- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

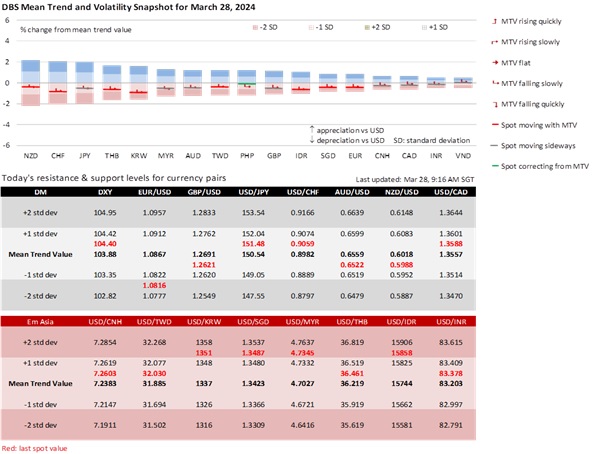

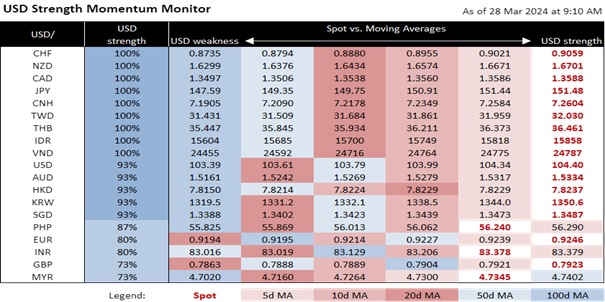

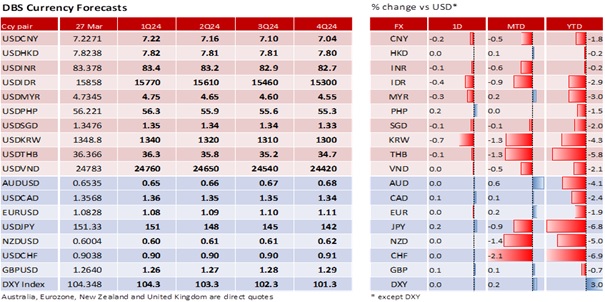

The DXY Index appreciated 2.9% to 104.3 in 1Q 2024, contrasting sharply with the 4.6% depreciation to 101.3 in 4Q 2023. The US Federal Reserve started 2024 by pushing back the market’s aggressive bet for seven Fed rate cuts discounted at the end of 2023. The market is now aligned with the three rate cuts reaffirmed in the Fed’s Summary of Economic Projections. After declining 69.2 bps to 3.88% in 4Q23, the US Treasury yield recovered 31 bps to 4.19% this quarter. The S&P 500 index rallied 10% ytd to 5248 yesterday, in addition to the 11.2% surge in 4Q23. Today, the US Bureau of Economic Analysis will likely reaffirm that the US economy expanded by a healthy annualized 3.2% QoQ saar in 4Q23 vs. the exceptional 4.9% growth in 3Q23.

However, the Atlanta Fed GDPNow model is projecting more growth deceleration to 2.1% in 1Q24. The US employment rate increased to 3.9% in February, its highest since January 2022. Tomorrow, consensus expects the PCE deflator inflation to rise by 0.4% MoM (2.5% YoY) in February from 0.3% MoM (2.4% YoY) in January. Conversely, the Fed’s preferred gauge, the PCE core deflator, is expected to slow to 0.4% MoM to 0.3%, keeping it unchanged in YoY terms at 2.8%. The above US data are near the Fed’s economic assumptions underlining its call for three rate cuts this year, i.e., real GDP growth hitting 2.1% QoQ saar in 4Q24 amid an unemployment rate of 4%, PCE inflation of 2.4% YoY, and PCE core inflation of 2.6%.

The first quarter was also significant for changes to monetary policy and its outlook. The Bank of Japan ended its negative interest rate policy and yield curve control framework in March, one month earlier than the polls on March 19. The Swiss National Bank lowered interest rates by 25 bps to 1.50% on March 21. Despite the divergent policy actions, the JPY was not spared from the selling pressures in the CHF triggered by falling currency volatility, which encouraged carry trades with wide interest rate and bond yield differentials. USD/JPY and USD/CHF broke above 150 and 0.90, spilling over into USD/CNY, rising above 7.20. Apart from Japan seen going slow in normalizing policy, and Switzerland and China adopting dovish biases, a few Fed officials suggested the Fed might delay and deliver fewer rate cuts. We expect Japan and China to keep dampening the speculation against their currencies and await signals from the Swiss on when they consider the CHF’s overvaluation corrected.

Other global central banks also signalled the end of their hiking cycle and a more balanced bias between inflation and growth. The European Central Bank sent the strongest signal about lowering rates before the summer recess that starts after its July meeting. Some ECB members have pushed for two cuts before the recess, However, ECB President Christine Lagarde and senior ECB officials do not want to commit to any number beyond the summer cut, staying data-dependent and making decisions meeting by meeting. As we enter the second quarter, we will also pay attention to signs of the weak EU and UK economies turning the corner amid a less exceptional US economy. Hence, we cannot rule out the DXY reverting to weakness again in 2Q24 after its partial rebound in 1Q24 from 4Q23.

Quote of the day

" Success is a collection of problems solved.”

I.M. Pei

28 March in history

The Louvre Pyramid designed by I. M. Pei was inaugurated by French President François Mitterrand in Paris in 1989.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.