- Banking

- Wealth

- NRI Banking

- Customer Services

Bajaj Allianz Extra Care Plus

medical expenses UIN: BAJHLIP23069V032223

At a Glance

We all love a little extra something; whether it is an extra set of helping hands or extra time to complete an exam, it always comes in handy. Our Extra Care Plus, A top-up health cover, provides an add-on cover to your existing health insurance policy It acts like a ‘Stepney’ to your health insurance policy after you use up your sum insured limit. Our Extra Care Plus is the top-up health protection your existing health cover needs.

Cover Level

| Sum Insured and deductible Options. Sum Insured (in INR) | Aggregate Deductible Options (in INR) | |||

| 300000 | 200000 | |||

| 500000 | 200000 | 300000 | ||

| 1000000 | 200000 | 300000 | 500000 | |

| 1500000 | 300000 | 500000 | ||

| 2000000 | 300000 | 500000 | 1000000 | |

| 2500000 | 300000 | 500000 | 1000000 | |

| 5000000 | 300000 | 500000 | 1000000 | |

What is a deductible?

Deductible is a cost sharing requirement, which means company will not be liable for a specified amount of the covered expenses, which will apply before any benefits are payable by the company. A deductible does not reduce the sum insured.

What is an Aggregate Deductible?

The claim amount of the claims made during the policy period keeps on adding until the aggregate deductible amount is met, any amount above the aggregate deductible is paid by the Insurance Company.

Plan Benefits

Coverage and Benefit –

Inpatient Hospitalization- Cover up to Sum Insured.

Intensive Care Unit (ICU) & Nursing expenses, Cost of prosthetics device implanted during the surgical procedures Surgeon, Anesthetist, Medical Practitioner, Consultants, Specialists Fees Relevant laboratory diagnostic tests, X-ray and such similar expenses Anesthesia, blood, oxygen, operation theatre charges, surgical appliances Medicines & Drugs, Dialysis, Chemotherapy, Radiotherapy, cost of Artificial Limbs Room rent and boarding expenses

Pre- Hospitalization - 60 days immediately before being hospitalized

Post- Hospitalization - 90 days immediately after discharged from hospital

Modern Treatment Methods: Modern Treatment Methods and Advancement in Technologies are covered up to Base Sum Insured, subject to policy terms, conditions, coverages, waiting periods and exclusions.

Ambulance- An ambulance offered by a health care or ambulance service provider for transferring the insured person to the nearest hospital with adequate emergency facilities

Maximum benefit of Rs.3000/- per valid hospitalization claim

Day care Treatment: We will pay you the medical expenses as listed under In-patient Hospitalisation Expenses for Day care procedures / Surgeries taken as an inpatient in a hospital or day care centre but not in the outpatient department. List of Day Care Procedures is given in the annexure I of Policy wordings.

Maternity- Medical Expenses related to pregnancy, childbirth and medically recommended or lawful termination of pregnancy, including its complications.

Limited to maximum 2 deliveries or lawful terminations during the lifetime of the insured person. In patient hospitalization expenses of pre-natal and post natal hospitalization

Medical expenses for maternity including complications of maternity over and above the aggregate deductible limit as specified under the policy schedule

Preventive Health Checkup- Additional benefit for which aggregate deductible is not applicable Payable at the end of continuous period of 3 years.The actual amount of medical checkup expenses up to Rs. 1000/- for policy covering 1 member and up to Rs.2000/- for more than 1 member under the same policy

Organ Donor- Organ donor is any person whose organ has been made available in accordance and in compliance with THE TRANSPLANTATION OF HUMAN ORGANS (AMENDMENT) BILL, 2011.

Pre and post medical expenses or any other medical treatment for the donor consequent of the harvesting is not payable. Cover up to Sum Insure.

Eligibility

Members : Individual Plan - Self, Spouse, dependent children,

dependent parents

Members : Family Floater - Self, Spouse, dependent Children, Parents - Maximum 6 members in Floater can be insured under this policy

Policy Term: 1yr, 2yrs & 3yrs

Plan option : Individual & Family Floater

|

Relationship |

Min Entry Age (years) |

Max Entry Age (years) |

Renewal |

|

Adult Members |

18 Years |

80 years |

Life long renewal |

|

Child Dependent |

3 months |

25 years |

35 years (Can be renewed life long, separate proposal form should be submitted) |

Optional Covers

Air- Ambulance (Optional) -Option to choose Air Ambulance cover on payment of additional premium. Expenses incurred for ambulance transportation in an airplane or helicopter for rapid ambulance transportation from the site of first occurrence of the illness/accident to the nearest hospital in an emergency life threatening health conditions. Aggregate deductible is not applicable

|

Benefit |

Sum Insured Options |

|

Air Ambulance |

2 lac, 5 lac, 10 lac |

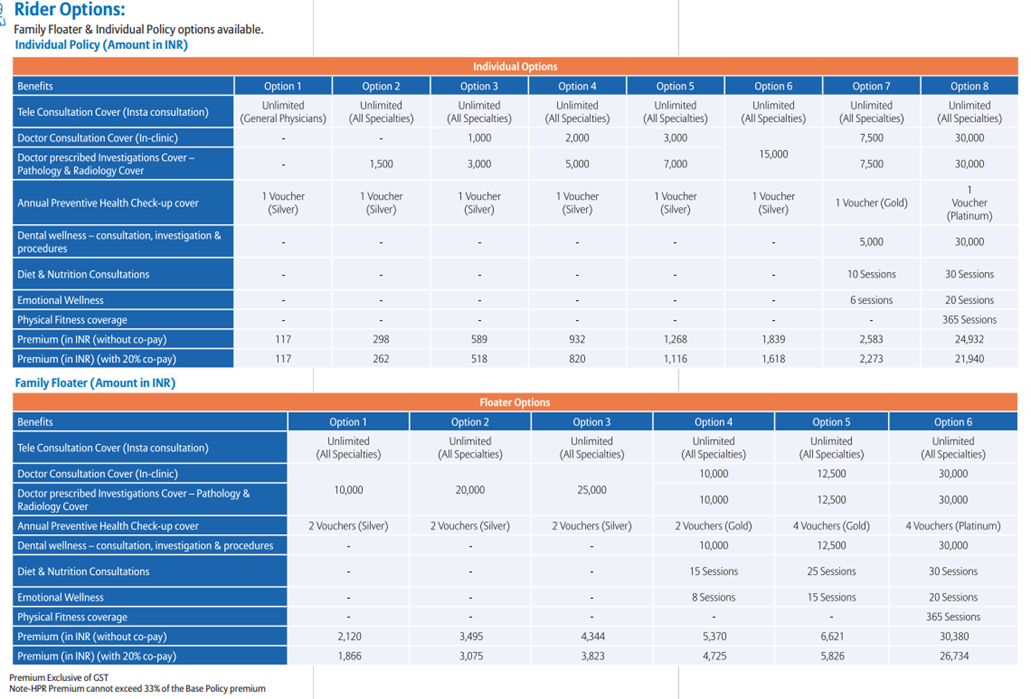

Health Prime Rider UIN: BAJHLIA24087V022324

This is a rider, which can be opted with any product. It majorly covers teleconsultations, investigation like pathology, radiology etc., doctor consultations, annual preventive health checkup. Premium will vary depending upon the type of covers opted as per the options opted. Health Prime is a rider for select retail and group Health/PA products. It can take care of multiple accompanying medical service expenses that otherwise remain uncovered.

The policy covers:

- Dental wellness- Consultation, investigation & procedures

- Diet & Nutrition Consultations - Get expert advice on good nutrition and diet

- Preventive Health Check-up - (45+ Test Parameters at Network Centres)

- 24x7 Unlimited Tele-Consultation - Consultation through video, audio, or chat channel

- 90,000+ Doctors - (35+ Specialisations for Tele-Consultation)

- Investigations cover- Pathology & Radiology Expenses

- Doctor Consultation Cover - Doctor consultation benefits available for various options

- Physical Fitness Coverage - Avail fitness facilities in network Gymnasiums

- Emotional Wellness Cover- Consult an emotional health coach/psychologist

- Affordable Premium- Premium start from Rs. 117 only*

Eligibility - Anyone who has an eligible Bajaj Allianz retail insurance policy, or a personal accident policy, can buy the Health Prime rider for themselves or their family members.

Policy Tenure - Rider will be as per the Base Policy with which it is opted

Coverage:

- Tele Consultation Cover: If the Insured member is suffering from any illness or injury he / she can consult Medical Practitioner/ Physician/Doctor listed on the Digital platform of concerned service provider’s application via video, audio, or chat channel.

- Doctor Consultation Cover (In Clinic): If the Insured/Insured member/s is suffering from any illness or injury he / she can consult Medical Practitioner/ Physician/Doctor in person from prescribed network centers or the Insured/Insured member/s can consult Medical Practitioner/ Physician/Doctor outside prescribed network centers up to the limit as specified under this Rider . *Read with Base Policy Schedule.

- Doctor-Prescribed Investigations Cover – Pathology & Radiology Expenses: If the Insured/Insured member/s is suffering from any illness or injury he / she can avail the service for investigations for pathology or radiology from prescribed network centers or outside prescribed network centers up the limit as specified under this Rider read with Base Policy Schedule.

- Annual Preventive Health Check - up Cover:

- The Insured/Insured member/s can avail the free Preventive health checkup once in every Policy Year as per the list given below.

Silver Gold Platinum Hemogram Hemogram Hemogram Liver function test Liver function test Liver function test Urine routine Urine routine Urine routine Diabetic Profile Diabetic Profile Diabetic Profile Lipid profile Lipid profile Lipid profile Kidney Function Tests Complete Kidney Function Profile Complete Kidney Function Profile Thyroid Thyroid Thyroid Bone Health Bone Health Bone Health Vitamins Vitamins Vitamins Vitamins Iron Deficiency Profile Vitamins Iron Deficiency Profile Vitamins Iron Deficiency Profile - The health checkup can be availed on a cashless basis in the prescribed list of hospitals or diagnostic centers.

- The Insured/Insured member/s can avail the free Preventive health checkup once in every Policy Year as per the list given below.

- Dental Wellness - Consultation, Investigation & Procedures

- Consultation with dentist • Dental Fillings • Dental X-ray investigation (IOPA) • Procedures like Root Canal Treatment, Extractions, Crown restorations covered.

- Diet & Nutrition Consultations – Get expert advice on how to maintain a balance between good nutrition and diet • Video/audio/chat consultation with renowned Dieticians and Nutritionist listed on the Digital platform • This is a cashless servie.

- Emotional Wellness - Consult an emotional health coach/psychologist listed on the Digital platform • This is a cashless service.

- Physical Fitness coverage - Avail fitness facilities in network Gymnasiums • Total 365 sessions, One session per day allowed.

Discount

- Voluntary Co-payment Option - 20%

- Family Discount- 2 Member -10% and More than 2 member 15%

- Long team discount – 2 Years -4% and 3 Years of policy 8%

Waiting Period

30 Days waiting period is applicable on all covers

Pre-existing Disease waiting period will be applicable as per the base policy

For more details https://www.bajajallianz.com/health-insurance-plans/top-up-health-insurance.html

Disclaimer

Bajaj Allianz Extra Care Plus is an IRDAI approved product with UIN: BAJHLIP23069V032223, which is underwritten and serviced by Bajaj Allianz General Insurance Co. Limited. This brochure is not a contract of Insurance. Please refer policy document for exact terms and conditions and specific details applicable to this Insurance. Your participation in this insurance product is purely on a voluntary basis. We advise you to take your own professional advice before you participate.

DBS Bank India Limited (IRDA of India Registration Number: CA 0257) having the registered office at GF: Nos. 11 & 12, Capitol Point BKS Marg, Connaught Place, Delhi - 110001 is the Corporate Agent of Bajaj Allianz General Insurance Company Limited (IRDA of India Regn.No.113) CIN: U66010PN2000PLC015329 having the Registered office address at Yerwada Pune - 411006. DBS Bank India Limited (Bank) does not underwrite the risk or act as an insurer. The Extra Care Plus policy by Bajaj Allianz with UIN: BAJHLIP23069V032223 is underwritten by Bajaj Allianz General Insurance Company Limited. The contract of insurance is between the insurer and the insured and not between the Bank and the insured. Bank does not give any warranty, as to the accuracy and completeness of the policies. Bank does not accept any liability or losses attributable to your contract of Insurance. Participation by the Bank’s customers in the insurance products is purely on a voluntary basis and is not linked to availment of any other facility from the bank. ISNP registration valid.

The contents and product information of this web site are given strictly for your convenience and is indicative in nature and ‘as is’ received from the Insurer. Nothing contained herein is to be construed as advice, recommendation, offer for a policy or any other assistance. Bank does not guarantee that this website reflects latest amendments/ information at all times or at any time. Bank shall have no liability to the customer for any loss or damage of any kind incurred for reliance on the content and product information available on this website.

For more details on risk factors, terms and conditions, exclusions, please read sales brochure of insurer and policy terms and conditions carefully before concluding a sale. Tax benefits are available as per the prevailing tax laws, which are subject to change.

Contact our 24-hour toll free customer service helpline number 1-800-209-4555 / 1-860-267-1234 or our overseas customer service number 91-44-66854555 or write to us at [email protected]. Visit us at: www.dbs.com/in

UIN: BAJHLIP23069V032223

BEWARE OF SPURIOUS PHONE CALLS AND FICTIOUS/FRADULENT OFFERS

- IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

NRI Banking

Resident Indian Account

Need Help?

Contact us 1860 267 1234 / 1800 209 4555

Only from SG 800 852 6186

For Int'l +91 44 6685 4555

Or have someone contact you

Others

- Other Banking Accounts

- Currency Exchange Rate

- Related Links

- Changes in ODI

- Changes in LRS

- RTGS / NEFT Facilitation centre

- Security and You

- Careers

- Social Good

- Cyber Security

- Sitemap

- Annual Report

- Banking Forms

- Commission Structure for Investments Products

- Commission Structure for Insurance Products

- Grievance Redressal

- Important Announcements

- Unclaimed Deposits - RBI's UDGAM

- Unclaimed Deposits - Search Customer

- Regulatory Disclosure

- Time limit for loan disposal & service delivery

- Treasures Savings Account Charges & Fees

- Current Account

- Interest Rates

- Unparliamentary Language

- List of Repossessed Properties