- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

- JPY rebounds on Japan’s unconfirmed intervention 30 Apr 2024

- FOMC and European risks dominate29 Apr 2024

- Long SGD-CNH to Express the RMB Weakness View26 Apr 2024

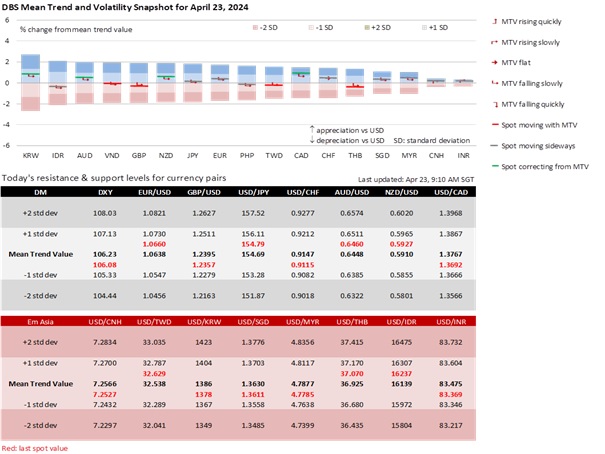

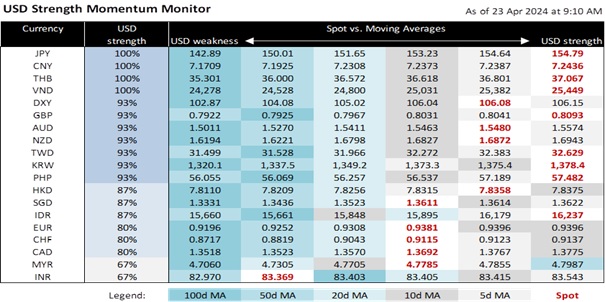

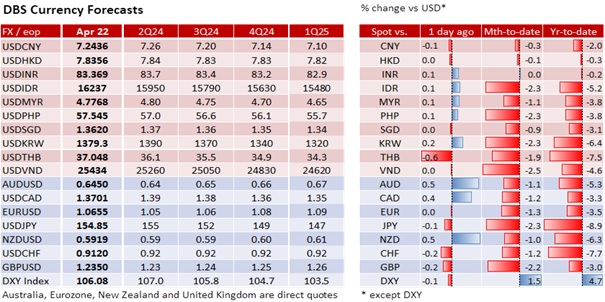

DXY appreciated by 0.2% to 105.86 ahead of significant US data releases. Today, consensus expects US advanced GDP growth to slow a second quarter to an annualized 2.5% QoQ saar in 1Q24 from 3.4% in the previous quarter. However, the US economy will be considered resilient from personal consumption growth starting the year at a pace of 3%, above the 2% average in 2022-2023. Based on past experiences, the above consensus projection by the Atlanta GDPNow model suggests positive surprises in today’s report.

Tomorrow, the US PCE deflators should mirror the stickiness in CPI inflation. Consensus sees headline and core inflation increasing a second month at the same 0.3% MoM pace in March. Barring downside surprises, these data should set a less dovish tone at the FOMC meeting on May 1. Interest rate futures have pushed out the first Fed cut to September and see only 1-2 cuts this year vs. the three rate cuts the Fed projected in March. The US Treasury 10Y yield rose 4 bps to 4.64%, eyeing the 4.69% high seen on April 16, with investors staying on the sidelines.

USD/JPY broke above 155 after US durable goods orders expanded a second month to 2.6% MoM sa in March from 0.7% in February and -6.9% in January. We cannot rule out a hawkish tone at tomorrow’s Bank of Japan meeting. BOJ Governor Kazuo Ueda could open the door for another rate hike later this year after assessing that there was no disruption from terminating its negative interest rate policy and yield curve control framework in March. More importantly, Tokyo has received implicit approval for intervention to address disorderly and excessive exchange rate volatility. On 17 April, the finance ministers of the US, Japan, and South Korea issued a trilateral joint statement to “consult closely” on foreign exchange rate markets.

The USD’s strength is starting to meet policy resistance in Asia. USD/KRW peaked at 1400 on April 16 and fell to 1370 yesterday after South Korean policymakers vowed to take steps on excessive volatility. USD/IDR spiked to 16200 this month after holding a 15600-15800 range in the previous 2.5 months, prompting a surprise 25 bps rate hike to 6.50% by Bank Indonesia yesterday to widen the policy rate differential with its US counterpart. Last month, on March 21, Taiwan also surprised with a rate hike after USD/TWD hit a four-month high near 32. Targeting this month’s electricity price increases, Taiwan’s hike did not stop USD/TWD from breaching the last October’s high of 32.50 on unfavourable yield differentials. USD/THB also hit 37 this week on the country’s negative rate differentials against the US. Philippine policymakers are also delaying rate cuts after USD/PHP rose to 57.50, its highest level since November 2022. In mid-April, the IMF said foreign exchange intervention could be appropriate under situations where exchange rate volatility was excessive under disorderly market conditions.

Quote of the day

"Self defense is not only our right, it is our duty.”

Ronald Reagan

25 April in history

In 1953, Francis Crick and James Watson's discovery of the double helix structure of DNA was published in "Nature" magazine.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- JPY rebounds on Japan’s unconfirmed intervention 30 Apr 2024

- FOMC and European risks dominate29 Apr 2024

- Long SGD-CNH to Express the RMB Weakness View26 Apr 2024

Related Insights

- JPY rebounds on Japan’s unconfirmed intervention 30 Apr 2024

- FOMC and European risks dominate29 Apr 2024

- Long SGD-CNH to Express the RMB Weakness View26 Apr 2024