentiment and demand. Amid risk-off sentiment in the wider markets, speculators sold TerraUSD in massive sizes when trading volumes were low. This caused the currency to slip below its USD1 peg, and investors rushed to liquidate their holdings in both TerraUSD and Luna faster than the algorithmic stabilisation could function. The Luna Foundation Guard (an organisation meant to support the Terra ecosystem) intervened to support the TerraUSD through the sale of Bitcoin in its reserves, but to no avail. Today, TerraUSD has plummeted far below its peg while Luna is worth a fraction of a penny despite starting the month above USD80.

Some have speculated that this was a concerted attack on the Terra ecosystem, reminiscent of George Soros’ successful bet against the British pound in the 1990s. While nothing can be concretely proven at this point, it is interesting to note that 60-year-old economic theory regarding conventional fiat currencies – namely the Mundell–Fleming trilemma – can still explain the dysfunction about the recent stablecoin de-pegging.

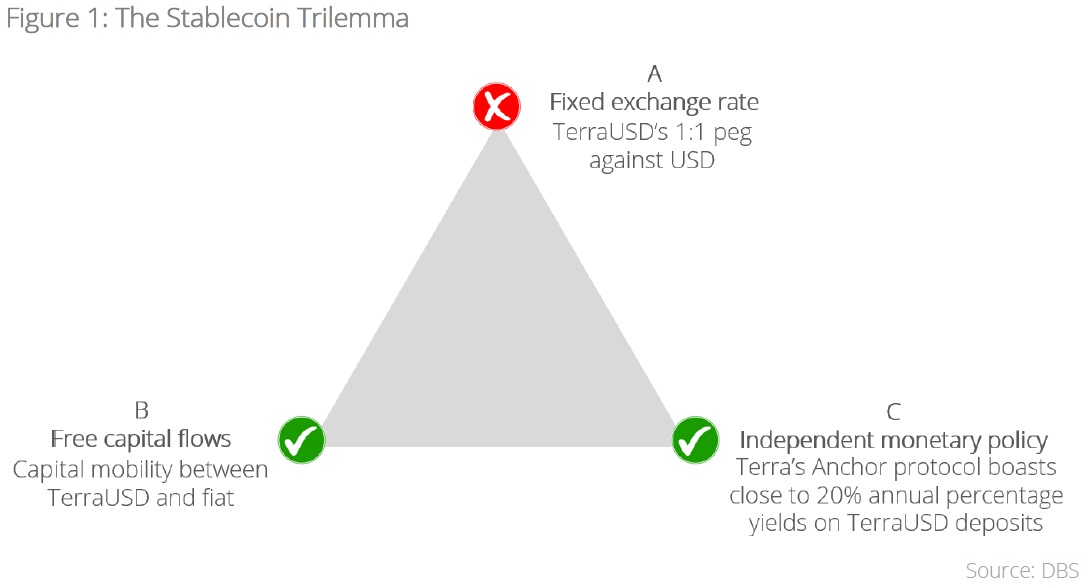

Doomed from the start. The Mundell–Fleming trilemma – or the Impossible Trinity – is a concept in international economics that states that it is impossible for policy to have at the same time (a) a fixed foreign exchange rate, (b) free capital flows, and (c) independent monetary policy. Any country can at best only have two out of the three. Yet the TerraUSD ecosystem violated the trilemma by (a) fixing their 1:1 peg to the USD, (b) maintaining free capital flows between Terra and fiat, and (c) independently “setting monetary policy” – purportedly paying close to 20% annual percentage yields (APY) on TerraUSD deposits on the Anchor protocol. In the end, the Impossible Trinity proved it earned its well-deserved moniker – TerraUSD found that it had to eventually surrender its 1:1 peg to the USD.

What about other cryptocurrencies? The dramatic drop in value of TerraUSD begets questions regarding risks of the equivalent of bank runs on other stablecoins. If other collateralised stablecoins such as Tether and USD Coin are indeed fully backed by reserves, investors would be able to exchange their coins for USD at any time. Reality, however, is less simple, as issuers such as Tether have been criticised for their failure to provide evidence supporting the existence of their purported reserves. Worryingly, Tether suffered its biggest drop in the wake of the TerraUSD fiasco when it broke its peg against the dollar and momentarily fell to USD0.945. A “bank-run”-like loss of confidence in Tether could pose a systemic risk for the entire cryptocurrency ecosystem given its central role in crypto trading.

The recent market volatility illustrates that investors should not take the stability of stablecoins for granted – their higher-than-average yields do turn out to also possess higher-than-average risks. As with any investment, investors would do well to understand the nature of unique risks associated with their cryptocurrency exposure. Given the significant volatility and high-risk of cryptocurrency investing, exposure should be limited to a satellite portion of a well-diversified portfolio.

Download the PDF to read the report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024

Related Insights

- Gold: Another record high in the books16 Apr 2024

- Alternatives 2Q24: New Equilibrium09 Apr 2024

- Approaching the Bitcoin Halving Cycle05 Jan 2024