- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

A portfolio review is essential to assess whether your investment strategy aligns with your financial goals. The ever-changing nature of the current global market environment will require you to do a portfolio review and rebalancing from time to time. This is because the original asset allocation would have deviated with equity asset class weightage going up during market rally and debt asset class weightage going up during market falls. A regular assessment of the portfolio is necessary to assess if it’s on the right track or if some action is needed to achieve your financial goals. Fret not, we’ve got you covered.

In this simple guide, we will explain the importance of portfolio review and provide you with the roadmap on how to undertake a review that will keep you steered on your path to achieving your financial objectives.

The evaluation begins with a review of your asset classes including equities, debts and alternative investments.

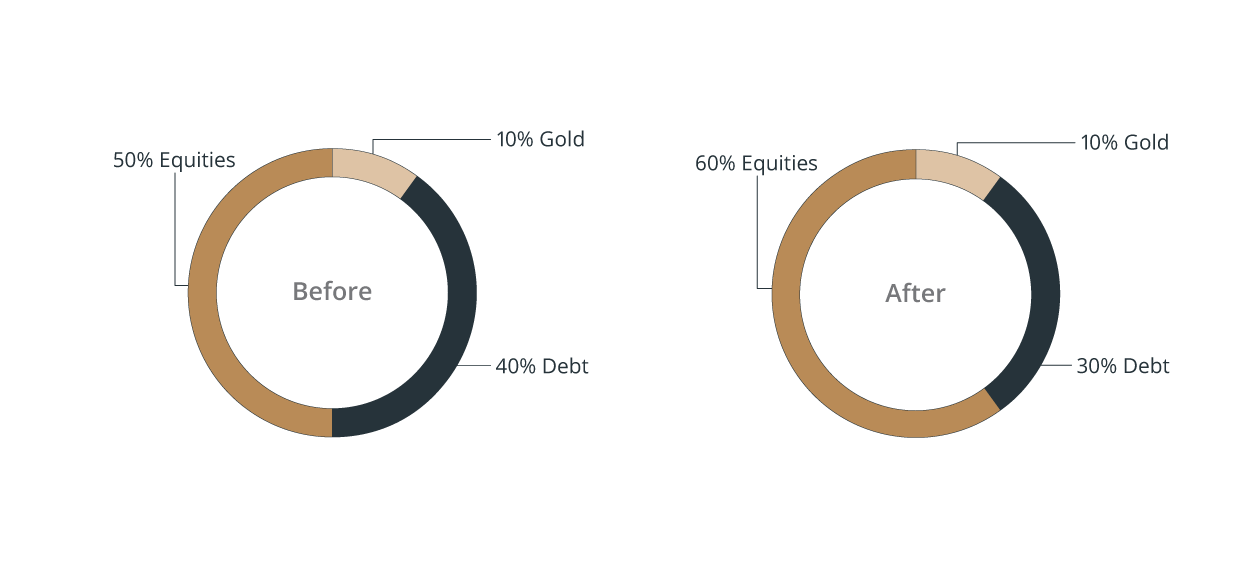

To initiate the review, it is crucial to assess each asset class within your portfolio against your Strategic Asset Allocation specific to your risk profile. The Strategic Asset Allocation sets the optimal target allocations to different asset classes and provides framework / guideline to rebalance the current asset allocation periodically to stay aligned with the assigned asset allocation through every market conditions.

For instance, imagine that you had initially allocated 50% of your portfolio to equities based on your strategic asset allocation while 40% to debt and 10% to Gold. Now, due to the stock market’s surge over the past year, your equity allocation has now soared to 60%, while allocation to debt has gone down to 30% whereas gold has remained flat at 10%. This is when you need to consider rebalancing your portfolio. By selling a portion of your overweight asset class, you can redeem the 10% and restore it back to its intended allocation.

A meticulous portfolio review involves scrutinizing every aspect of your investments. Let’s start with market capitalization (i.e. how much a company is worth based on its stock market value) that can help evaluate your exposure to different market capitalizations. At the same time portfolio needs to be diversified across investment styles. Current market correction has brought value investing into focus. One needs to ensure that allocation to both growth and value investing style investments are components of the equity portfolio.

Sectors and Styles could help you identify on an overall basis performance of individual schemes / stocks on a risk-reward basis and the need to continue with the winners and eliminate the laggards.

1. Sector Allocation

Gauging one’s sector allocation helps to understand how diversified one’s investment portfolio is. One needs to avoid duplication into sectors when investing via Mutual Funds while avoid going overboard or skew towards a particular sector when investing in stocks directly. Sector allocation should ideally represent mix of sectors that are expected to do well and have reasonable weightage in the portfolio based on current market conditions.

2. Market Cap Analysis

In addition to that, having a clear understanding of the positioning of your portfolio across different Market Caps like large-cap, mid-cap and small-cap stocks. Market Cap analysis can help to determine the aggregate risk the portfolio carries with regard to valuation of different segment of the market.

Diversification and Liquidity Considerations

1. Gold as a Diversification Tool

While doing a portfolio review, one must also ascertain whether one’s portfolio has reasonable exposure to gold. For generating superior risk adjusted performance, we suggest having small allocation to gold as it has the ability to protect against event risk, war, uncertainty besides offering portfolio diversification due to low correlation with other asset classes.

2. Liquidity Analysis

It is also important to have a reasonable level of liquidity, which constitutes around 5-10% of one’s investment portfolio. This buffer acts like a safety net for unforeseen emergency needs requiring funds that can otherwise adversely impact overall financial goals.

DBS Wealth management approach

A professional portfolio evaluation usually is a seven step process involving team of experts (Investment Specialist, Insurance Specialist, Mortgage Specialist, Forex Specialist and Portfolio Counsellor) as follows:

- Understanding your needs and objectives

- Assessing Your Risk Profile factoring your time horizon and liquidity needs

- Performance evaluation of products forming part of the portfolio

- Offering Solutions that meets your needs and aspirations

- Executing transactions via a dedicated service team

- Providing Statements, Reports regarding your investments

- Analysis of portfolio at regular intervals

At DBS we not only provide comprehensive investment solutions across Mutual Funds, Sovereign Gold Bonds but also offer sophisticated products like Portfolio Management Services, Alternate Investment Funds (referral basis) besides tailored offerings like Overseas Investments and Bonds. We believe our expertise and Asian connectivity can help you keep one step ahead of the curve via timely market insights and conclave with industry experts / top fund managers.

Conducting constant comprehensive investment reviews can be time consuming and feel confusing if you are new to it. But don’t worry as we are here to help you do exactly that! We have a team of qualified relationship managers ready to assist you in navigating these tricky evaluations. Simply click on the “CONTACT ME” button below and our Relationship Managers will get in touch with you.

Please feel free to browse through our Wealth Masterclass page and find many other helpful articles on building a good investment portfolio.

Know More articles on mutual funds products to diversify your investment portfolio.

Discuss Now our funds fact sheet, with curated information on equity, debt, hybrid, gold and ULIP funds.

Download Now digibank by DBS Application to access these ratios via the mutual fund section.

Topic

Explore more

Wealth FeedThis article is for information purposes only. We recommend you get in touch with your investment advisor for any financial advise.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

DBS Bank India Limited – AMFI registered Mutual Fund Distributor (ARN-155319)